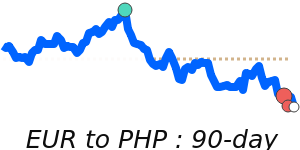

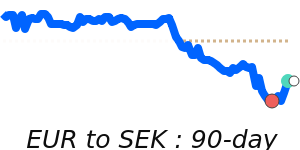

The euro (EUR) has recently faced headwinds as the latest Eurozone unemployment data revealed a slight uptick to 6.3% in August, falling short of expectations to maintain the record low of 6.2%. This unexpected rise in unemployment has tempered the recent positive momentum of the euro, which had been fueled by improved economic conditions in the region.

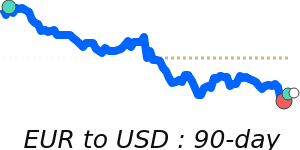

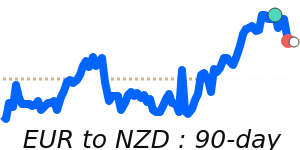

Market focus will be keenly directed toward comments from European Central Bank (ECB) President Christine Lagarde, who may offer insights on the future direction of monetary policy. Analysts suggest that if she indicates a halt to interest rate cuts, the euro could regain strength. Despite recent cuts, the euro has still appreciated by over 10% against the US dollar within a four-month period. However, the robust euro is presenting challenges for the ECB, particularly regarding its impact on inflation and exports. ECB Vice President Luis de Guindos has expressed confidence in the inflation outlook despite the euro's strength, noting risks remain "quite contained."

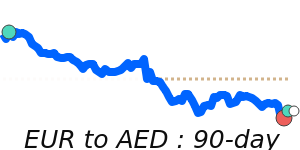

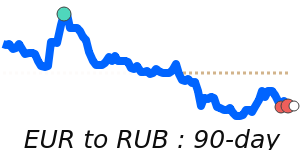

Geopolitical factors continue to shape the euro's performance as well. The ongoing conflict in Ukraine and associated economic disruptions, including sanctions on Russia and energy supply issues, are creating a volatile environment for the Eurozone. Market participants are advised to consider these factors as they assess trends and potential impacts on the euro.

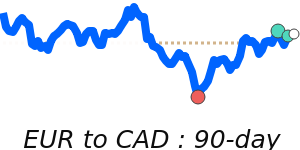

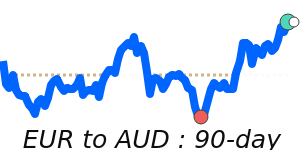

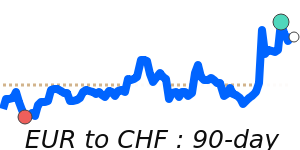

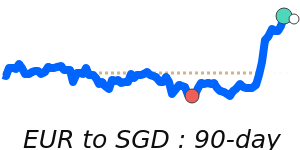

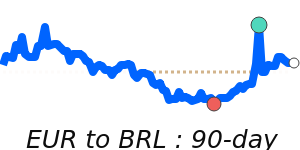

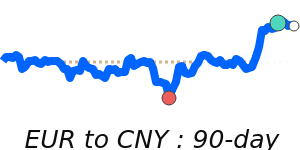

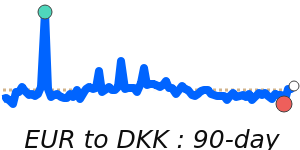

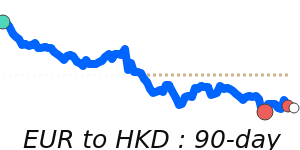

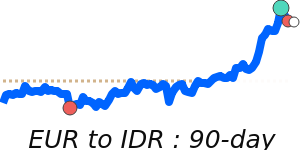

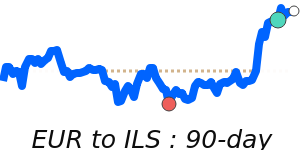

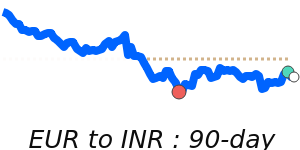

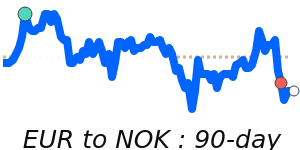

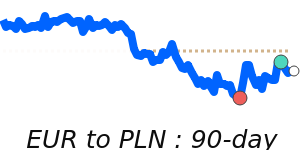

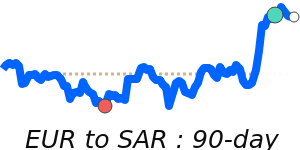

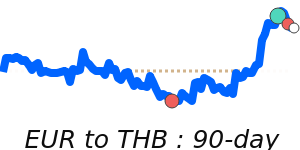

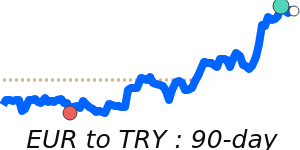

Recent price data indicates that the EUR/USD pair is trading at 1.1714, slightly above its three-month average, indicating relative stability. The EUR/GBP at 0.8721 is also performing just above its average, while the EUR/JPY at 175.2 has shown a notable increase against its average value. While the euro's appreciation has been significant, the ongoing tensions in the region and central bank policies will remain critical in determining the currency's trajectory.

In parallel, the oil market may indirectly influence euro performance due to its potential impact on inflation and trade balances. Currently, oil is trading at $65.22, which is 3.9% below its three-month average, suggesting volatility in raw material costs that could further affect economic conditions across Europe.

As the eurozone navigates these multifaceted challenges, it remains essential for businesses and individuals engaging in international transactions to stay informed on these developments. Monitoring ECB communications and macroeconomic indicators will be crucial for making informed currency exchange decisions in the near term.