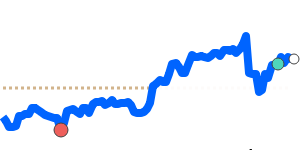

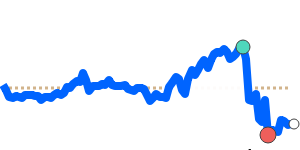

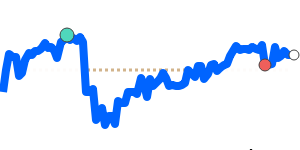

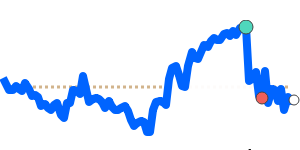

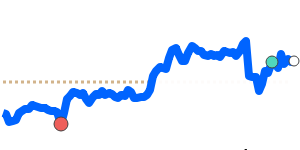

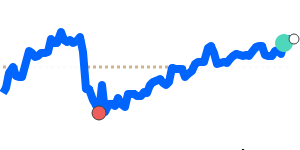

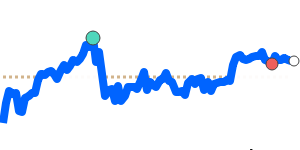

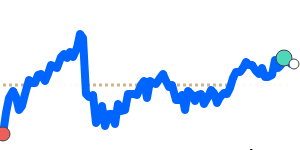

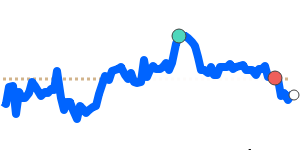

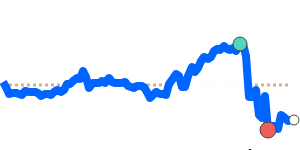

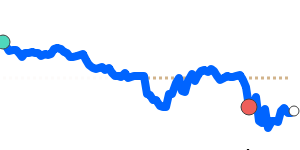

USD/NOK Outlook:

The USD/NOK is likely to decrease as the exchange rate is near its recent lows and below its 90-day average. Escalating geopolitical tensions are fueling a flight to the US dollar, but the overall strength of the krone is limiting the dollar's gains.

Key drivers:

• Rate gap: The US Federal Reserve’s cautious stance contrasts with Norway’s economic stability, supported by recent inflation trends.

• Risk/commodities: Oil prices are significantly up, creating demand for NOK since higher oil prices benefit Norway as a major exporter.

• One macro factor: Growing concerns over global growth due to geopolitical events are bolstering USD demand but may slow NOK's appreciation.

Range:

USD/NOK is expected to hold within its recent range, influenced by high oil prices and ongoing geopolitical risks.

What could change it:

• Upside risk: A sudden de-escalation of geopolitical tensions could weaken the USD appeal.

• Downside risk: A sharp drop in oil prices could reduce demand for NOK sharply.