OFX 2.0 for Business: Global Accounts, Cards & Spend Control

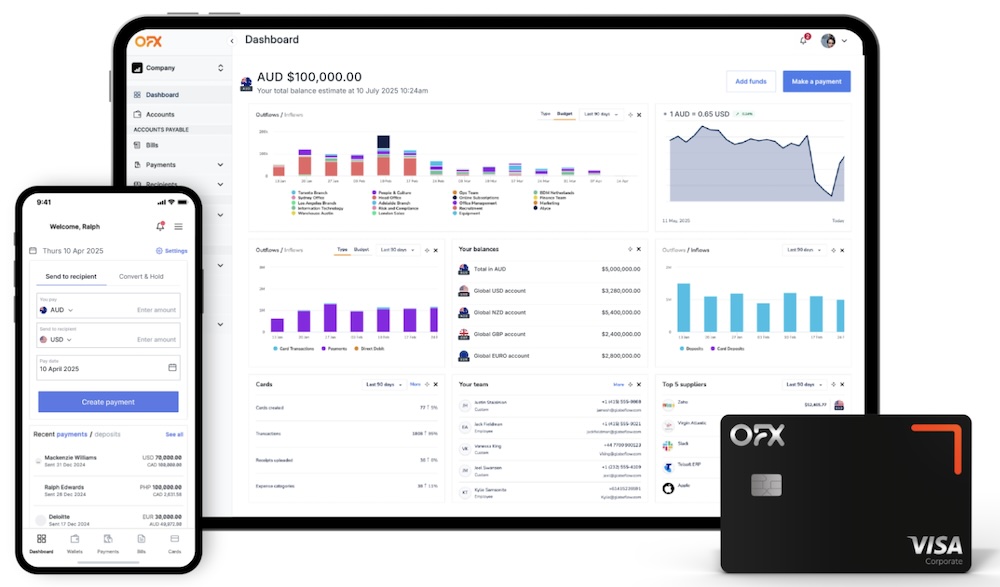

OFX has switched on “OFX 2.0” for businesses—adding global currency accounts, corporate cards and spend control, AP/batch tools, and accounting sync. Here’s how it reshapes FX from simple transfers to full finance ops.

SYDNEY — 11 Aug 2025 — OFX has begun migrating Australian business customers to its new client platform—internally dubbed OFX 2.0—and has launched it in Canada, framing a pivot from pure FX transfers to a broader financial-operations suite for CFOs and finance teams. The upgrade adds multi-currency accounts, Visa corporate cards, spend management, batch/AP tools and accounting integrations, alongside a fresh fee structure.

The latest

• Platform rollout: NCP (the new client platform behind “OFX 2.0”) launched in Australia and Canada; OFX targets new Corporate clients across North America, Europe (incl. UK) and Asia by end-FY26.

• What’s new for businesses:

• Global accounts to pay, hold and receive in 30+ currencies, with local account details in USD, EUR, GBP, CAD (and AUD base).

• Visa corporate cards (virtual & physical), Apple Pay/Google Pay support; spend management, bills/AP, batch & payroll payments.

• Integrations: two-way sync enhancements and connectors for Xero and QuickBooks (plus Employment Hero); advisor portal for accountants.

• Mobile: a dedicated OFX Business AU app for approvals, bills and payments on the go.

• Fees & terms update (AU): $15 fee for sub-A$10k FX payments removed; $10 SWIFT send and $5 SWIFT receive fees apply (local rails avoid them where available); 20 free domestic transactions/month on Business plan (200 on Business Plus), then A$1 each.

Why it matters

• From FX to finance ops: OFX 2.0 moves the firm beyond spot FX into cards, accounts, AR/AP, spend and treasury tooling—features SMEs often still rely on banks for. Early data shows new NCP clients use ~2.2 products on average, and non-FX revenue made up 27% of new-client revenue in FY25 (target ~40% in FY26).

• Control and visibility: Local details in major currencies plus card-based spend controls and accounting sync reduce reconciliation pain and bank fees for exporters, marketplaces and global payables teams.

By the numbers (early traction)

• 2,544 active clients on NCP (Mar 2025), up from 605 a year earlier.

• Adoption among new NCP clients: Global currency accounts 72%, FX 70%, Cards 22%, Accounting integrations 20%.

• Avg ~6.8 cards per card client; ~11.8k monthly spend per card client (Mar 2025).

What to watch

• Global migration cadence through FY26 and whether SMEs consolidate bank relationships into OFX 2.0.

• Feature adds flagged by OFX: Treasury-as-a-Service, pricing/subscription modules, and further fraud/risk controls.

• Competitive benchmark on local account coverage, card cashback and AP automation vs fintech peers as OFX scales outside ANZ/Canada.

Read our review of the OFX Global Currency Account for more on their multi-currency accounts and FX services.

Compare OFX exchange rates now

Disclaimer: Please note any provider recommendations, currency forecasts or any opinions of our authors should not be taken as a reference to buy or sell any financial product.