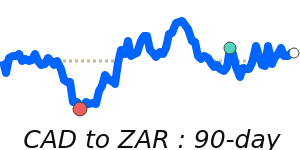

The Canadian dollar (CAD) edged lower yesterday as oil prices eased from recent highs. With crude prices slipping, the CAD lost some support that came from higher oil amid concerns over energy supply disruptions in the Middle East.

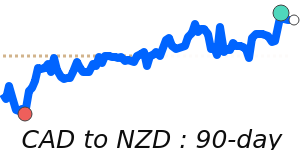

However, the CAD remains somewhat supported by ongoing oil exports, especially as oil prices remain elevated compared to recent levels. Today, if oil prices recover and push higher, the CAD could regain some of its strength against the US dollar and other currencies.

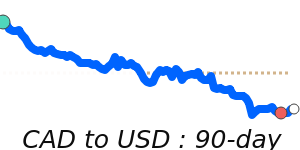

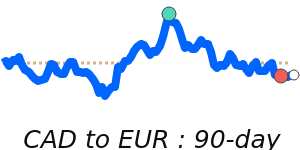

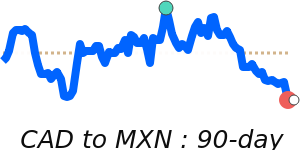

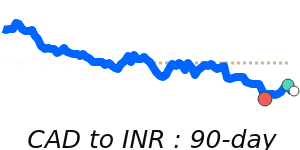

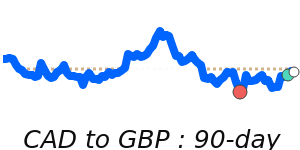

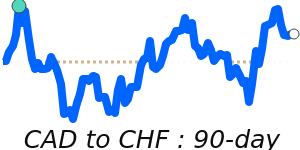

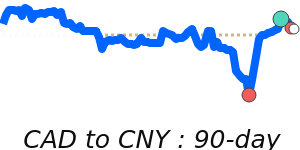

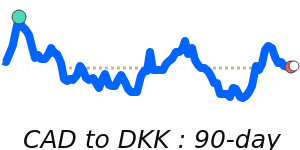

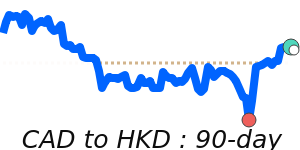

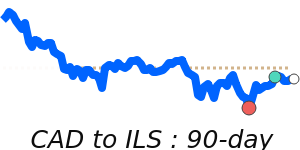

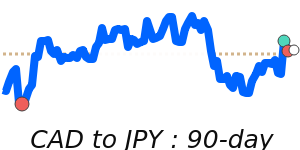

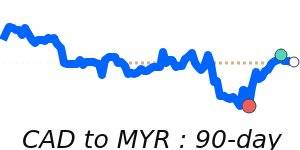

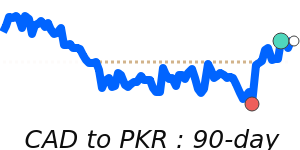

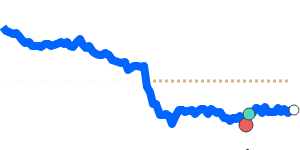

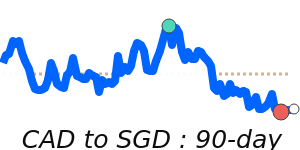

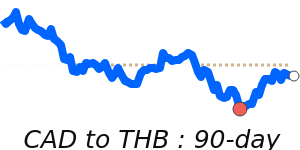

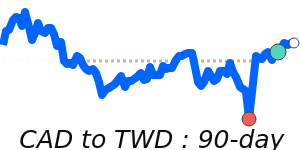

Currently, the USD/CAD pair is near its 14-day high of approximately 0.7365. The Canadian dollar also trades stronger against the Euro, pound, and yen, with recent 90-day highs against GBP and JPY. Despite these gains, the CAD faces headwinds from broad USD safe-haven flows related to geopolitical tensions, which tend to favor the dollar in times of uncertainty.

Overall, the CAD's near-term outlook will largely hinge on oil price movements. If crude stabilizes or rises again, the CAD could outperform other risk currencies. Conversely, if geopolitical tensions escalate and energy supply concerns deepen, the CAD could strengthen further, especially against currencies linked to global risk sentiment.