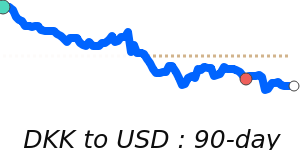

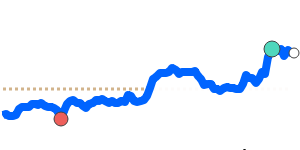

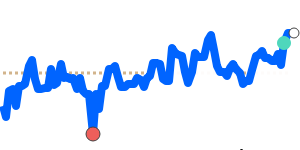

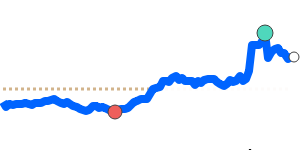

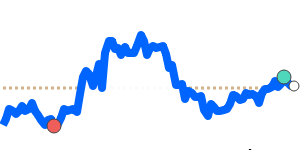

USD/DKK Outlook:

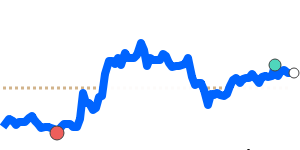

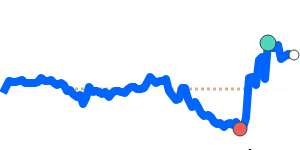

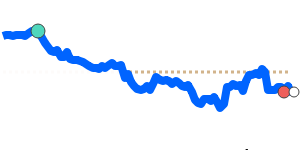

The outlook for USD/DKK is slightly weaker, but likely to move sideways as the rate is below its recent average and near recent lows. Current uncertainties surrounding US tariffs are keeping the dollar subdued and affecting its demand.

Key drivers:

• Rate gap: The Federal Reserve is expected to adjust its monetary policy that might strengthen the USD, but Denmark's relatively stable interest rates have kept the DKK competitive.

• Risk/commodities: Recent declines in oil prices have influenced global risk appetite adversely, leading to reduced demand for the USD.

• One macro factor: The upcoming US inflation reports could shift USD strength, contributing to the volatility of the exchange rate.

Range:

USD/DKK is likely to drift within the recent 3-month range as continued trade tensions create uncertainty.

What could change it:

• Upside risk: A significant surprise in US inflation data could strengthen the dollar.

• Downside risk: Further developments in US tariff policies leading to heightened uncertainty could pressure the USD further.