Outlook

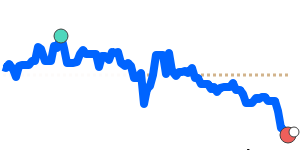

The Philippine peso is seen staying in a narrow range near the current levels, with about modest downside and upside risk contingent on domestic headlines and global risk sentiment. The surge in the Overnight Reference Rate (ORR)-based peso IRS market supports better policy transmission and price discovery, which should help anchor the peso as the BSP steers policy. Domestic political and fiscal risks linked to infrastructure spending remain a headwind for confidence, as highlighted by banks and market observers. A scenario of improving risk appetite and a more stable U.S. policy path could push the peso toward the upper end of its range; a renewed risk-off environment or unresolved corruption headlines could push it toward the lower end. Current price data show PHP trading around 0.017210 USD per PHP, with a very tight 2.9% range in the last session. Key cross-rates sit near their 3-month averages but within stable bands.

Key drivers

- ORR-based peso IRS market established in 2024 and expanding into 2026, improving price discovery and policy transmission as volumes surged to PHP 43.5 billion and total market size neared PHP 100 billion by January 2026.

- Peso depreciation in late 2025 tied to infrastructure corruption concerns; BSP maintains ample USD reserves and allows market forces to determine the exchange rate, supporting limited intervention while policy credibility is assessed.

- Global banks flagged political and fiscal risks to the Philippine peso economy in 2025, highlighting potential effects on investor confidence and sentiment.

- HSBC’s January 2025 forecast that the peso could breach ₱59 per USD by Q2 2025 adds a historical risk reference for downside scenarios.

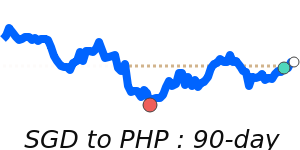

- Current price posture: PHPUSD near 0.017210, with PHP/EUR around 0.014625, PHP/GBP around 0.012789, and PHP/JPY around 2.6703, all trading within relatively stable bands.

Range

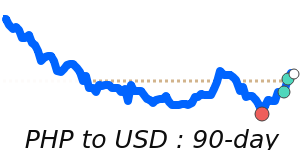

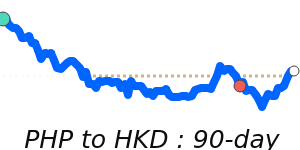

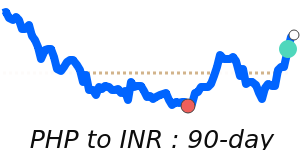

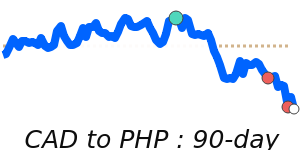

PHP/USD: current near 0.017210; range 0.016796–0.017287; 3-month average about 0.017.

PHP/EUR: current 0.014625; range 0.014088–0.014771; 3-month average about 0.014492.

PHP/GBP: current 0.012789; range 0.012249–0.012983; 3-month average about 0.012633.

PHP/JPY: current 2.6703; range 2.5814–2.6939; 3-month average about 2.6528.

What could change it

- A more decisive policy stance or intervention by the BSP using USD reserves to strengthen the peso during risk-off episodes.

- Resolution or material improvement in domestic corruption headlines, boosting investor confidence and stabilizing sentiment.

- A shift in global risk appetite or major changes in U.S. monetary policy that alter USD strength or carry trade dynamics.

- An update to external growth conditions or fiscal developments that alters near-term risk premia for Philippine assets.