Outlook

The euro faces a mixed path as January retail sales and ECB minutes loom. A forecast improvement in eurozone retail activity could provide modest support, while the ECB minutes may offer fresh cues on policy direction.

Key drivers

- Forecast January eurozone retail sales rebound could lift the euro.

- ECB policy minutes due to offer fresh cues on policy path.

- Unemployment in the euro area at a record low provides a constructive backdrop.

- Oil remains elevated, adding inflation risk and currency sensitivity.

Range

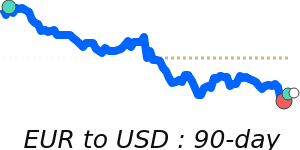

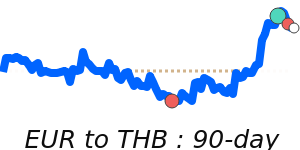

EURUSD 1.1632, about 1% below its 3-month average of 1.1754, with a very stable 3.8% range from 1.1586 to 1.2031.

EURGBP 0.8703, near its 3-month average, within a stable 1.8% range from 0.8628 to 0.8787.

EURJPY 182.6, at 7-day lows near its 3-month average, in a very stable 3.1% range from 180.6 to 186.2.

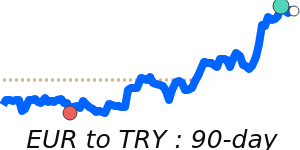

Brent Crude OIL/USD 82.55, well above its 3-month average of 65.99, trading in a highly volatile range from 59.04 to 84.53.

What could change it

- A stronger eurozone data print or a clearer, more hawkish ECB minutes tone could push the euro higher.

- A softer oil backdrop or easing geopolitical tensions could cap euro gains.