Is the NGN to USD Exchange Rate Likely to Improve?

Predicting exchange rate movements is always challenging, as they’re influenced by a wide range of economic and geopolitical factors. One useful way to assess the current value of the Nigerian naira against the US dollar is to review how the NGN/USD rate has changed over time.

The table below shows the percentage change in the NGN to USD exchange rate across various timeframes—from the past 2 weeks to the last 20 years:

| Date | NGN/USD | Period |

|---|

13 Dec 2025 | 0.000688 | 2 Week |

28 Sep 2025 | 0.000673 | 3 Month |

27 Dec 2024 | 0.000646 | 1 Year |

28 Dec 2020 | 0.002625 | 5 Year |

30 Dec 2015 | 0.005024 | 10 Year |

01 Jan 2006 | 0.007646 | 20 Year |

NGN/USD historic rates

Current market bias: Bearish

Key drivers:

- Anticipated interest rate cuts from the Federal Reserve could weaken the USD significantly.

- Increasing inflation in Nigeria is projected to reach 37% in 2026, pressuring the Naira.

- Global economic growth and rising commodity prices may impact currency performance.

Near-term range: The USD to NGN is likely to remain within a stable corridor as it approaches its three-month average following recent trends.

What could change it: Upside risks include improvements in US consumer sentiment, which could temporarily bolster USD strength. However, downside risks are substantial due to high inflation in Nigeria and ongoing global economic uncertainties.

---

USD to NGN exchange rate shows a bearish bias. Fed's expected rate cuts may weaken the USD, while Nigeria's inflation could hit 37% by 2026. Near-term, USD may stay stable as pressures persist; potential shifts depend on US consumer sentiment & inflation impacts

NGN to USD Conversion: What Is Your Money Worth?

To help you understand the real-world value of the current exchange rate, the table below shows how much Nigerian naira are worth in US dollar across a range of amounts.

This gives a quick view of what you’d get when converting different NGN amounts at today’s rate * :

*Converted at the current NGN-USD interbank exchange rate.

Calculate actual payout amounts for

Send Money

and

Travel Money

exchange rates.

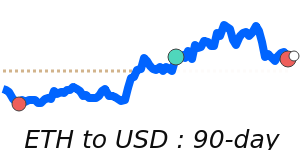

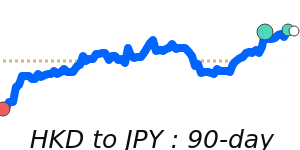

Is US dollar (USD) expected to go up or down?

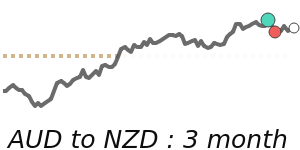

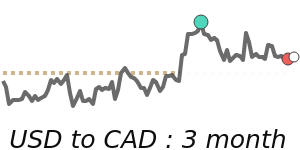

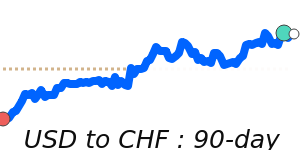

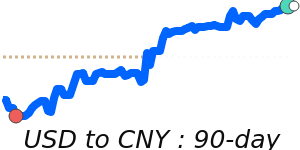

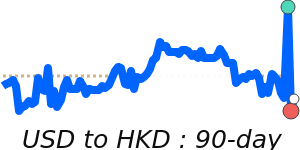

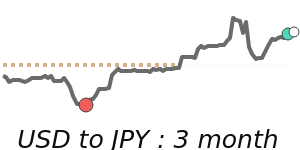

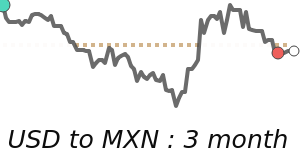

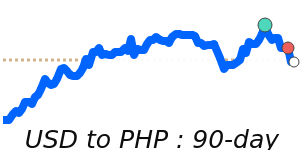

This is always a difficult question as exchange rates are influenced by many factors, so a good method to consider the US dollar current value is to look the USD performance against a range of other currencies over various time periods.

The following table looks at the performance of the USD exchange rate against selections of other currencies over time periods from the previous 2 days back to the last 5 years.

Popular Rates (A - Z)