Compare Live ExchangeFX Rates & Save on International Transfers

EUR-CZK Rate Calculator

Best Exchange Rates

Trusted by 3M+ visitors. $250M+ saved on FX.

On $10,000, specialists are often 5-6% better than bank rates - Saving you $500-$600

More than 3 million satisfied visitors have saved over $250M+ on foreign exchange.

We partner with only the largest, safest and most trusted foreign exchange brands.

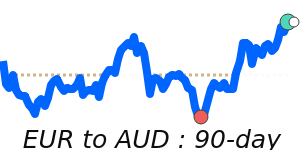

Track AUD rates - transact when market in your favour. Follow FX forecasts & analysis.

Any marketing fees we receive from partners do not affect your exchange rate savings.

Save on International Money Transfers

Sending money abroad can be an expensive business, more so if you aren’t even aware of all the hidden fees. Money transfer companies and banks profit by charging you fees and a normally hidden margin on the exchange rate.

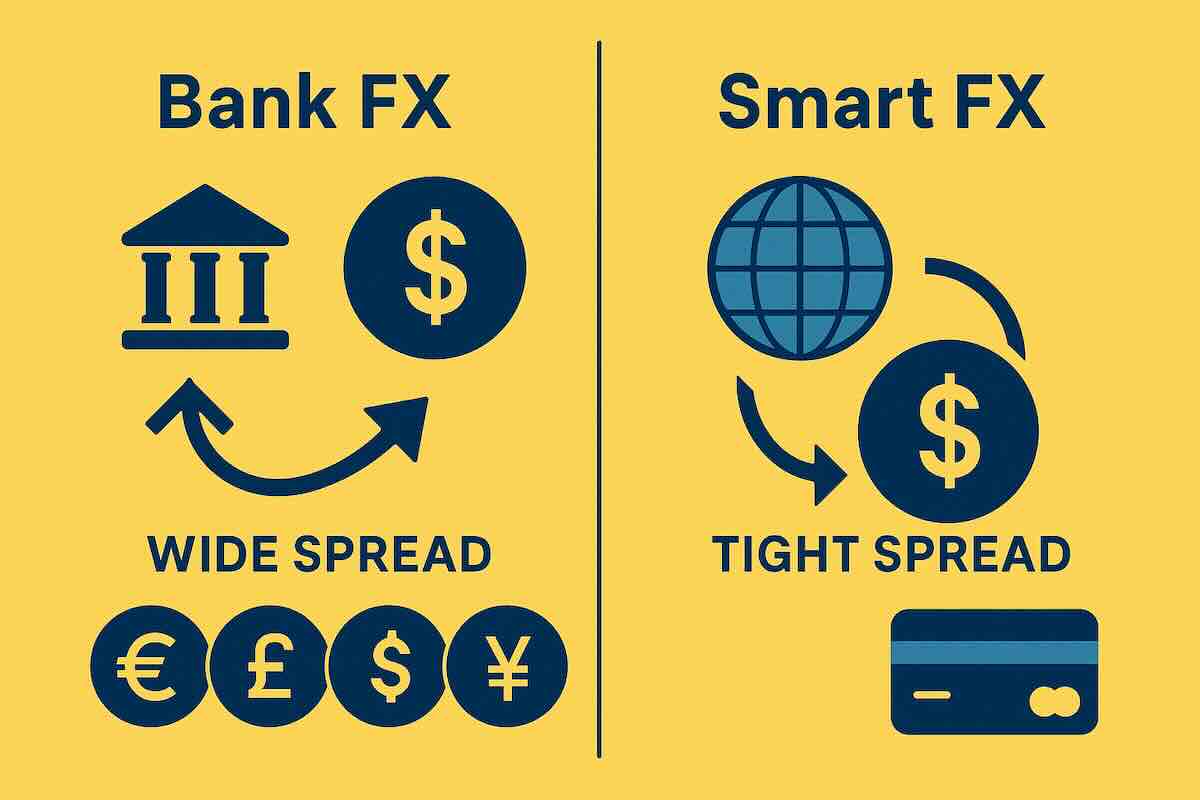

Using your Bank to make international wire transfers can be very expensive – often 5% to 6% worse than using a foreign exchange specialist to send money abroad or pay a foreign invoice.

Where do you want to Save Sending Money?

BER FX Rate Tracker

Follow exchange rates via your personal BER FX Tracker to keep track of trending currency pairs so that you can take advantage of opportunities and trends in the market.

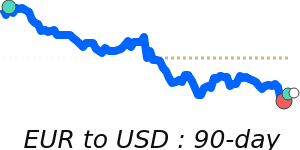

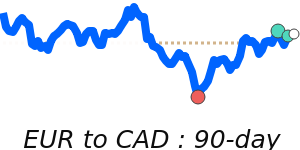

Latest Euro Exchange Rates

We compare exchange rates from major global financial institutions.

Save with our partners who are among the best & most trusted global brands.

Get Better Currency Exchange Rates

We show you how to save by ordering foreign cash online or compare rates on multi-currency travel cards for better currency exchange rates, convenience and security for your next trip or overseas online purchase.

Smarter Currency Decisions Start Here

Read our Guides , Reviews , Euro News and Forecasts

News 2026-03-03

Currency Market Update - Week ending 2026-03-07

Weekly currency market update—practical actions for SMBs, expats and travellers across AUD, CAD, GBP, NZD, SGD, USD, EUR and JPY

News 2026-02-02

Biggest Currency Movers – January 2026

January saw clear winners and losers in FX markets, driven by interest rate expectations, risk appetite, and global growth signals.

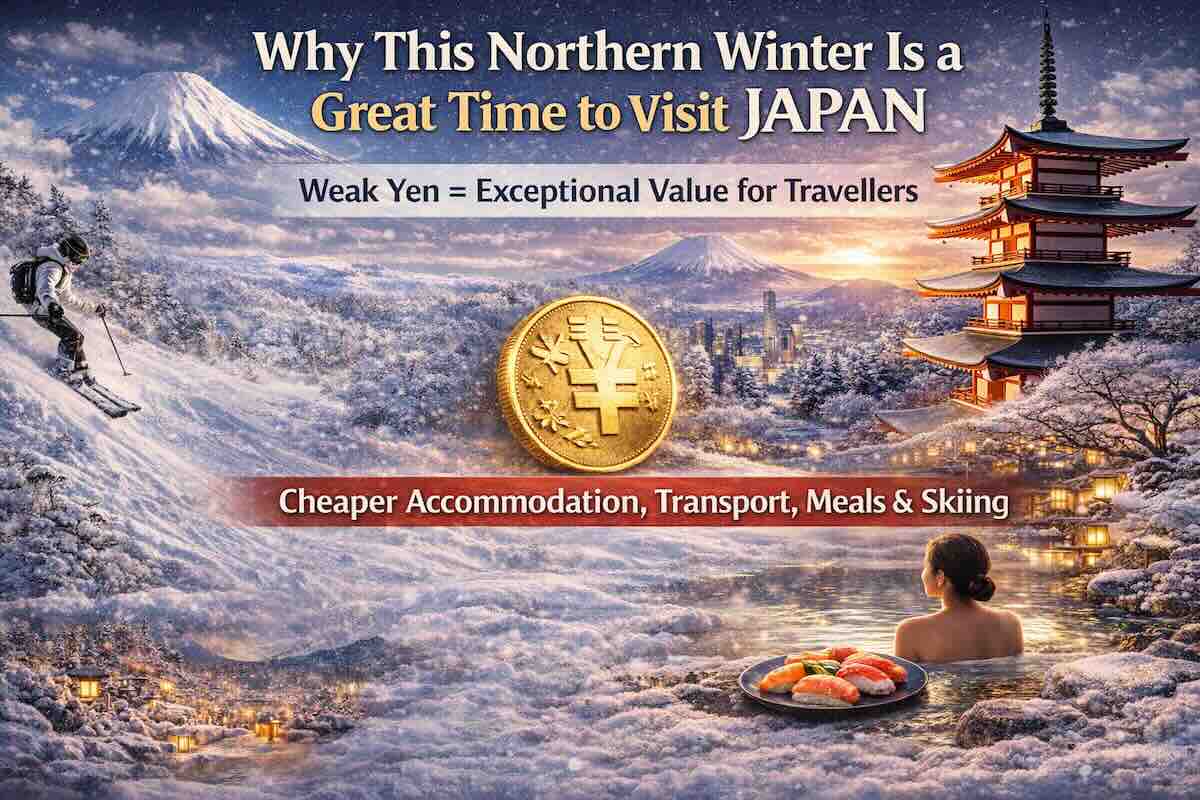

News 2025-12-23

Japan Travel Boom: Weak Yen Makes Winter Trips Exceptional Value

With the yen down sharply against major currencies, winter in Japan offers rare value on hotels, food, transport, and skiing. A rare currency tailwind for travellers.

The Most Expensive FX Mistakes People Make

Foreign exchange mistakes rarely feel expensive at the time — but they add up fast. Here are the most costly FX mistakes people make, and how to avoid them.

News 2025-12-21

Australian Dollar Outlook: RBA–Fed Split Could Drive AUD Higher

Markets are rapidly repricing Australian interest rates higher while the US moves toward cuts — a mix that has historically been powerful for the Aussie dollar.

How to Receive Freelance Payments from Abroad and Save on Exchange Rates

Freelancers working with overseas clients can lose hundreds to bank fees and bad FX rates. Here’s how to receive international payments safely, cheaply and quickly.

Nepal Raises Daily Remittance Limit to NPR 2.5 Million

Nepal’s central bank has eased foreign exchange rules, increasing the daily inbound remittance cap to NPR 2.5 million (≈ USD 18-20k). Here’s what’s changed and what it means for senders and recipients.

News 2025-09-11

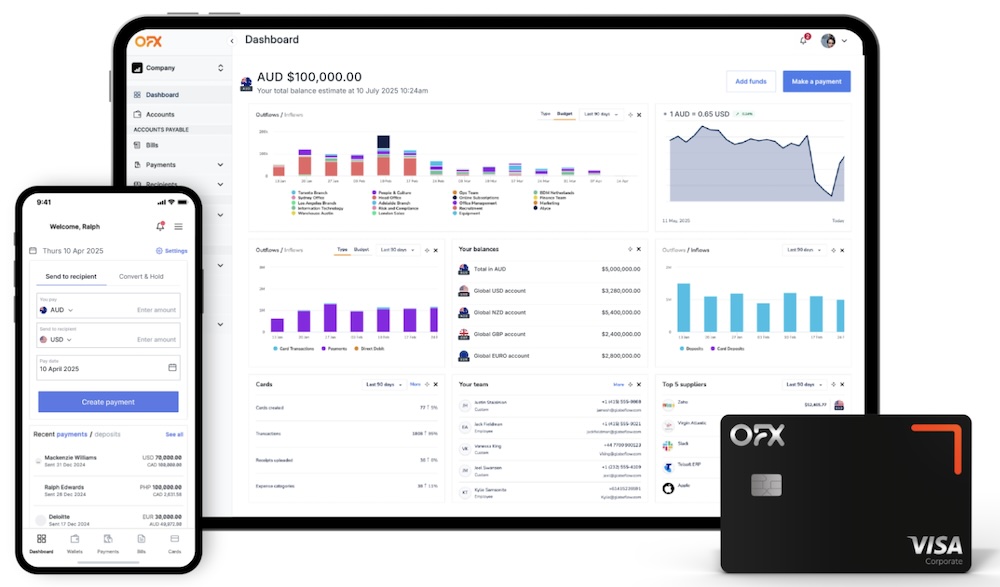

OFX 2.0 for Business: Global Accounts, Cards & Spend Control

OFX has switched on “OFX 2.0” for businesses—adding global currency accounts, corporate cards and spend control, AP/batch tools, and accounting sync. Here’s how it reshapes FX from simple transfers to full finance ops.

News 2025-08-28

Global Central Banks Shift Policy: Key FX Impacts for August 2025

Central banks are moving in different directions—Australia cuts, UK eases despite inflation, and the Fed faces political risks. Here’s what it means for exchange rates and transfer timing.

News 2025-08-08

Revolut rolls out eSIM, Mobile Plans, RevPoints boosts and UK trading

Revolut is doubling down on user perks: cheaper roaming via in-app eSIM, a Mobile Plan on the way, richer RevPoints for travel bookings, and UK/EU stock trading coming soon. Here’s the practical impact for travelers and everyday spenders.

News 2025-08-02

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate

President Trump has raised U.S. tariffs to an average of 15.2%, targeting Canada, Asia, and Europe, as part of his push to reshape global trade. Markets and currencies reacted with caution amid rising uncertainty.

Best Exchange Rates Compare & Save on Foreign Exchange

For over a decade, BestExchangeRates.com has been a trusted resource for comparing foreign exchange rates worldwide.

We make it easy to avoid hidden fees and inflated margins by comparing live rates from major banks and trusted money transfer specialists. Whether you’re sending money abroad or exchanging cash for travel, our tools highlight the cheapest and most convenient options in real time.

Our mission is simple: transparency. We break down complex FX fees so you can make informed decisions and keep more of your money where it belongs—in your pocket.