Outlook

The PLN looks firmer after the NBP paused rate cuts at 4.00% and inflation keeps drifting toward target. Poland’s growth path remains solid, supported by EU funds, and UBS sees the zloty staying broadly steady versus euro and dollar through 2026. Political divisions within the ruling coalition add policy risk and could spark short-term moves.

Key drivers

- NBP pause supports the real rate and zloty resilience.

- Inflation cooling toward target reinforces confidence and real value of the currency.

- IMF growth projections for Poland suggest a stronger economy in 2025–26.

- Domestic political risk could trigger volatility around policy announcements.

Range

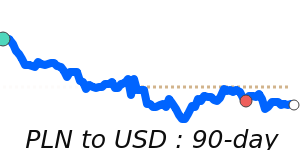

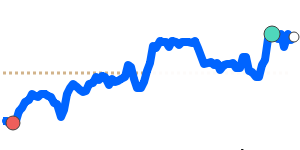

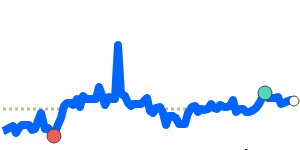

PLN/USD around 0.2705 (90-day low), range 0.2705–0.2867

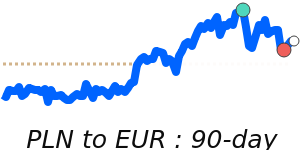

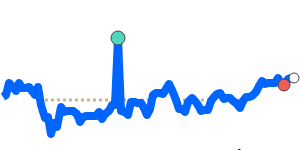

PLN/EUR around 0.2330 (90-day low), range 0.2330–0.2383

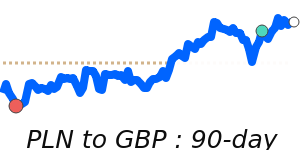

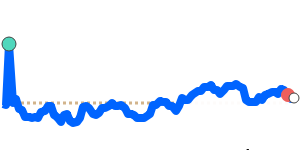

PLN/GBP around 0.2026 (90-day low), range 0.2026–0.2084

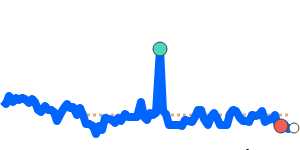

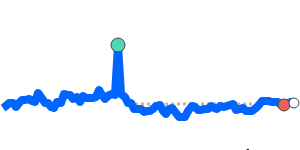

PLN/JPY around 42.69 (60-day low), range 42.65–44.33

What could change it

- An unexpected NBP policy move (hike or new guidance) could shift the path.

- A clearer fiscal stance or changes in political support could affect policy risk.

- A shift in global risk appetite or external funding flows could alter demand for PLN.