Outlook

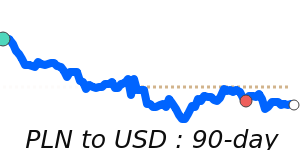

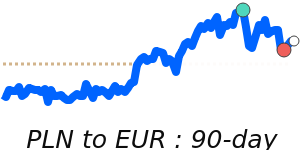

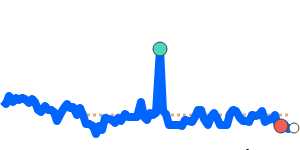

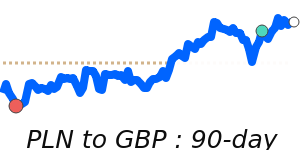

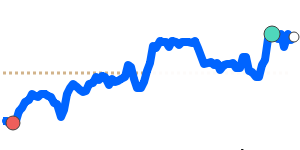

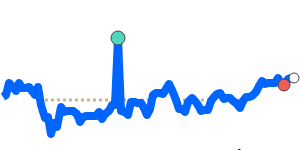

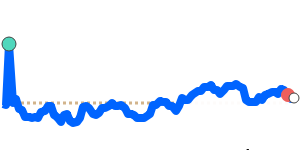

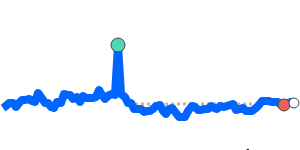

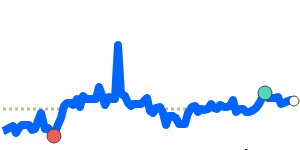

Poland's zloty remains sensitive to political risk even as growth and contained inflation offer support. The PLN has traded in tight ranges against major peers, with PLN/USD near 0.2802 and within a 0.2737–0.2867 band, PLN/EUR around 0.2371 within 0.2360–0.2383, PLN/GBP near 0.2066 within 0.2043–0.2084, and PLN/JPY around 43.76 within 42.65–44.33. A political stabilisation and a steady NBP policy path could support modest gains, while a deeper coalition rift or softer growth would cap upside.

Key drivers

Poland’s political instability, with a deepening rift inside the ruling coalition, adds a persistent risk premium to the PLN. The National Bank of Poland is projected to keep rates at 5.75% in 2026, outpacing the Eurozone and U.S. paths. GDP growth is forecast at about 3.5% in 2026, supported by EU-funded investments under programs like the Recovery and Resilience Facility. Inflation cooled to 2.8% in October 2025, with core inflation at 3.0%, the lowest in several years. Together, these factors create a balance between a relatively strong growth outlook and political and policy uncertainty that can limit sustained PLN strength.

Range

PLN/USD: 0.2737–0.2867, with 7-day highs near 0.2802 and the pair about 0.6% above its 3-month average of 0.2786. PLN/EUR: 0.2360–0.2383, near the 3-month average, around 0.2371. PLN/GBP: 0.2043–0.2084, with 7-day lows near 0.2066. PLN/JPY: 42.65–44.33, with 43.76 about 0.7% above the 3-month average of 43.46.

What could change it

A resolution of the political split and improved risk sentiment could push the PLN higher, while a renewed coalition clash would weigh on it. If the NBP signals a shift in policy or inflation surprises emerge, the currency could move decisively in either direction. Faster disbursement of EU funds and stronger domestic data would support PLN gains; weaker data or external shocks would constrain upside or push the PLN lower.