Outlook

THB is likely to remain in a tight, range-bound path near current levels in the near term. The currency's direction will hinge on domestic policy signals and the broader dollar trend. Markets have signalled that a controlled depreciation could be used to support exports and tourism if needed, aligning with early-2026 views.

Key drivers

- Bank of Thailand tightens currency controls, focusing on forex transactions with gold traders and currency dealers to curb baht strength.

- Finance Ministry worries that a very strong baht could hurt export-dependent growth.

- Illicit funds, including flows through digital assets, have been contributing to baht appreciation and affecting tourism.

- Markets in January 2026 suggested that a controlled depreciation could support exports and tourism, potentially guiding policy if needed.

Range

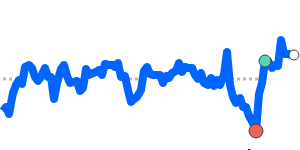

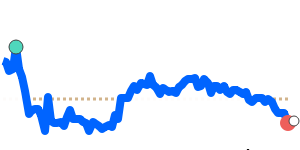

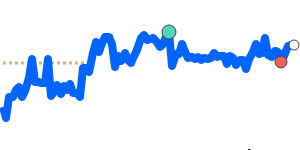

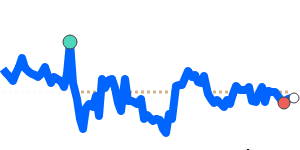

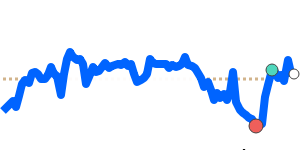

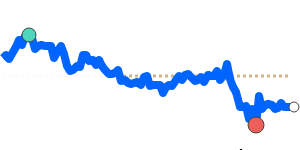

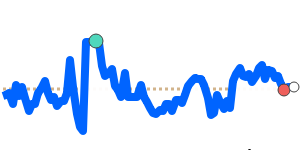

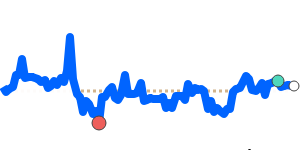

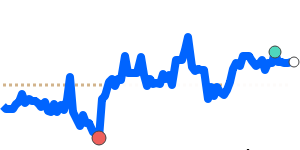

THB/USD at 0.032185, just 1.1% above its 3-month average of 0.031847, after trading within a stable 4.6% range from 0.031016 to 0.032456. THB/EUR at 0.027244, 0.5% above its 3-month average of 0.027108, with a stable 3.1% range from 0.026701 to 0.027522. THB/GBP at 0.023741, 0.5% above its 3-month average of 0.023619, within a 4.0% range from 0.023049 to 0.023982. THB/JPY at 5.0270, 1.2% above its 3-month average of 4.9681, trading in a stable 5.3% range from 4.8434 to 5.1007.

What could change it

- Further BoT action to tighten or unwind currency controls could push the baht higher or lower.

- A shift toward a more pronounced depreciation to support exports and tourism could weigh on the baht.

- A stronger or weaker US dollar driven by US data could move THB pairs in the corresponding direction.

- Regulatory actions affecting illicit fund flows or digital-asset channels could alter near-term baht dynamics.