Sending money abroad with AusPost

Australia Post is an agent for Western Union, as such all the exchange rates and fees you will get from a visit to an Auspost branch to send money overseas will be those of Western Union.

Western Union are really only a good option if you are in a rush or you and/or the recipient do not have bank accounts.

BestExchangeRates recommends:

- For bank to bank transfers, it is always better to use a FX specialist.

- Consider much cheaper and better options such as TorFX and OFX.

- Find the best provider and rates for your destination currency and amount with our comparison calculator.

What is the

best Send Money conversion rate for SGD to AUD?

The best SGD to AUD exchange rate is our partner deal rate of 1.187 from OFX . This is -0.5% compared to the mid-market rate 1.1930.

The standard OFX SGD-AUD rate is 1.1736, -1.6% from the mid-rate. Visit OFX here to secure the better rate.

As exchange rates can vary

significantly between banks and also between currency exchange providers,

it's therefore important to carefully compare

Singapore dollar (SGD) to Australian dollar (AUD) rates from different sources before making a conversion.

The above

Australia Post - Singapore dollar to Aussie comparison table

makes it easy to compare the Total Fees (both variable and fixed) you are being charged by

Australia Post and other foreign exchange providers against the latest SGD-AUD mid-rate and the possible savings of using various providers.

How do Australia Post SGD-AUD rates compare between providers?

Looking at the full

SGD to AUD - Send Money comparison table the provider with the best SGD to AUD exchange rate is OFX at 1.187, -0.5% from the latest mid-market rate 1.1930.

The next best is XE at 1.1859, -0.6% from the mid-rate.

Then Wise at 1.1859, which is -0.6% from the mid-rate.

Among the banks the CIMB Bank rate is 1.1509 at -3.5% the OCBC Bank rate is 1.1608 at -2.7% and the Maybank rate is 1.1513 at -3.5% compared to the mid-rate 1.1930.

It's important to note that exchange rates also fluctuate frequently due to market conditions. Additionally,

banks and foreign exchange providers often apply a margin to the exchange rate, resulting in a less favorable rate for customers compared to the mid-market rate.

For more competitive rates, you might consider using a specialized currency exchange service

like Australia Post or platforms that offer rates closer to the mid-market rate.

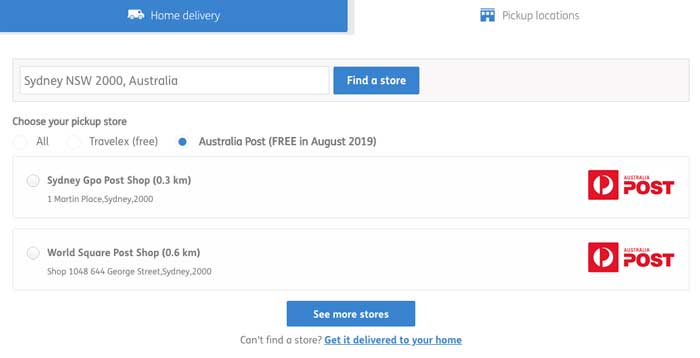

Free Home Delivery when you Buy Online Travel Money & Cards with $0 commission and great exchange rates only available from Travelex Online.

Free Home Delivery when you Buy Online Travel Money & Cards with $0 commission and great exchange rates only available from Travelex Online. Remember at the Travelex Online checkout you can request free home delivery or to pick up your foreign cash at your local Post Office branch.

Remember at the Travelex Online checkout you can request free home delivery or to pick up your foreign cash at your local Post Office branch.