The New Zealand dollar (NZD) has shown resilience recently, bolstered by an optimistic market sentiment at the start of the week. Analysts note that this positive mood could help the 'kiwi' maintain its gains, especially if market confidence continues in the sessions ahead.

Currently, the NZD/USD exchange rate stands at 0.6090, which is approximately 2.5% higher than its 3-month average of 0.5944. This represents a significant fluctuation, with the currency trading in a volatile 10.2% range between 0.5534 and 0.6099. The correlation between NZD/USD and AUD/USD remains evident, influenced by commodity market dynamics and geographical ties.

However, external factors loom on the horizon that could impact the NZD negatively. There are concerns regarding potential new tariffs under a possible Trump presidency, which could affect demand for key commodities from major trading partners like Europe and China. This dynamic could subsequently dampen the NZD as traders react to shifts in global demand.

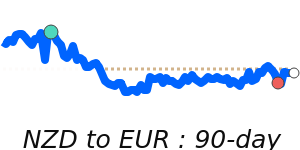

In terms of other currency pair performances, the NZD is currently facing challenges against the Euro, having recently dipped to 60-day lows near 0.5161—1.2% below its 3-month average of 0.5225. This pair has exhibited relative stability within a 5.1% range from 0.5051 to 0.5309. Conversely, against the British pound, the NZD is trading at 0.4461, slightly above its 3-month average and demonstrating a more stable movement within a 3.9% range.

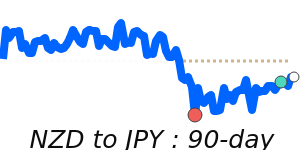

Meanwhile, the NZD to JPY exchange rate has decreased to 7-day lows around 87.39, which is 1.9% above its 3-month average of 85.81, reflecting an 8.5% trading range from lows of 80.96 to highs of 87.81.

In summary, while the New Zealand dollar has demonstrated strength recently, external geopolitical factors and trading dynamics may create uncertainty for its future performance.