EUR Market Update

13 Mar 2026 • 00:22 GMT

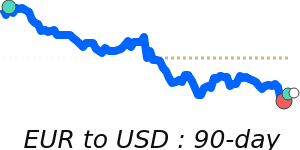

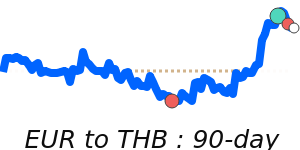

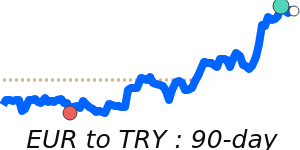

The euro remains under some pressure against the US dollar, trading around 1.1521. This is nearly 2% below its three-month average of 1.1745, reflecting ongoing concerns over geopolitical tensions and energy shocks in Europe. The recent decline follows a rejection from near 1.2100 earlier this year and a break below the 200-day moving average, suggesting potential for further short-term downside. Market focus is on the 1.1500 level, with risks of testing lower support.

Meanwhile, the USD continues to stay firm, bolstered by increased safe-haven demand amid Middle East tensions and rising oil prices. This geopolitical backdrop favors the dollar, keeping EUR/USD near its weaker ranges. Despite recent hints of modest euro support from inflation expectations, the pair’s outlook remains cautious. Longer-term forecasts vary, but many analysts see limited upside in the near term, with some predicting EUR/USD could drift slightly higher toward 1.15 and beyond as conditions stabilize.

In summary, the euro faces downward pressure against the dollar in the near term. Traders should watch for any shifts in geopolitical developments or economic data that could influence the pair’s direction.

EURUSD Near-term bias: 🔴 Mild downside

Expected range: 1.1510 – 1.1710

Dominant driver: 🌍 Global risk sentiment

3-month trend: ⚪ Range-bound