The US dollar (USD) is currently under pressure due to increasing concerns about the economic trajectory in the United States. Analysts noted that uncertainty surrounding President Trump's upcoming nominee for the Federal Reserve Chair contributes further to this downward trend. Market participants are particularly attentive to initial jobless claims data released last week; any signs hinting at labor market weakness could bolster expectations for a Federal Reserve rate cut, adversely affecting the USD.

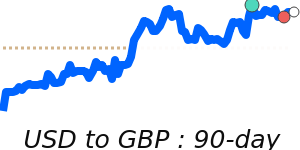

Recent data shows that the USD to EUR exchange rate has reached 7-day lows around 0.8574, which is 1.3% below its 3-month average of 0.8684. This pair has exhibited relative stability within a 6.5% range between 0.8470 and 0.9019. Meanwhile, the USD to GBP is also at 7-day lows near 0.7486, a modest 0.8% above its 3-month average of 0.7424, trading within a narrower range of 4.3% from 0.7275 to 0.7590. In contrast, the USD to JPY is slightly stronger at 147.2, which is 1.0% above its 3-month average of 145.7, fluctuating within a range of 5.8% from 142.5 to 150.7.

Oil prices, which have historically impacted the euro, are also worth noting as they influence overall market sentiment towards the dollar. Currently, oil is priced at $66.89 per barrel, 2.1% below its 3-month average of $68.31, having moved within a significantly volatile range that spans 25.6% from $62.78 to $78.85. Rising oil prices generally bolster demand for the USD, particularly as the dollar is the preferred currency for global oil transactions.

Financial experts suggest that the future strength of the USD hinges on the Federal Reserve's monetary policy moves, inflation trends, and broader economic performance. With persistent geopolitical tensions contributing to the USD's safe-haven status, this currency remains pivotal in shaping global financial markets despite ongoing discussions around de-dollarization. As global uncertainties continue, market participants will likely keep a close watch on key economic indicators to inform their trading strategies.