Recent Guides >

By Topic: (Travel Money) Foreign Transfers(20) Fx Specialists(12) Large Amounts(11) Travel Money(11) Expat(10) Foreign Currency Accounts(8) Travel Cards(8) Ofx(7) Business Fx Specialists(7) Study Abroad(6) Wise(5) Fx Risk(5) Fx Analysis(4) About Us(4) Popular(3) Revolut(2) Property(2) Travel(1) Banks(1) Online Sellers(1) Pursuits(1)

By Currency: USD(6) AUD(6) JPY(4) CAD(4) EUR(3) SGD(2) THB(2) NPR(1) CNY(1) HKD(1) MXN(1) MYR(1) NOK(1) PHP(1) IDR(1) GBP(1) NZD(1)

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

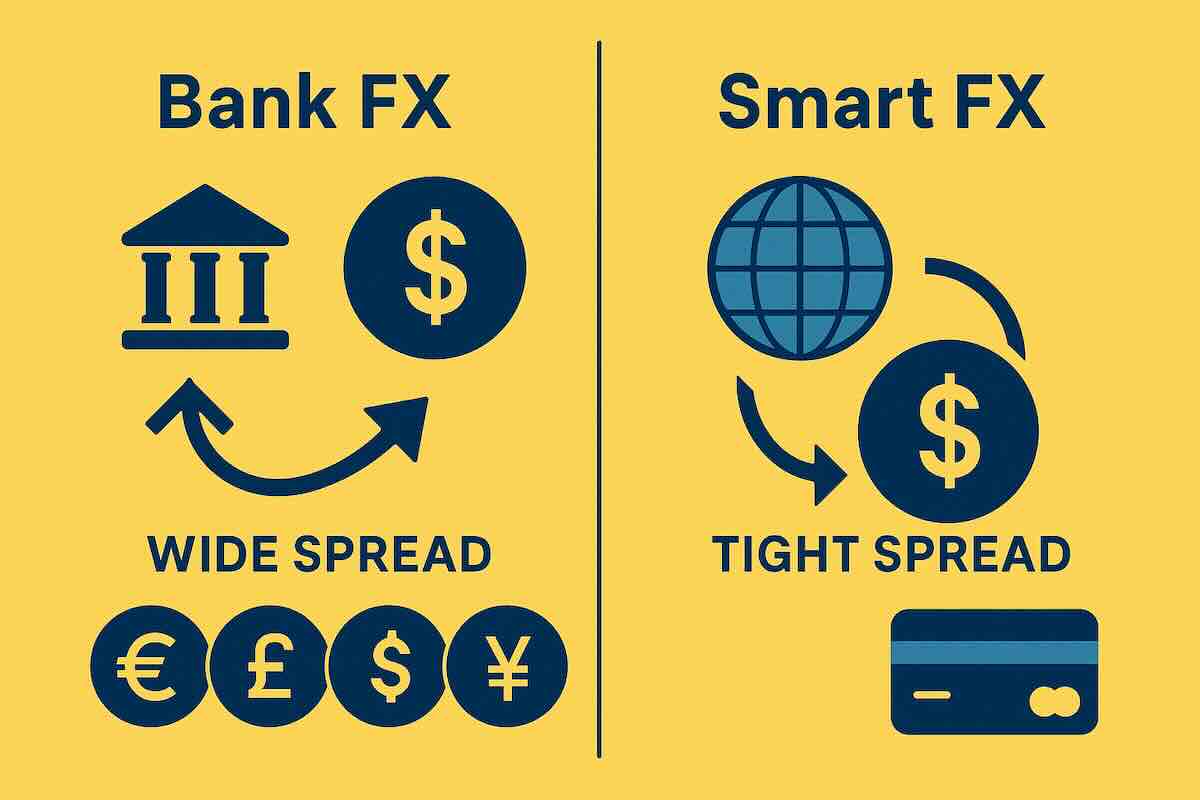

The Most Expensive FX Mistakes People Make

Foreign exchange mistakes rarely feel expensive at the time — but they add up fast. Here are the most costly FX mistakes people make, and how to avoid them.

Compare the Best Travel Money Cards for Fees, Exchange Rates & Features

Compare Wise, Revolut, and Travelex travel money cards to find the best option for your next trip. Discover key differences in fees, exchange rates, ATM access, and features to help you save on foreign spending.

Travel Money - Which is Best? Cash or Cards

Multi-currency travel cards are one of the best ways to spend overseas without high bank fees. Learn how they work, their key benefits, and what to watch out for when choosing a travel card for your next trip.

✈️ Top 5 Travel Money Options: Best Ways to Spend Abroad in 2025

Looking for the best travel money options for your next international trip? Whether you’re heading overseas for vacation, work, or study, choosing the right way to access and spend your money abroad is key to avoiding hidden fees and poor exchange rates.

Wise vs Revolut vs Travelex – Best Travel Money Card Comparison

Looking for the best travel card? We compare Wise, Revolut, and Travelex across key features like FX rates, fees, ATM access, and app tools so you can choose the smartest way to manage your money abroad.

Strong Singapore Dollar Sparks Travel Boom and Economic Shifts

The Singapore dollar has reached its highest level in over a decade, boosting outbound travel and curbing inflation, but also putting pressure on exporters and local businesses. While sectors like logistics and finance benefit, retail, hospitality, and exports face challenges from the strong currency.

What is a Closed Currency?

A closed currency is a one that is not available for purchase in countries other than its country of origin. We take a look at what that means for a traveller visiting a country with a closed currency.

Best Ways to Save on Currency Exchange

We show you how to Pre-order foreign cash online for better currency exchange rates and save money for your next trip.

Pay in your Own currency? - The Travel Rip-off to Avoid

Dynamic Currency Conversion (DCC), it comes at a cost.

Travel Money - why compare foreign currency exchange rates?

A little bit of research and comparing travel money exchange rates before you go on holiday, could help you increase how much cash you have available to spend overseas.