AUD Market Update

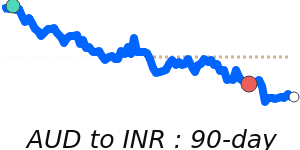

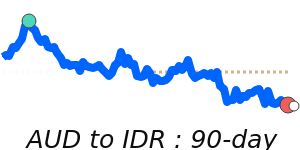

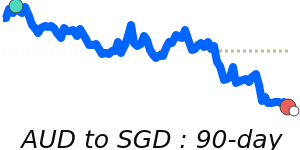

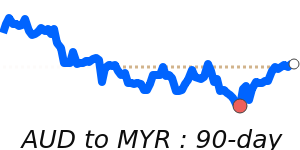

The Australian dollar experienced some ups and downs recently amid mixed global signals. Early in the week, the AUD found some support as US dollar weakness gave it a breather. However, fresh risk aversion emerged due to escalating tensions in the Middle East, which put downward pressure on the currency during the European trading session.

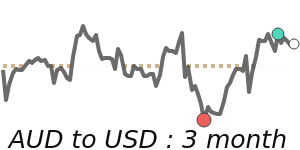

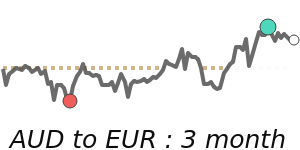

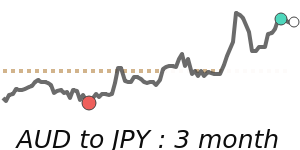

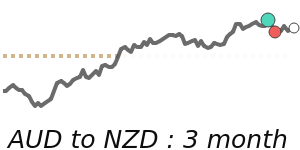

against the US dollar, the AUD is trading around 0.6970, roughly 1.6% higher than its three-month average, staying within a recent range of about 0.6604 to 0.7125. The AUD also gained against the Euro and the British pound, trading at around 0.6053 and 0.5243 respectively—both above their recent averages. Meanwhile, the AUD has also strengthened against the Japanese yen, with the pair at about 110.6, a 3.3% increase over its three-month average.

Despite market volatility, the AUD remains supported by commodity prices and recent central bank actions, including a rate hike by the Reserve Bank of Australia. If global tensions ease and Chinese economic data show resilience, there could be further support for the Aussie. However, ongoing geopolitical risks and global market sentiment will continue to play a significant role in its near-term direction.