Outlook

The NZD remains in a tug-of-war between domestic dynamics and external signals. The RBNZ is expected to hold at 5.50% while possibly signaling a somewhat hawkish stance, which could support the kiwi. A more cautious tone, however, would cap gains or push the currency lower. Dairy prices are firm, and US rate-cut speculation may influence USD moves, affecting NZD pairs broadly.

Key drivers

• RBNZ keeps the Official Cash Rate at 5.50% and may sound more hawkish than prior communications, offering a potential lift for NZD.

• Mixed NZ employment data show unemployment at 4.1% in Q4 2025, suggesting a modest softening in the labor market that could temper NZD gains.

• Global Dairy Trade auction results rose 3.2%, boosting New Zealand’s terms of trade and supporting the currency.

• Markets price in a potential 25-basis-point cut by the US Federal Reserve in the coming months, which could influence NZD/USD movements.

Range

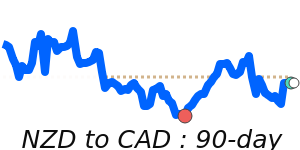

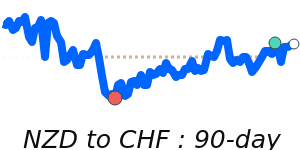

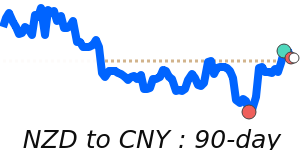

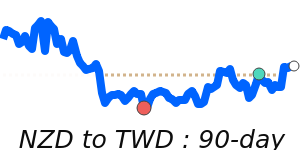

NZD/USD: 7-day high near 0.6049; range 0.5590 to 0.6077; 3-month average 0.5837; about 3.6% above.

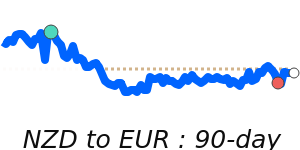

NZD/EUR: 7-day high near 0.5104; range 0.4850 to 0.5122; 3-month average 0.4977; about 2.5% above.

NZD/GBP: 90-day high near 0.4460; range 0.4268 to 0.4460; 3-month average 0.4339; about 2.7% above.

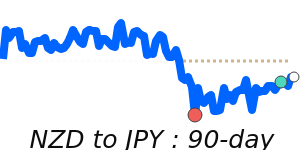

NZD/JPY: 92.59; range 87.70 to 94.79; 3-month average 91.09; about 1.6% above.

What could change it

• A more hawkish RBNZ stance or surprise in communication could push NZD higher; a softer tone could limit gains or weigh on it.

• Shifts in US rate-cut expectations (especially a larger or earlier cut) could shift NZD/USD and other cross rates.

• Further strength in Global Dairy Trade prices beyond the current 3.2% lift could support the NZD.

• Global risk sentiment shifts (risk-on vs risk-off) will influence the kiwi’s appetite as a risk proxy.