Is the VND to USD Exchange Rate Likely to Improve?

Predicting exchange rate movements is always challenging, as they’re influenced by a wide range of economic and geopolitical factors. One useful way to assess the current value of the Vietnamese dong against the US dollar is to review how the VND/USD rate has changed over time.

The table below shows the percentage change in the VND to USD exchange rate across various timeframes—from the past 2 weeks to the last 20 years:

| Date | VND/USD | Period |

|---|

14 Dec 2025 | 0.000038 | 2 Week |

29 Sep 2025 | 0.000038 | 3 Month |

28 Dec 2024 | 0.000039 | 1 Year |

29 Dec 2020 | 0.000043 | 5 Year |

31 Dec 2015 | 0.000045 | 10 Year |

02 Jan 2006 | 0.000061 | 20 Year |

VND/USD historic rates

Current market bias: Bearish for USD to VND.

Key drivers:

- Interest rate differential: The Federal Reserve is expected to cut rates, weakening the USD, while Vietnam’s strong growth target boosts the VND.

- Economic growth: Vietnam's target of over 10% growth for 2026 supports a stronger currency.

Near-term range: The USD/VND exchange rate is likely to fluctuate near current levels, around a recent low, reflecting a narrow trading range.

What could change it: Upside risk includes improvement in U.S. consumer sentiment, which may temporarily strengthen the USD. Conversely, political developments in Vietnam, such as upcoming legislative elections, could negatively impact investor confidence in the VND.

---

Expect a bearish trend for USD/VND. Fed rate cuts may weaken USD, while Vietnam’s projected 10% growth should support VND. Recent lows around 26,285 indicate a narrow range ahead. Watch for U.S. sentiment shifts or political factors in Vietnam affecting confidence

VND to USD Conversion: What Is Your Money Worth?

To help you understand the real-world value of the current exchange rate, the table below shows how much Vietnamese dong are worth in US dollar across a range of amounts.

This gives a quick view of what you’d get when converting different VND amounts at today’s rate * :

*Converted at the current VND-USD interbank exchange rate.

Calculate actual payout amounts for

Send Money

and

Travel Money

exchange rates.

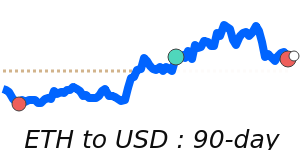

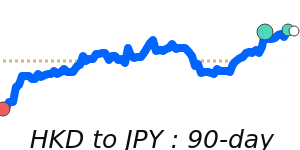

Is US dollar (USD) expected to go up or down?

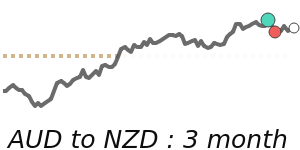

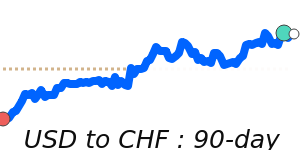

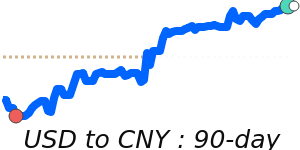

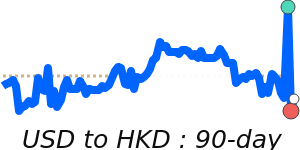

This is always a difficult question as exchange rates are influenced by many factors, so a good method to consider the US dollar current value is to look the USD performance against a range of other currencies over various time periods.

The following table looks at the performance of the USD exchange rate against selections of other currencies over time periods from the previous 2 days back to the last 5 years.

Popular Rates (A - Z)