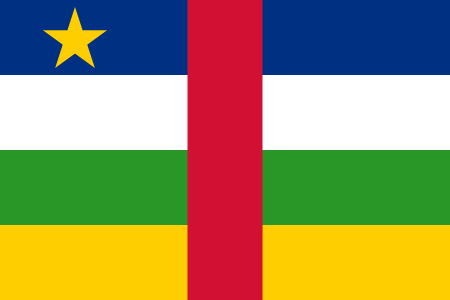

Currency in Central African Republic: XAF Send & Spend FX Guide

Resources for Expats, Travelers, and Entrepreneurs Navigating Life and Trade in Central African Republic with the Central African franc.

What's in this Central African Republic currency guide?

What currency is used in Central African Republic?

The official currency of Central African Republic (country code: CF) is the Central African franc, with symbol FCFA and currency code XAF.

What is a good Central African franc exchange rate?

The BestExchangeRates.com currency comparison table below helps you see the total cost of your currency transaction by showing the exchange rates offered by different providers. It also makes it easy to spot potential savings from market-leading FX services compared to bank rates.

To see a full list of rates, enter your transaction type, currencies and amount then click ‘GET RATES’:

Loading rates...

|

|

|

Good things to know about the Central African franc

Here are some things you might want to know about the Central African CFA franc:

- The Central African CFA franc (XAF) is the currency of six independent states in Central Africa - Cameroon, Central African Republic, Chad, Republic of the Congo, Equatorial Guinea and Gabon.

- It is represented by the symbol "FCFA" and is abbreviated as XAF.

- The CFA franc was introduced in 1945, replacing the French Equatorial African franc. It is pegged to the euro at a fixed exchange rate of 1 euro = 655.957 CFA francs.

- The value of the CFA franc is guaranteed by the Central Bank of Central African States, which is responsible for issuing and managing the currency.

- The physical currency consists of coins and banknotes. The coins come in denominations of 1, 2, 5, 10, 25, 50, 100, and 500 CFA francs. The banknotes come in denominations of 500, 1,000, 2,000, 5,000, and 10,000 CFA francs.

- The banknotes feature images of famous historical figures, such as King Béhanzin and King Njoya. The design of the currency is constantly being updated, so the physical appearance of the coins and banknotes may vary slightly over time.

- The currency was introduced to the previously French colonies in Equatorial Africa in 1945, replacing the French Equatorial African franc. The currency continued in use when these colonies gained their independence. Equatorial Guinea, the only former Spanish colony in the zone, adopted the CFA franc in 1984.

- Both XAF and XOF currencies are referred to as the CFA franc.

For more XAF information check out our selection of Central African franc news and guides.

Frequently Asked Questions

What currency should I use in Central African Republic?

The domestic currency in Central African Republic is the Central African franc.

What is the Central African franc currency code and symbol?

The three letter currency code for the Central African franc is XAF — symbol is FCFA.

What does the Central African franc look like?

Here is an example Central African franc banknote:

Which countries use the Central African franc?

It is the domestic currency in Cameroon, Central African Republic, Chad, Congo, Equatorial Guinea and Gabon.

Is the Central African franc a closed currency?

No, the Central African franc is freely available and convertible. See guide: What is a closed currency?

What are equivalent amounts of USD and XAF?

Here are some popular conversion amounts for USD to XAF (US dollar to Central African franc)*.

| USD | XAF |

|---|---|

| $ 1,000 | FCFA 562,290 |

| $ 5,000 | FCFA 2,811,450 |

| $ 20,000 | FCFA 11,245,800 |

| $ 100,000 | FCFA 56,229,000 |

| USD | XAF |

|---|---|

| $ 1.7780 | FCFA 1,000 |

| $ 8.8900 | FCFA 5,000 |

| $ 35.56 | FCFA 20,000 |

| $ 177.80 | FCFA 100,000 |

More amounts

*Converted at the current USDXAF interbank exchange rate. Calculate actual payout amounts for Send Money and Travel Money exchange rates.

Travel money for Central African Republic

Using Wise for Central African franc travel money is a smart choice for savvy travelers. With its competitive exchange rates and low fees, Wise allows you to convert and manage multiple currencies effortlessly.

Be careful when using your own bank's Debit/Credit Card, as your bank may also charge an extra 3% as an “Overseas Transaction Charge” plus “Overseas ATM” fees for withdrawing cash on top of the standard Visa/Mastercard 2.5% from market mid-rate.

For card purchases, if you are offered a choice of currencies always select to Pay in Central African franc otherwise you will typically get much worst dynamic currency conversion (DCC) exchange rates.

If you really want Central African franc cash before departure, you can save money by ordering online. You generally get better rates and can pick up the XAF cash locally or even on travel day at the airport.

Central African Republic: Travel Guide

Traveling to Central African Republic requires careful financial planning to ensure a smooth and cost-effective experience. Here's a comprehensive guide to help you navigate currency considerations and manage your money effectively during your visit.

The Central African Republic (CAR) is a landlocked country located in Central Africa. It is bordered by Chad to the north, Sudan to the northeast, South Sudan to the east, the Democratic Republic of Congo to the south, the Republic of Congo to the southwest, and Cameroon to the west.

The country has a population of around 4.8 million people and is one of the least developed countries in the world, with a GDP per capita of around $300. The majority of the population is engaged in subsistence agriculture, and the country has limited natural resources and a poorly developed infrastructure.

CAR has a long history of political instability and violence, with multiple coups and armed conflicts having occurred in recent decades. This has greatly hindered the country's economic and social development. The CAR is also affected by religious and ethnic conflict, it has been in a state of civil war since 2013 and the United Nations has maintained a peacekeeping mission in the country since 2014. The conflicts have resulted in a humanitarian crisis, with a large number of people being internally displaced or fleeing as refugees.

Everyday Costs in in Central African Republic

How much does it really cost to live, work, or travel in Central African Republic? Here's what to expect for daily expenses and expat living.

Currency Guide for the Central African Republic (ISO Code: CF)

When planning a one-week mid-range stay in the Central African Republic (CAR), travelers should budget around 400,000 to 600,000 Central African CFA francs (XAF). This estimate should cover accommodation, meals, transportation, and entertainment while allowing some flexibility for leisure activities. Here’s a breakdown of typical daily expenses in CAR:

- 🍽️ Meal at a local restaurant: 3,000 - 10,000 XAF

- ☕ Coffee: 1,000 - 2,000 XAF

- 🚌 Public transport fare: 250 - 1,500 XAF

- 📶 Prepaid SIM card: 5,000 - 10,000 XAF

- 🏨 Budget hotel or Airbnb: 10,000 - 25,000 XAF

Traveling in CAR is generally considered cheap compared to countries like the United States or the UK, where similar meals could easily cost over $10 (USD) and hotels often start at $100. Overall, visitors will find CAR affordable, providing a unique experience with savings compared to Western standards.

Expat Section: Living in Central African Republic

For expatriates relocating to the Central African Republic, the typical monthly living costs can range from 500,000 to 1,200,000 XAF, depending on lifestyle choices. This budget covers rent, utilities, food, and transportation. Banking in CAR has its challenges, but using international bank cards is becoming more accepted. However, cash remains king, especially in rural areas. It's advisable to have a reliable local bank account for day-to-day expenses, while using online transfer services like Wise or OFX for sending and receiving money can be more cost-effective than traditional banks. Exchanging money locally can offer convenience, but check rates as they can vary significantly—especially in more remote locations. For larger transactions, online services may save you money and time.

USD/XAF Market Data

The below interactive chart displays the USD/XAF change and UP📈 DOWN📉 trends over the past 1 Year.

Recent Central African franc Market News

The Central African CFA franc has a fixed rate of exchange with the euro, set at 1 euro = 655.957 CFA francs, so the EURCFA exchange rate should not fluctuate very much.

For more XAF information read our News and guides to the Central African franc.

Send Money to Central African Republic - Best Rates

To get a good (and fair) exchange rate when sending money to Central African Republic you need to find and compare exchange rates for International Money Transfers (IMTs).

The available FX rates for sending money abroad can be very different to the mid-market (wholesale) rate which you see reported online and in the News.

You should especially compare your own bank's exchange rates to those available from Money Transfer specialists to see how much you can save - we make that calculation easy in the below table.

Get a better deal for foreign transfers to Central African Republic

When sending money to Central African Republic it’s important to compare your bank’s rates & fees with those we have negotiated with our partner money transfer providers. To get a better deal you should follow these 4 simple steps :

- Open an account with a BER reviewed FX provider (id docs may be required)

- You specify the local or Central African franc amount you want to transfer

- Make a local currency domestic transfer for the requested amount to the provider's bank account in your country

- Once your funds are received by the provider the converted XAF amount will be transfered to the recipient account you specify in Central African Republic.

Use the above calculator to compare the exchange rates of FX specialist providers rates versus your bank's standard rates you can hopefully save around 5% and maybe more - end result is more Central African franc deposited into the recipient bank account and less margins and fees kept by the banks!

Managing money while living and working in Central African Republic

Managing your money effectively while living and working abroad can be challenging, but there are several steps you can take to ensure that your finances are in order.

Understand Central African franc currency exchange rates: Exchange rates can have a big impact on your finances, so it is important to keep an eye on the XAF exchange rate and consider using a money transfer specialist or a credit card that does not charge foreign transaction fees to get the best exchange rate.

Use a local Central African franc bank account: A local XAF bank account can make it easier for you to manage your finances and pay bills while you are in Central African Republic. It may also be more convenient to use a local XAF bank account to make purchases and withdraw cash.

Research local laws and regulations: It is important to understand the local laws and regulations that apply to financial transactions in Central African Republic. This can help you avoid legal issues and ensure that you are complying with local requirements.

Consider the tax implications: It is important to understand the tax implications of living or doing business in Central African Republic. This can help you plan your finances and ensure that you are paying the correct amount of tax.

Seek financial advice: If you are unsure of how to manage your finances in Central African Republic, it is a good idea to seek the advice of a financial professional who is familiar with the local financial system. This can help you make informed decisions and avoid financial pitfalls.

We have put together some key points to help managing your money effectively, you can reduce financial stress and enjoy your experience living or doing business in Central African Republic.

The CAR's economy is based mainly on agriculture, forestry, and mining. The country has a diverse range of natural resources, including diamonds, gold, timber, and oil, but these resources have not been fully exploited due to lack of investment, poor infrastructure and lack of governance.

CAR is also affected by poverty, and the majority of the population lives below the poverty line. The UN, the EU and other international organizations, along with some countries, are providing assistance to the CAR to improve the situation, but progress is slow due to the ongoing instability and insecurity.