The New Zealand dollar (NZD) has regained some ground recently amid improving risk sentiment. After a muted start yesterday, the kiwi strengthened through the day, tracking the positive mood in financial markets. However, with no major New Zealand data scheduled today, the currency's movement will likely remain driven by global risk appetite.

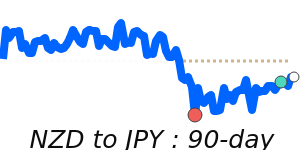

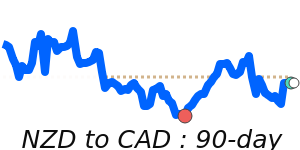

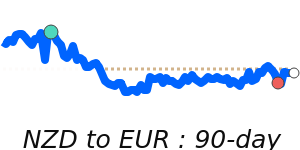

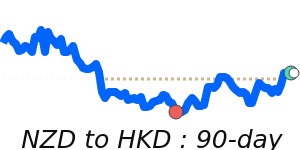

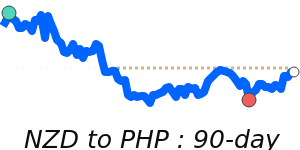

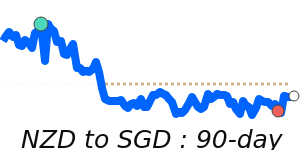

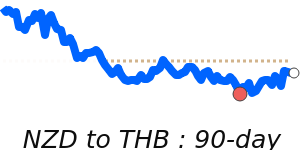

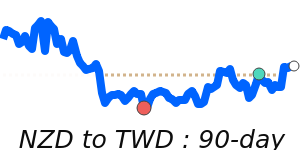

The NZD remains sensitive to changes in market sentiment. Recently, its decline was influenced by the Reserve Bank of New Zealand’s decision to hold interest rates steady at 2.25%, signaling a cautious stance and prompting a short-term dip. Nonetheless, the NZD’s recent recovery is supported by gains against the Euro and the Japanese yen, with the pair trading above their three-month averages. Conversely, against the Australian dollar and the Canadian dollar, the kiwi remains near multi-week lows, reflecting ongoing risk-off tendencies in those currencies.

Overall, as risk sentiment improves, we might see the NZD continue its recovery, but it remains vulnerable to shifts in global economic conditions and trade developments. Keep an eye on market mood, especially as no domestic data is expected to influence the currency today.