Outlook

The rand is trading with a cautious but mixed tone. Current price action shows ZAR near 14-day highs against USD at roughly 0.063057 USD per ZAR (about 3.5% above its 3-month average of 0.06092), with similar strength versus EUR and GBP on 90-day measures. This suggests modest near-term resilience if global risk sentiment improves and gold remains supportive, but gains may be limited by domestic political uncertainty and trade-policy sensitivities.

Across the board, the rand faces a tug-of-war between domestic policy support and external headwinds. Domestic policy shifts, notably SARB’s move to a 6.75% repo rate and the inflation target around 3% (±1%), underpin a framework for price stability and growth. However, political developments and trade dynamics, including AGOA considerations, add Caps to sustained strength. A sustained bid would likely require both improved political reform momentum and a stable external environment.

Key drivers

- Domestic policy framework: SARB’s 6.75% repo rate and the inflation target of 3% (±1%) aim to anchor inflation expectations and support growth, helping the rand when global conditions are favorable.

- Global commodity prices: Higher gold prices bolster export earnings and attract investment, providing upside support for the rand.

- Political developments: GNU internal conflicts and the DA’s withdrawal in 2025 have raised investor concern, eroding confidence and weighing on the rand.

- Trade relations: AGOA renewal through 2028 remains politically sensitive for South Africa, influencing trade dynamics and rand stability.

- Global macro and risk sentiment: US rate path, broader risk appetite, and commodity cycles drive spillovers into the rand, especially given SA’s export exposure.

- Market positioning and volatility: The currency has shown notable volatility in recent months, reflecting shifting domestic and external risk assessments.

Range

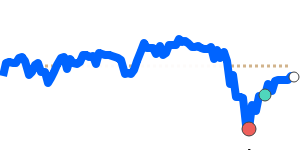

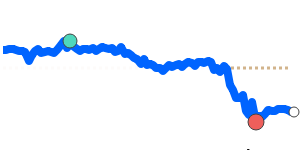

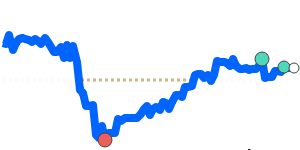

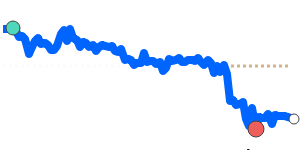

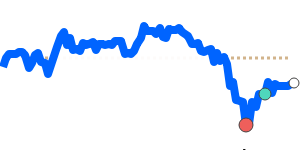

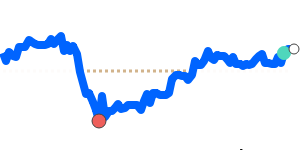

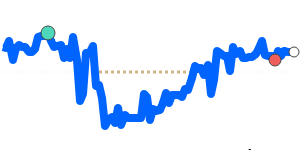

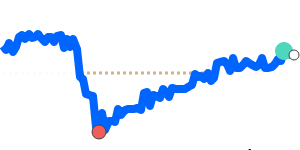

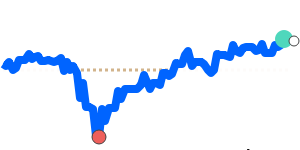

ZAR/USD is trading in a range roughly from 0.058279 to 0.063546, with 14-day highs near 0.063057 and about 9.0% intra-range movement. ZAR/EUR has traded in a 0.050262 to 0.053376 range, near 90-day highs at 0.053376. ZAR/GBP has ranged roughly 0.043959 to 0.046513, with 90-day highs around 0.046513. ZAR/JPY has moved within 9.0981 to 9.8580, current around 9.8488, about 8.4% range on the session.

What could change it

- Monetary policy shifts: Any surprise in SARB policy, such as another rate adjustment or a revision to the inflation target framework, would influence risk pricing for the rand.

- Inflation trajectory: A deviation from the 3% target (±1%) could alter yield expectations and FX flows.

- Political stability and reform progress: Renewed momentum on reforms or renewed political stability would support the rand; renewed instability would weigh on it.

- Trade policy developments: Progress or setbacks on AGOA renewal and South Africa’s inclusion could affect export outlook and investor sentiment.

- Commodity price moves: A sustained rise or fall in gold and other key commodity prices will influence rand earnings and capital flows.

- External risk environment: Changes in global risk appetite, US policy stance, or significant shifts in major currencies will impact the rand through risk and carry dynamics.