Outlook

CHF remains bid as a safe-haven amid global tensions, leaving it firmer vs peers. The SNB keeps 0% to protect inflation and exports. Markets expect vigilance on FX and possible intervention if the franc rallies too far. Risk appetite shifts could ease the bid.

Key drivers

- Safe-haven demand from tensions underpins CHF strength.

- SNB's 0% policy balances inflation risk with exporters.

- SNB can intervene if the franc rises too fast.

- 2025 tariff shock exposed export exposure and policy risk.

Range

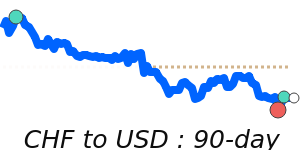

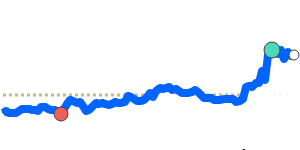

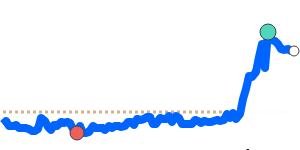

CHF/USD: current 1.2997; 3m avg 1.2709; range 1.2392–1.3115

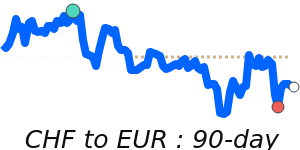

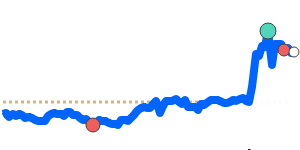

CHF/EUR: current 1.0997; 3m avg 1.0813; range 1.0648–1.1009

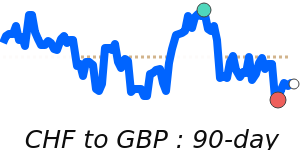

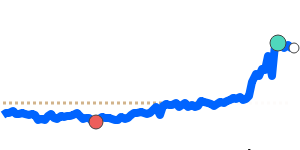

CHF/GBP: current 0.9639; 3m avg 0.9422; range 0.9298–0.9652

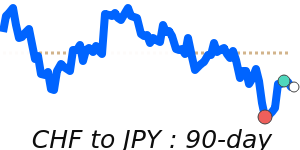

CHF/JPY: current 202.8; 3m avg 198.2; range 193.0–203.4

What could change it

- A shift in global growth or risk environment toward stability could ease CHF strength.

- Unexpected SNB policy shift or new currency action.

- Trade tensions escalate or ease, affecting risk demand.

- Switzerland’s export outlook or tariff policy developments.