Outlook

The NZD slides as geopolitical uncertainty rises, with risk appetite eroded. In the absence of notable domestic releases, kiwi moves should stay tied to global risk dynamics early this week. A firmer risk tone could lend modest support, while persistent risk-off keeps the kiwi under pressure.

Key drivers

- Geopolitical tensions keep risk appetite under pressure, weighing on the kiwi.

- External data and rate expectations drive cross rates, as New Zealand data remains light.

- Dairy and commodity price moves add nuance to NZDJPY and cross-pairs.

Range

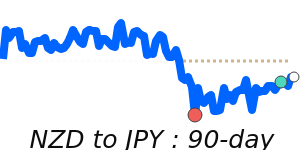

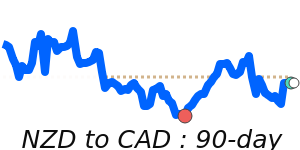

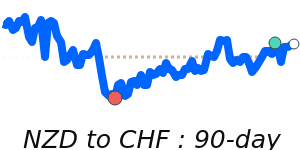

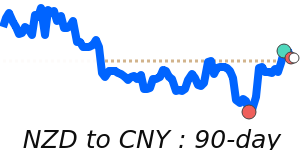

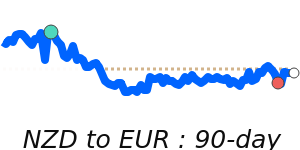

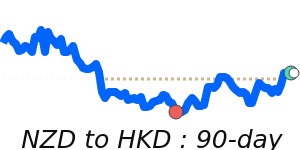

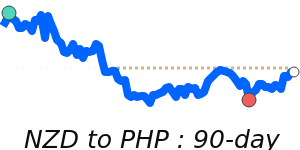

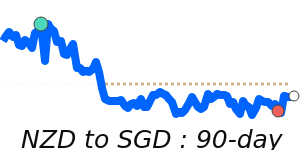

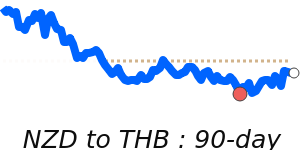

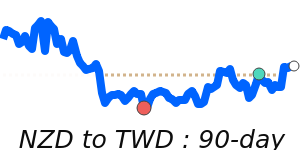

NZDUSD: around 0.5954, within a 0.5728–0.6077 range. NZDEUR: about 0.5064, within 0.4900–0.5122. NZDGBP: about 0.4442, within 0.4274–0.4460. NZDJPY: about 93.26, within 89.04–94.79. Current levels sit modestly above their 3‑month averages (roughly 1.3–2% higher for USD/EUR/GBP; about 1.7% for JPY).

What could change it

- A shift higher in risk appetite from geopolitical progress or easing tensions.

- Surprising domestic data or clearer guidance from the RBNZ could re-anchor kiwi moves.