Outlook

AUD remains choppy after stronger Q4 GDP. GDP rose to 0.8% from 0.5%, beating forecasts, but risk-off mood kept moves fragile. Tonight's Australian trade data could lift the Aussie if the surplus widens, yet ongoing geopolitical uncertainty may add near-term volatility.

Key drivers

- GDP: Strong Q4 data beat forecasts, but risk-off mood limited gains.

- Trade data: A wider surplus could provide AUD support.

- Geopolitics: Uncertainty adds near-term volatility.

- Risk appetite / commodities: Movements linked to global risk appetite and commodity prices.

Range

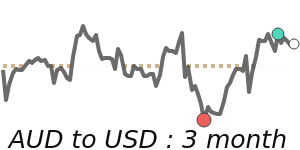

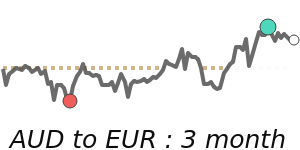

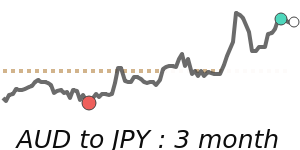

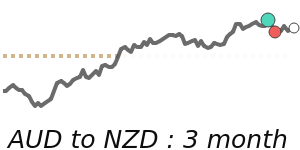

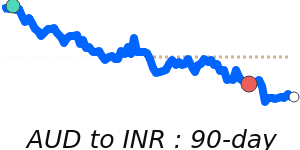

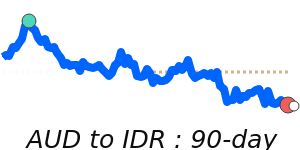

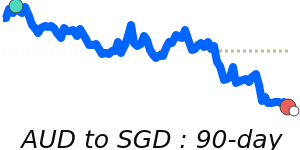

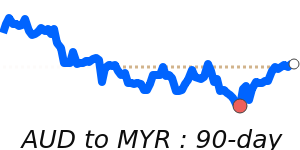

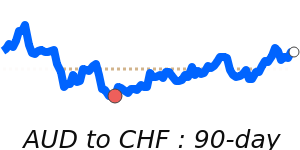

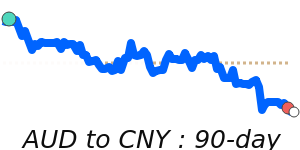

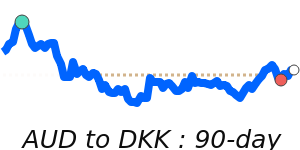

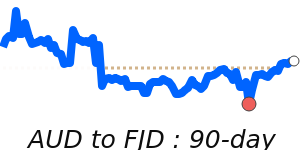

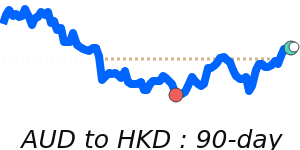

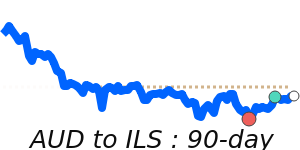

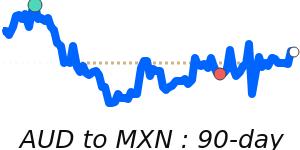

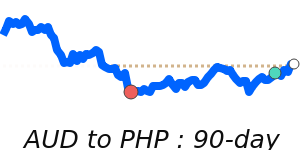

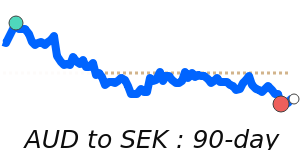

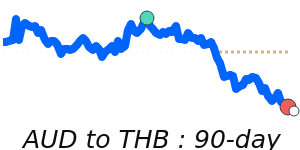

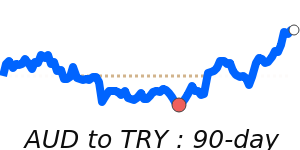

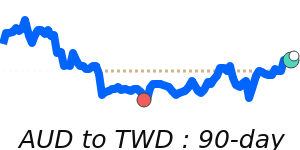

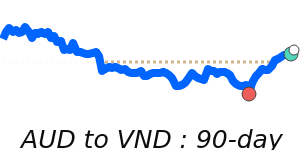

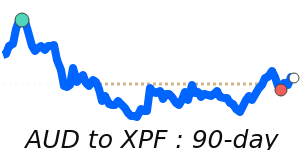

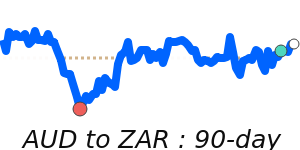

AUDUSD 0.7074, about 3.3% above the 3‑month average of 0.6845; range roughly 0.6604–0.7125. AUD/EUR near 0.6081, about 3.3% above the 3‑month average of 0.5823; range 0.5625–0.6081. AUD/GBP 0.5293, about 4.4% above the 3‑month average of 0.5072; range 0.4936–0.5293. AUD/JPY 111.0, about 3.9% above the 3‑month average of 106.8; range 102.6–111.5.

What could change it

- Trade balance surprise: A wider-than-expected surplus could push AUD higher.

- Global risk mood: A shift back to risk-off could weigh on AUD.

Commodity/US yields: Renewed moves in commodities or yields could steer AUD.