Outlook

The MXN faces ongoing sensitivity to Banxico’s policy stance and global risk sentiment. Banxico kept its benchmark at 7% in early February, signaling a cautious stance on inflation that kept downward pressure on MXN when the decision landed. In mid-February, softer U.S. dollar dynamics and stronger appetite for emerging-market currencies supported the peso, though a longer inflation pathway (Banxico now sees inflation returning to target in 2027) keeps policy risk skewed to the upside for the peso’s volatility. Ongoing US-Mexico trade discussions add a bilateral risk element. Near term, the peso could hover around the upper end of its recent ranges; sustained risk-on could push toward about 0.0584 USD per MXN, while risk-off or a hawkish tilt from Banxico could pull the rate toward 0.0540.

Key drivers

- Banxico kept the policy rate at 7% on February 6, signaling a cautious inflation view and weighing on MXN versus the USD.

- February 12 EM tailwinds and a softer dollar helped the peso; sentiment could stay supportive if risk appetite remains positive.

- Inflation outlook extended to Q2 2027, reflecting persistent core inflation and external challenges; policy may stay restrictive longer.

- Ongoing US-Mexico trade discussions and USMCA developments add variability to the peso’s path.

- Global risk sentiment and EM capital flows remain a key swing factor for MXN, with dollar moves often driving quick moves in the peso.

Range

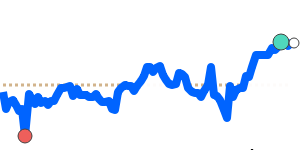

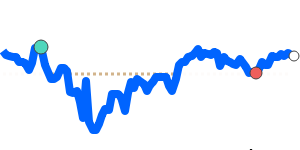

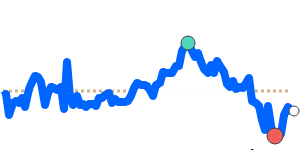

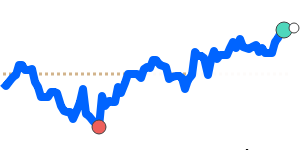

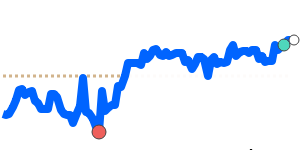

MXN/USD is near 0.058375, a 90-day high, about 3.9% above its 3-month average of 0.056195, with a 90-day range of 0.054040 to 0.058375. MXN/EUR sits near 0.049257, 2.8% above its 3-month average of 0.047913, trading in a 0.046900–0.049257 range. MXN/GBP is around 0.043023, 3.0% above its 3-month average of 0.041771, within a 0.040994–0.043045 range. MXN/JPY is about 8.9357, 1.9% above its 3-month average of 8.7689, within an 8.4612–9.1351 range.

What could change it

- Shifts in Banxico policy path or inflation trajectory (rate moves or a stronger/weaker inflation signal).

- A material change in U.S. dollar strength or global risk appetite driven by U.S. data, Fed messaging, or geopolitical events.

- Progress or setbacks in US-Mexico trade talks and USMCA-related developments.

- Shifts in EM capital flows or commodity price moves that alter appetite for EM currencies.

- Domestic data surprises (inflation, growth, remittance trends) that alter near-term policy expectations.