The Most Expensive FX Mistakes People Make

Foreign exchange mistakes rarely feel expensive at the time — but they add up fast. Here are the most costly FX mistakes people make, and how to avoid them.

Foreign exchange costs are often invisible.

Most people don’t lose money on FX because they picked the wrong day. They lose it because of hidden spreads, poor defaults, and “convenient” options that quietly inflate the rate.

Across travellers, expats and small businesses, the same mistakes show up again and again — and they can cost hundreds or even thousands of dollars without anyone realising.

Here are the most expensive FX mistakes people make, and what to do instead.

⸻

1. Accepting “Pay in Your Home Currency” Overseas

The mistake

Choosing to pay in your home currency at an ATM or card terminal instead of the local currency.

Why it’s expensive

• This triggers Dynamic Currency Conversion (DCC)

• Exchange rates are often 4–12% worse

• The markup is rarely shown clearly

What to do instead

Always choose the local currency and let your card provider handle the conversion.

Rule of thumb:

If you see “Guaranteed rate” or “Pay in AUD/USD/GBP” — decline it.

⸻

2. Using Bank Debit Cards for Overseas Spending

The mistake

Assuming debit cards are cheap and safe for international spending.

What usually happens

• FX margin of 2.5–3.5%

• Overseas ATM fees

• Foreign ATM owner fees

• Extra markups outside business hours

Why it adds up

Small transactions repeated many times quietly compound into large FX costs.

Better options

• Fee-free FX debit cards

• Multi-currency accounts

• Cards with zero foreign transaction fees

⸻

3. Making Large Transfers on Weekends or Late Fridays

The mistake

Sending international transfers when FX markets are closed.

Why pricing worsens

• Markets are illiquid

• Providers widen spreads to manage risk

• Some services add explicit weekend markups

Hidden cost

An extra 0.5–1.5% on large transfers — often unnoticed.

BER tip:

For large transfers, weekdays during the London–New York overlap usually offer tighter pricing.

⸻

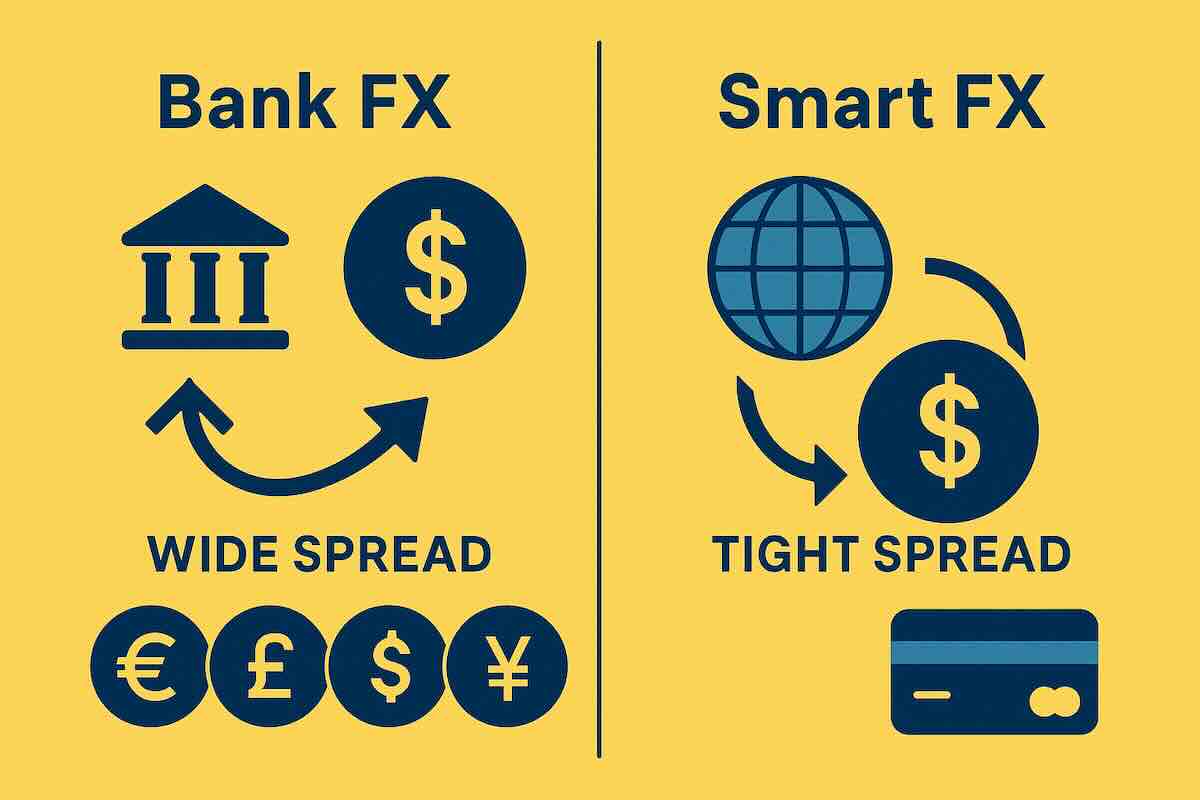

4. Using Banks for Large Transfers “Just to Be Safe”

The mistake

Choosing a bank for a large transfer because it feels safer.

The reality

• Bank FX margins are often 3–5%

• Specialist FX providers are typically 0.3–1.0%

• Funds still move via the same regulated banking systems

What this means

On large transfers, banks can cost thousands more for the same outcome.

Safety comes from regulation — not from paying a wider FX margin.

⸻

5. Leaving Future Payments Fully Exposed to FX Moves

The mistake

Ignoring exchange rate risk on known future payments.

Common examples:

• Property settlements

• School or university fees

• Supplier invoices

• Overseas mortgage payments

What goes wrong

• Sudden currency moves

• Budget overruns

• Margin pressure for businesses

Smarter approach

• Partial hedging

• Forward contracts

• Setting target rates and alerts

Even basic planning can significantly reduce FX risk.

⸻

6. Mixing Cards, Transfers and FX Accounts Without a Plan

The mistake

Using different products for spending, saving and transferring without understanding how each prices FX.

Why it’s costly

• Different spreads

• Different cut-off times

• Different weekend and markup rules

The result is inconsistent and often expensive FX pricing across your money.

What works better

• One clear FX setup for travel

• One approach for large transfers

• One provider for ongoing international payments

⸻

7. Believing “Zero Fees” Means Cheap FX

The mistake

Focusing on fees instead of the exchange rate.

What’s often missed

• FX margins hidden in the rate

• Promotional pricing that quietly expires

• Weekend or volatility markups

Always compare the exchange rate itself, not just the headline fee.

⸻

| FX Method | Typical FX Margin | Extra Fees | Best For | Key Risk |

|---|---|---|---|---|

| Bank Debit Card (Overseas) | 2.5% – 3.5% | ATM fees, foreign ATM fees | Occasional use | High hidden costs, DCC risk |

| Bank Credit Card | 2.0% – 3.0% | Foreign transaction fee | Short trips, hotels | FX margin often overlooked |

| Dynamic Currency Conversion (DCC) | 4% – 12% | Built into rate | Never recommended | Worst exchange rates |

| Bank International Transfer | 3.0% – 5.0% | $15–$50 transfer fee | Legacy users | Very expensive on large amounts |

| FX Specialist Transfer | 0.3% – 1.0% | Low or no fixed fees | Large transfers, SMEs | Timing still matters |

| Multi-Currency Account / FX App | 0.4% – 1.2% | Possible weekend markup | Travel, expats | Out-of-hours pricing |

⸻

How to Avoid These FX Mistakes

Simple habits that make a real difference

• Always pay in local currency

• Compare live FX rates before transferring

• Avoid weekend transfers for large amounts

• Use specialists for high-value transfers

• Separate travel FX from savings FX

• Set alerts instead of guessing timing

⸻

You can normally save 4% to 5% when you use a foreign transfer specialist rather than your bank.

It's important to compare the exchange rates being offered by our BER foreign transfer specialists using the calculator below to those of your bank and calculate how much you can save.

Final Word

Most FX losses don’t look like losses.

They feel like convenience, habit, or “close enough”.

The biggest savings don’t come from predicting markets — they come from avoiding silent FX costs that compound over time.

That’s exactly what comparing exchange rates properly is designed to prevent.

⸻

Disclaimer: Please note any provider recommendations, currency forecasts or any opinions of our authors should not be taken as a reference to buy or sell any financial product.