The Malaysian Ringgit (MYR) has recently faced significant pressure due to various economic factors, notably interest rate adjustments and global trade tensions. In a pivotal move in July, Bank Negara Malaysia (BNM) cut the Overnight Policy Rate for the first time in five years, reducing it by 25 basis points to 2.75%. This decision was made in response to a weakening economic outlook characterized by geopolitical uncertainties and trade issues, particularly the imposition of a 24% tariff on Malaysian exports by the United States. Despite these challenges, BNM highlighted the resilience of Malaysia's diversified economy, with the services sector representing a substantial portion of GDP.

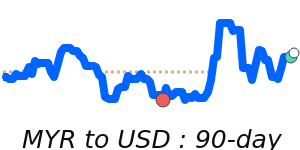

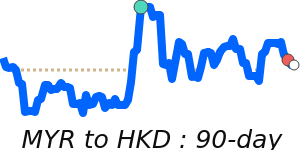

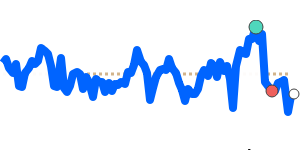

Analysts expect elevated volatility in the USD/MYR currency pair as ongoing negotiations regarding tariffs continue. The potential for further tariffs could apply downward pressure on the ringgit, impacting its valuation against other currencies. Currently, the USD/MYR exchange rate stands at 0.2370, close to its three-month average, with minimal fluctuations noted within a 2.1% range.

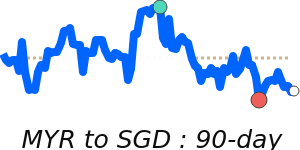

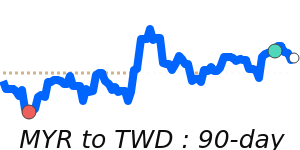

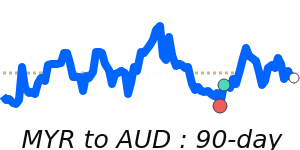

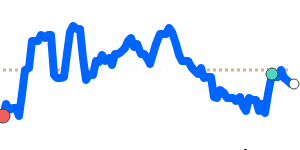

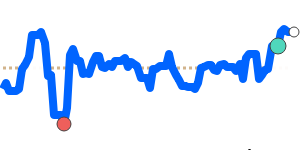

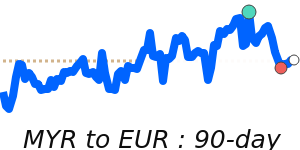

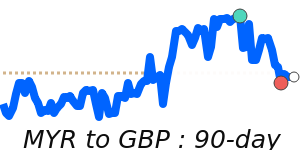

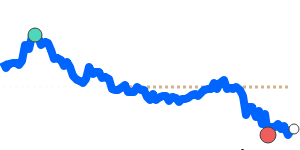

The MYR has shown some stability against the Euro and British Pound as well, trading at 0.2042 and 0.1776, respectively. These figures are slightly above their three-month averages, indicating somewhat steady conditions. In contrast, the MYR has appreciated against the Japanese yen, reflecting a stronger performance as it trades 2.7% above its three-month average.

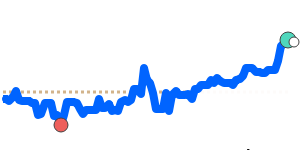

The movements of global oil prices also play a crucial role in the MYR's value, given Malaysia's status as a significant oil exporter. Currently, oil trades at $63.34, which is 6.1% below its three-month average. This recent decline may adversely impact the Ringgit as lower oil prices typically reduce revenue in oil-dependent economies.

As the Malaysian economy navigates these complexities, both domestic and external factors will continue to shape the trajectory of the MYR in the coming months. Currency market participants should keep a close watch on economic indicators, central bank policies, and international trade developments to make informed dealings.