GBP Market Update

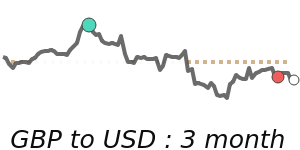

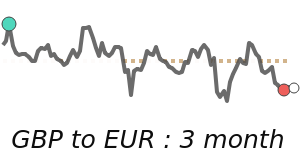

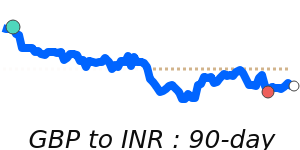

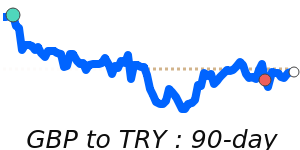

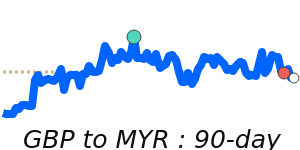

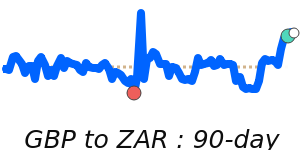

The British Pound has shown some resilience today, supported as traders move away from bets on BoE rate cuts. While the pound is near its 90-day lows against the US dollar at around 1.3294, it's trading better against the Euro at roughly 1.1548, close to a 30-day high. This shift reflects growing concerns over inflation, which remains elevated at 2.6%, leading markets to think the BoE will hold rates steady rather than cut them soon.

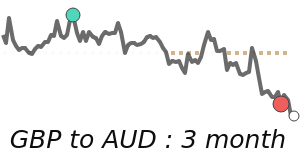

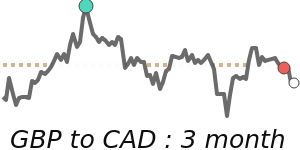

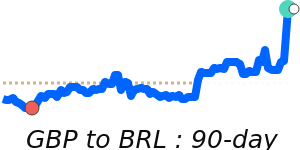

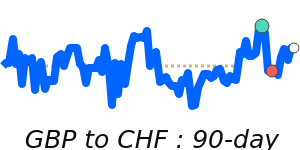

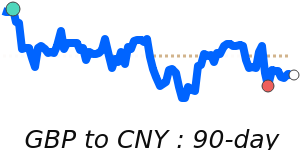

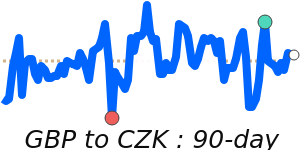

The pound's recent recovery comes despite mixed signals from the UK economy, including unexpectedly strong Q4 growth and ongoing inflationary pressures. In contrast, the GBP has been less volatile against the yen and remains near its recent averages, showing some stability. Meanwhile, against the Canadian dollar and Swiss franc, the pound continues to trade below its recent averages, indicating cautious sentiment.

Overall, the pound is holding steady amid global market influences, with key focus on later UK fiscal policy moves and global interest rate developments. Traders should watch for further signals from the UK and major central bank actions over the coming sessions.