Outlook

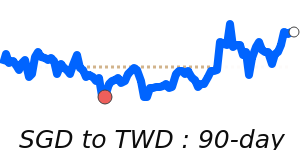

SGD edges modestly higher on Singapore’s resilient economy and a cautious MAS stance. Gains look capped by external risks, including tariff developments and global rate moves. Markets expect MAS to preserve policy flexibility, supporting the SGD on pullbacks but preventing sharp gains.

Key drivers

1. MAS policy remains accommodative after early-2025 easing.

2. External trade risk from US tariffs on Singapore goods persists.

3. Solid Q2 2025 growth underpins SGD resilience.

4. Subdued inflation gives MAS room to stay cautious.

Range

SGD/USD: current 0.7908; range 0.7706–0.7934

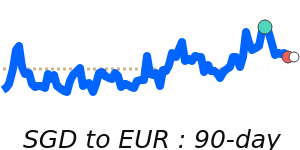

SGD/EUR: current 0.6688; range 0.6593–0.6704

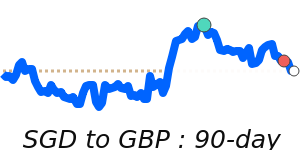

SGD/GBP: current 0.5866; range 0.5730–0.5866

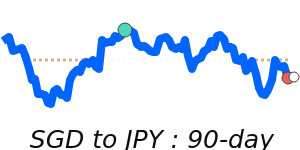

SGD/JPY: current 123.4; range 119.6–123.8

What could change it

1. A shift in MAS policy path or guidance.

2. Progress or reversal in US-Singapore tariff talks.

3. A surprise in inflation or growth that prompts faster or slower normalization.