Outlook

The Hong Kong dollar remains well supported by ongoing HKMA FX interventions and steady inward capital flows, with the peg likely to stay around 7.80 HKD per USD in the near term. The path depends on US dollar strength, Mainland inflows, and any shifts in HKMA policy. A break from the current tight range would require a notable change in these dynamics.

Key drivers

- HKMA interventions and higher Aggregate Balance supporting HKD stability; interventions have included purchases and currency actions to defend the peg.

- Strong net inbound flows via Southbound Stock Connect, helped by Mainland AI optimism, contributing to HKD appreciation pressure.

- Interbank rate influence from the Aggregate Balance and related carry-trade dynamics, shaping short-term HKD liquidity and volatility.

- Shifts in US rate expectations and broader global risk sentiment, which can alter demand for the HKD as a funding and carry currency.

Range

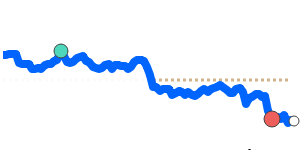

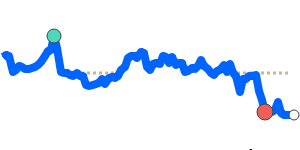

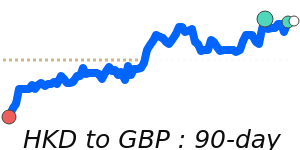

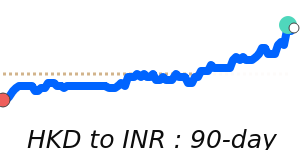

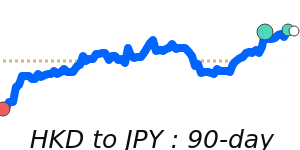

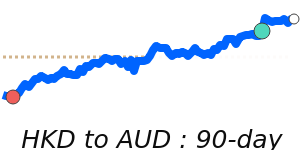

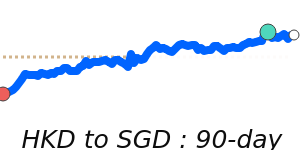

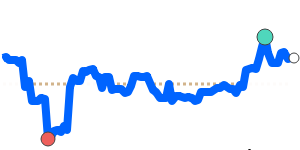

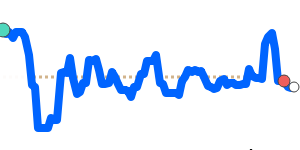

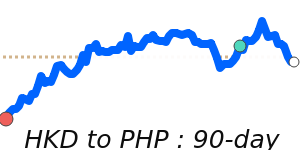

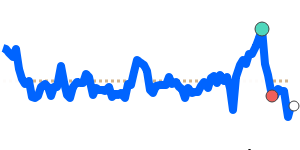

HKD/USD is around 0.1279, near its 3-month average and trading in a stable 0.1279–0.1287 range (3-month average slightly above 0.1279). HKD/EUR at 0.1085, about 0.7% below its 3-month average of 0.1093, with a range of 0.1065–0.1116. HKD/GBP at 0.094931, just below its 3-month average, trading within 0.092640–0.098051. HKD/JPY at 19.83, about 0.9% below its 3-month average of 20.02, within a 19.52–20.40 range.

What could change it

- Any change in HKMA policy or renewed intervention could drive HKD volatility higher or stronger depending on the direction of action.

- A sustained shift in US dollar strength or Fed guidance could push HKD moves away from current ranges.

- Alterations in Mainland inflows or Southbound Connect dynamics could shift the balance of HKD demand.

- Renewed capital flow reversals or heightened risk sentiment could test the peg and alter interbank liquidity conditions.