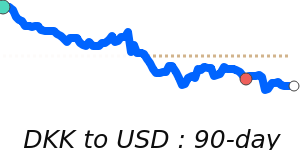

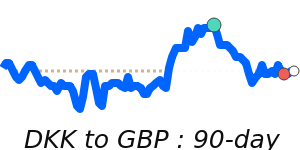

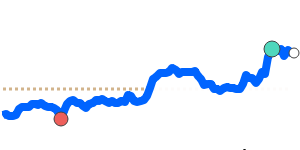

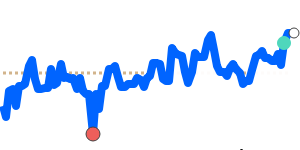

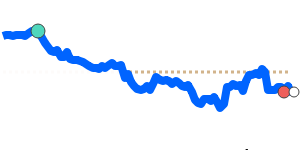

Bias: range-bound, with USD/DKK near the 90-day average and near the middle of the 3-month range.

Key drivers:

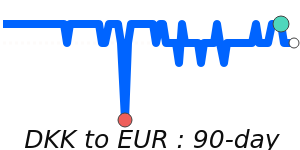

- Rate gap: US policy is expected to move toward cuts toward a neutral stance in 2026, while Denmark keeps the krone peg aligned with the ECB, a setup that can limit large moves in the pair and reduce carry risk for traders (the extra costs or gains from holding positions overnight).

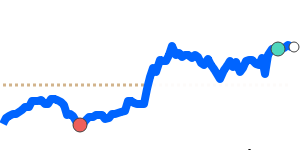

- US data: Upcoming payrolls and unemployment readings will shape bets on Fed easing and the timing of any policy change, in turn driving dollar demand and influencing hedges by importers and exporters.

- Danish policy: The peg regime, ECB alignment, and modest reserve movements support a steady krone stance even as global rate expectations wobble.

Range: The pair has traded in a very tight band, hovering around the middle of its recent 3-month range.

What could change it:

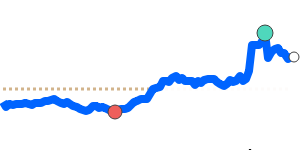

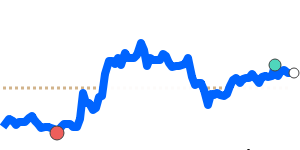

Upside risk: A stronger-than-expected US jobs report or signals from Fed officials that rate cuts will be delayed could lift the dollar.

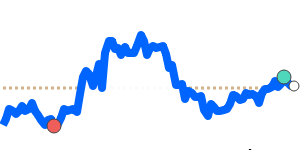

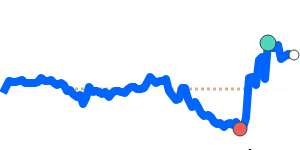

Downside risk: A clear path to rate cuts and dovish tones from Fed officials could ease dollar demand.