Outlook

The rand is seen trading in a cautious, range-bound mode near current levels. The November 2025 SARB rate cut to 6.75% and firmer gold prices provide some upside support, while domestic political risk and sensitive trade developments limit sustained gains. If US monetary policy remains restrictive or risk appetite softens, the rand could ease; signs of policy clarity and stronger commodity prices could help it hold or edge higher.

Key drivers

- Domestic policy: SARB’s 6.75% repo rate and a 3% inflation target (±1%) help anchor expectations and support growth.

- Global commodity prices: firmer gold prices bolster export earnings and attract investment, benefiting the rand.

- Political developments: GNU internal conflicts and the DA’s withdrawal in 2025 weigh on investor confidence and sentiment.

- Trade relations: AGOA extension through 2028, with SA inclusion remaining politically sensitive, shaping sentiment and potential flows.

- Global policy and risk sentiment: US rate expectations and overall risk appetite drive dollar strength and financial conditions.

Range

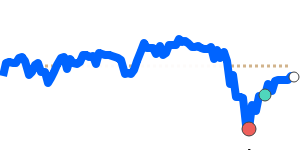

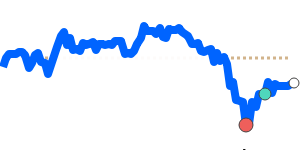

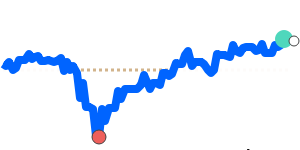

ZARUSD current 0.062752, 3-month average 0.060963 (2.9% above); range 0.058424–0.063546

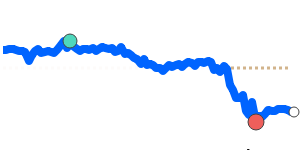

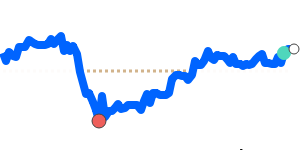

ZAREUR current 0.053170, 3-month average 0.051878 (2.5% above); range 0.050268–0.053373

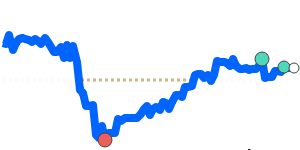

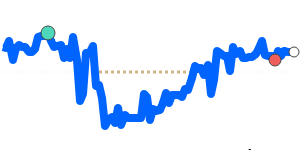

ZARGBP current 0.046519, 3-month average 0.045201 (2.9% above); range 0.043959–0.046559

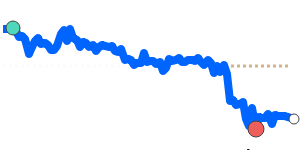

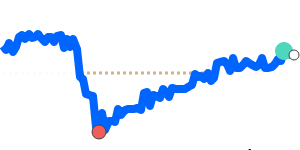

ZARJPY current 9.7856, 3-month average 9.5091 (2.9% above); range 9.0981–9.8580

What could change it

- A shift in US or global monetary policy that alters risk appetite or dollar strength.

- Resolution or escalation of SA political risks or clearer progress on economic reforms and AGOA-related trade dynamics.

- Large moves in gold or other commodity prices impacting export income and sentiment.

- Domestic data surprises (inflation, growth) influencing SARB policy expectations.