Outlook

Near term, the dollar is likely to stay in a narrow range as firmer ISM services data and a modest rise in U.S. yields offset a weaker ADP payrolls print. The immediate focus is on initial jobless claims for fresh signals on the labor market and the trajectory for yields and the USD. The broader tone may hinge on upcoming BoE and ECB policy updates.

Key drivers

- ISM services strength and a small yield uptick offset soft ADP, with initial jobless claims due to guide the next move in labor-market signals and USD direction.

- The Federal Reserve paused rate cuts and held the policy rate at 3.5%–3.75%, keeping a restrictive stance that supports USD resilience if inflation surprises to the upside.

- Global themes around de-dollarization and geopolitical tensions weigh on USD, including BRICS plans to lift local-currency trade and signs of central banks reducing dollar reserves.

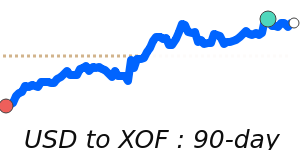

- Oil prices remain a factor for FX, with WTI around 67.91 USD, about 7% above the 3-month average; energy moves can influence EURUSD and risk sentiment, potentially limiting USD gains.

Range

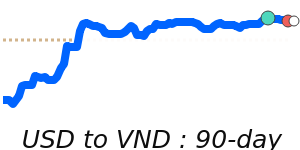

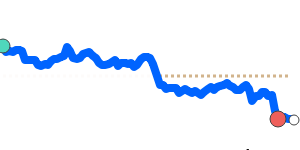

USD/EUR at 0.8462 (1.0% below its 3-month average of 0.8551), traded in a 0.8312–0.8684 range.

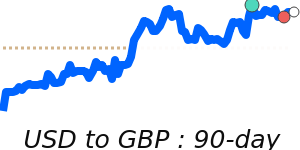

USD/GBP at 0.7347 (1.6% below its 3-month average of 0.7465), traded in a 0.7227–0.7663 range.

USD/JPY at 157.2 (0.6% above its 3-month average of 156.2), traded in a 152.3–159.1 range.

Brent Crude OIL/USD at 67.91 (7.1% above its 3-month average of 63.42), traded in a 59.04–69.09 range.

What could change it

- A surprise in initial jobless claims (stronger or weaker) could shift hedges and yield expectations, altering USD bias.

- A fresh shift in U.S. policy expectations or inflation data that changes the perceived path of Fed policy.

- BoE/ECB policy surprises that alter global rate differentials and risk sentiment.

- Steps in de-dollarization momentum or geopolitical developments that intensify or ease pressure on the dollar.