Outlook

The US dollar wavered amid market uncertainty, with mixed momentum as tariff concerns and risk appetite shift. Today’s State of the Union address will be a key cue for tariff direction and risk sentiment; a clear escalation signal could spark volatility and weigh on USD, while softer rhetoric would support steadier gains. The dollar remains influenced by strong US data and prospects for further Fed tightening, but oil at elevated levels adds a broader inflation backdrop that can complicate dollar moves across assets. Oil price at 71.03 USD per barrel is about 9.9% above its 3-month average, underscoring higher energy costs that can influence EUR and overall risk sentiment.

Key drivers

- Federal Reserve's Interest Rate Decisions: The policy path continues to shape USD, with recent hikes attracting capital inflows; markets have priced in potential further tightening if data stay solid.

- Economic Data Releases: Strong GDP growth and persistently low unemployment bolster USD expectations and support rate-hike bets.

- Global Trade Dynamics: The widening US trade deficit and import-led demand can pressure USD as dollars are exchanged to settle cross-border trade.

- Geopolitical Events: Ongoing tensions and trade-related uncertainty tend to push investors toward safe-haven assets, including the USD, when risk appetite wanes.

Range

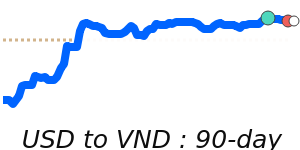

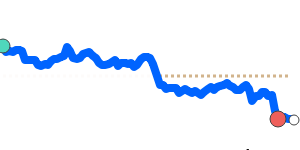

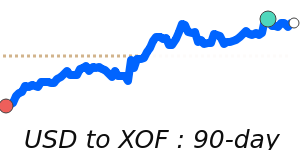

USD to EUR at 0.8492, just below its 3-month average, having traded in a very stable 3.8% range from 0.8312 to 0.8631

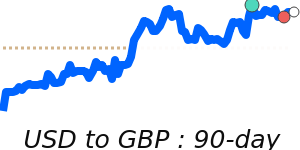

USD to GBP at 0.7410, near its 3-month average, having traded in a quite stable 4.7% range from 0.7227 to 0.7569

USD to JPY is at 155.9, near its 3-month average, having traded in a quite stable 4.5% range from 152.3 to 159.1

OIL to USD at 71.03 is 9.9% above its 3-month average of 64.61, having traded in a very volatile 21.5% range from 59.04 to 71.76

What could change it

- Tariff developments: Any escalation or de-escalation in US tariffs could sharply alter risk sentiment and USD direction.

- Fed communications: Hawkish signals or softening tone from the Fed, informed by fresh data, could push the USD higher or lower.

- Data surprises: Strong or weak US economic data relative to expectations can shift rate expectations and currency flows.

- Geopolitical shifts: Changes in global tensions or trade relations can alter safe-haven demand for USD.

- Oil price trajectory: Further moves in oil could influence risk appetite and inflation expectations, indirectly affecting USD and euro dynamics.