Currency in Saint Pierre and Miquelon: EUR Send & Spend FX Guide

Resources for Expats, Travelers and Entrepreneurs Navigating Life and Trade in Saint Pierre and Miquelon with the Euro.

Resources for Expats, Travelers and Entrepreneurs Navigating Life and Trade in Saint Pierre and Miquelon with the Euro.

What's in this Saint Pierre and Miquelon currency guide?

What currency is used in Saint Pierre and Miquelon?

The official currency of Saint Pierre and Miquelon (country code: PM) is the Euro, with symbol € and currency code EUR.

What is a good Euro exchange rate?

The BestExchangeRates.com currency comparison table below helps you see the total cost of your currency transaction by showing the exchange rates offered by different providers. It also makes it easy to spot potential savings from market-leading FX services compared to bank rates.

To see a full list of rates, enter your transaction type, currencies and amount then click ‘GET RATES’:

Loading rates...

|

|

|

Good things to know about the Euro

The euro (ISO: EUR) is involved in slightly more than 30% of all foreign exchange deals, and as such, is the world’s second most traded currency, behind the US dollar.

The euro is the currency of the eurozone (officially called the ‘euro area’), which consists of 19 of the 28 member states of the European Union, and is used by almost 350 million Europeans. It was introduced in January 1999.

Of all the thousands of exchange rates that exist in the world, the euro-to-US dollar exchange rate is the most actively traded, or most ‘liquid’.

Since its introduction, the euro’s lowest value against the dollar came in October 2000 when EUR/USD hit lows of 0.8231. The currency was strongest in July 2008, shortly before the worst stage of the 2007-2009 financial crisis, when EUR/USD reached 1.6038.

There are currently more than twenty nations and territories which peg their currencies to the euro, the largest of which is Denmark.

The euro banknotes and coins

The Euro is issued in banknotes of €5, €10, €20, €50, €100, €200, and €500, and in coins of 1 cent, 2 cents, 5 cents, 10 cents, 20 cents, 50 cents, €1, and €2.

The banknotes feature images of historical and cultural figures from across the European Union, while the coins depict each member country's unique design. The design of the Euro banknotes and coins is intended to be easily identifiable and difficult to counterfeit.

For more EUR information check out our selection of Euro news and guides.

Frequently Asked Questions

What currency should I use in Saint Pierre and Miquelon?

The domestic currency in Saint Pierre and Miquelon is the Euro.

What is the Euro currency code and symbol?

The three letter currency code for the Euro is EUR — symbol is €.

What does the Euro look like?

Here is an example Euro banknote:

Which countries use the Euro?

It is the domestic currency in Eurozone, Aaland Islands, Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Estonia, Finland, France, French Guinea, French Southern Territories, Germany, Greece, Guadeloupe, Vatican City, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Monaco, Montenegro, Netherlands, Portugal, Reunion, Saint Barthelemy, Saint Martin, Saint Pierre and Miquelon, San Marino, Slovakia, Slovenia and Spain.

Is the Euro a closed currency?

No, the Euro is freely available and convertible. See guide: What is a closed currency?

What are equivalent amounts of USD and EUR?

Here are some popular conversion amounts for USD to EUR (US dollar to Euro)*.

*Converted at the current USDEUR interbank exchange rate. Calculate actual payout amounts for Send Money and Travel Money exchange rates.

Travel money for Saint Pierre and Miquelon

Using Wise for Euro travel money is a smart choice for savvy travelers. With its competitive exchange rates and low fees, Wise allows you to convert and manage multiple currencies effortlessly.

Be careful when using your own bank's Debit/Credit Card, as your bank may also charge an extra 3% as an “Overseas Transaction Charge” plus “Overseas ATM” fees for withdrawing cash on top of the standard Visa/Mastercard 2.5% from market mid-rate.

For card purchases, if you are offered a choice of currencies always select to Pay in Euro otherwise you will typically get much worst dynamic currency conversion (DCC) exchange rates.

If you really want Euro cash before departure, you can save money by ordering online. You generally get better rates and can pick up the EUR cash locally or even on travel day at the airport.

Saint Pierre and Miquelon: Travel Guide

Traveling to Saint Pierre and Miquelon requires careful financial planning to ensure a smooth and cost-effective experience. Here's a comprehensive guide to help you navigate currency considerations and manage your money effectively during your visit.

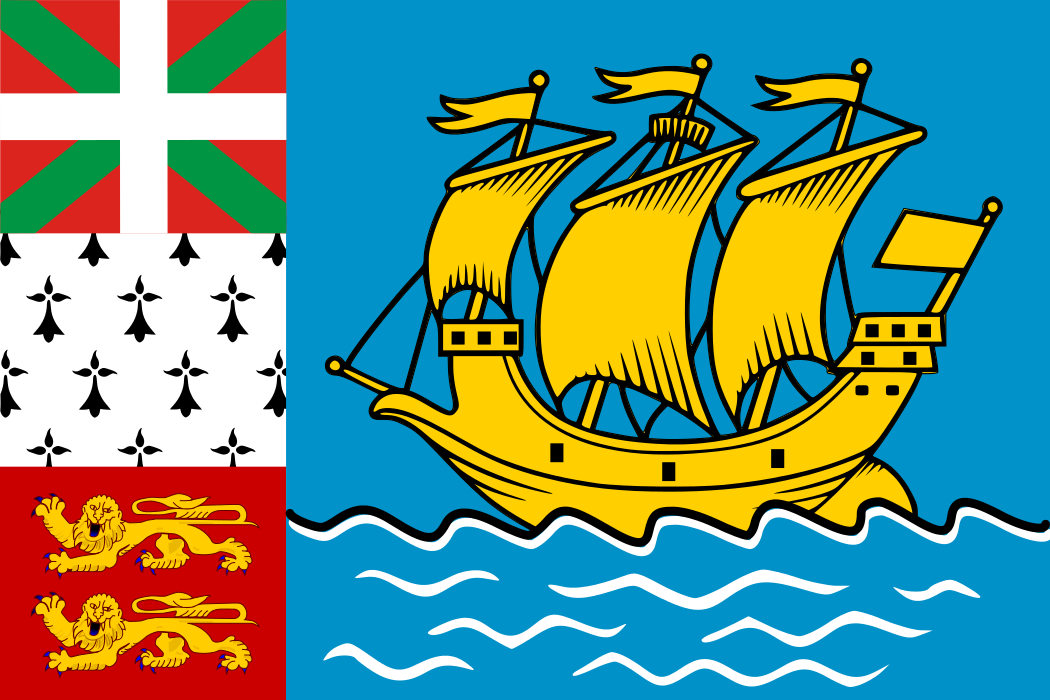

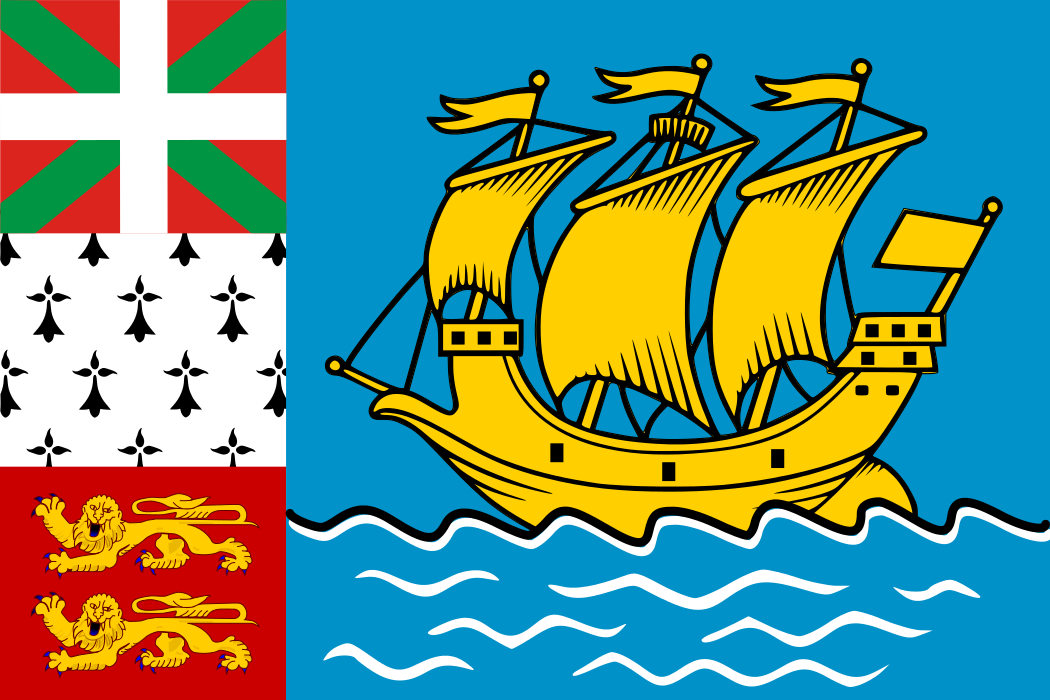

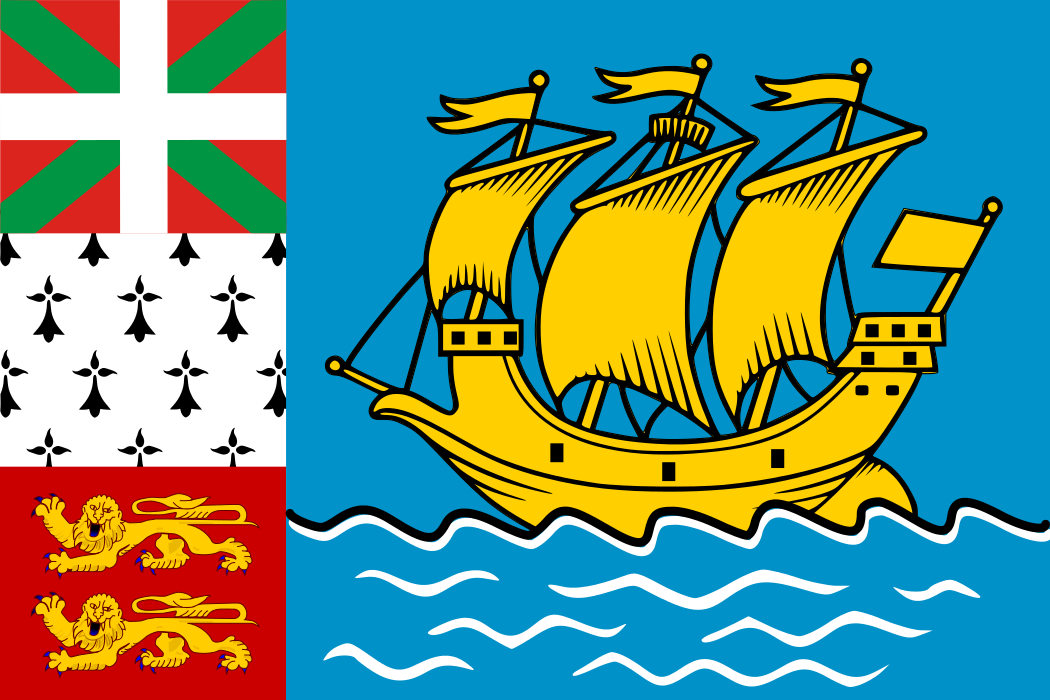

A trip to the French islands of Saint-Pierre and Miquelon is a must for anyone planning travel in eastern Newfoundland. With a piece of Europe just 20 km from the province’s southern coast, why wouldn’t you plan an international trip? That being said, a visit to the archipelago does require some preparation. The islands of St-Pierre and Miquelon aren't just French-like with their berets, baguettes and Bordeaux, they are France, governed and financed by the tricolore. St-Pierre is the more populated and developed island, with most of its 5500 residents living in the town of St-Pierre. Miquelon is larger geographically but has only 600 residents overall.

Jacques Cartier claimed the islands for France in 1536, after they were discovered by the Portuguese in 1520. At the end of the Seven Years' War in 1763, the islands were turned over to Britain, only to be given back to France in 1816. And French they've remained ever since.

How to travel Saint Pierre and Miquelon?

Air St-Pierre flies to St John's, Montréal and Halifax. There are two to three flights weekly to each city. Taxis to/from the airport cost around €5. From Fortune on Newfoundland, the St-Pierre Ferry makes the hour-long trip to and from the island once daily (twice on Wednesdays) in July and August. It runs less often the rest of the year. Departure times vary, so check the website. Boats carry foot passengers only, though plans are in the works for two car ferries.

Much can be seen on foot. Roads are steep outside of town, so prepare to huff and puff. Car-rental agencies are resistant to renting to tourists, who admittedly have difficulty navigating the unsignposted, narrow, one-way streets. The visitor center rents bicycles (per day €13) and there are also motorized bicycles for rent. Local ferries head to Miquelon and Langlade; check with the visitor center for schedules and costs.

Travel tips for Saint Pierre and Miquelon.

Just like in Europe, the winding narrow streets of Saint-Pierre are filled with vibrant shops and must-try restaurants – the key is finding them all! The town of Saint-Pierre isn’t zoned out like many cities in Canada, meaning that you may find the perfect souvenir in a tiny shop tucked among houses on a seemingly residential street. Saint-Pierre’s size makes it easy to explore by foot, so be sure to put on your walking shoes and meander down every possible street.

The archipelago is a relatively small region that hosts a fair number of tourists each season. As a result, accommodations are limited, and it can even be a challenge to find supper during the height of summer, if you're not prepared! Plan your trip as far in advance as possible, and book accommodations, excursions, and dinner reservations as soon as you’ve decided on dates. Getting the logistics sorted out early means you'll be able to experience everything you want to, without worry.

Everyday Costs in in Saint Pierre and Miquelon

How much does it really cost to live, work, or travel in Saint Pierre and Miquelon? Here's what to expect for daily expenses and expat living.

Currency Guide: Saint Pierre and Miquelon (PM)

For travelers planning a mid-range stay of one week in Saint Pierre and Miquelon, a budget of approximately 1,200 to 1,500 EUR (equivalent to about 1,300 to 1,600 USD) should be adequate. This budget allows for a comfortable balance between enjoying the local culture and dining options while keeping an eye on expenses. Here’s a quick look at typical daily expenses in the local currency (EUR):

- 🍽 Meal at a local restaurant: 15-25 EUR

- ☕️ Coffee: 2-4 EUR

- 🚍 Public transport fare: 2.50 EUR

- 📱 Prepaid SIM card: 20-30 EUR

- 🏨 Budget hotel or Airbnb: 80-120 EUR per night

In general, Saint Pierre and Miquelon can be considered an average-cost destination to visit. Compared to the United States, prices for dining and accommodation are similar, making it accessible for many travelers. However, when compared to Canada, travelers may find Saint Pierre and Miquelon's costs slightly higher, particularly for groceries and dining, as many goods need to be imported.

Living Costs for Expats

For expats living in Saint Pierre and Miquelon, monthly living costs can vary, but a typical budget might range from 1,200 to 1,800 EUR, depending on lifestyle choices. This estimate includes rental expenses, groceries, utilities, and occasional dining out. It’s essential to embrace local markets for fresh produce, which can be a more economical choice than imported goods.

When it comes to banking, most expats can successfully use debit and credit cards, particularly Visa and MasterCard, which are widely accepted. However, it's advisable to keep some local currency on hand for smaller transactions. For managing international finances, services like Wise or OFX are often recommended for better currency exchange rates compared to local banks. While it is possible to exchange money locally, individuals may benefit from using these online transfer services to ensure they get the most favorable exchange rates, especially when transferring larger sums.

USD/EUR Market Data

The below interactive chart displays the USD/EUR change and UP📈 DOWN📉 trends over the past 1 Year.

Recent Euro Market News

Euro (EUR) Market Overview - March 9, 2026

The euro has faced headwinds recently amid geopolitical tensions and economic concerns. The escalation in the Middle East and the death of Iran's Supreme Leader have increased demand for safe-haven assets like the US Dollar, exerting downward pressure on the euro. Additionally, Germany's weak retail sales data heightens worries about the Eurozone's economic outlook. However, there are signs of investor confidence returning with inflows into euro-denominated assets, and inflation has cooled to 1.7%, which may influence future monetary policy decisions. Analysts remain divided on EUR/USD forecasts, with some anticipating a move toward 1.20 as structural factors shift.

Key watchpoints

- Geopolitical tensions boosting the US Dollar while pressuring EUR

- Weak German retail sales impacting economic sentiment

- Divergent analyst forecasts with potential upside toward 1.20

For more EUR information read our News and guides to the Euro.

Send Money to Saint Pierre and Miquelon - Best Rates

To get a good (and fair) exchange rate when sending money to Saint Pierre and Miquelon you need to find and compare exchange rates for International Money Transfers (IMTs).

The available FX rates for sending money abroad can be very different to the mid-market (wholesale) rate which you see reported online and in the News.

You should especially compare your own bank's exchange rates to those available from Money Transfer specialists to see how much you can save - we make that calculation easy in the below table.

Get a better deal for foreign transfers to Saint Pierre and Miquelon

When sending money to Saint Pierre and Miquelon it’s important to compare your bank’s rates & fees with those we have negotiated with our partner money transfer providers. To get a better deal you should follow these 4 simple steps :

- Open an account with a BER reviewed FX provider (id docs may be required)

- You specify the local or Euro amount you want to transfer

- Make a local currency domestic transfer for the requested amount to the provider's bank account in your country

- Once your funds are received by the provider the converted EUR amount will be transfered to the recipient account you specify in Saint Pierre and Miquelon.

Use the above calculator to compare the exchange rates of FX specialist providers rates versus your bank's standard rates you can hopefully save around 5% and maybe more - end result is more Euro deposited into the recipient bank account and less margins and fees kept by the banks!