AED Market Update

The UAE Dirham has been relatively stable against most major currencies this week. It remains near its 3-month average against the US dollar of 0.2723, keeping the exchange rate steady amid global uncertainties.

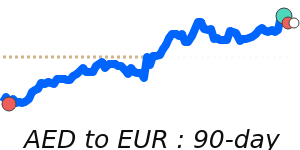

against the Euro, the AED has strengthened to near 0.2365, about 2% above its 3-month average, driven by the dollar’s strength and a recent rise in the euro. Similarly, the AED has reached 0.2048 against the British pound, around 1.5% higher than its recent average, reflecting confidence in the UAE’s economic prospects and stable regional trade.

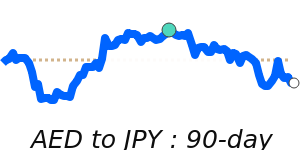

The AED also saw a notable increase versus the Japanese yen, trading near 43.20, about 1.6% above its 3-month average. These gains highlight ongoing currency stability amidst geopolitical tensions and rising oil prices, which are impacting global markets.

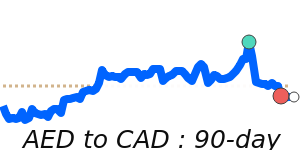

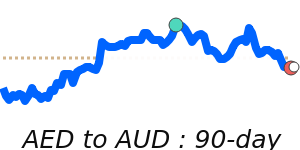

Meanwhile, the AED has traded slightly below its 3-month average against the Australian dollar and CAD, but within normal ranges. The currency has also edged higher against the Indian rupee, near 25.09, supported by stable inflation and diversification efforts in the UAE.

Overall, the Dirham remains tied closely to the US dollar and continues to show resilience amid recent geopolitical and economic developments.