Explore our latest Wise tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (170)

By Topic:

About Us (11)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (30) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (75) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (7) BSD (1) BTC (6) BTN (1) BWP (1) BZD (1) CAD (52) CDF (1) CHF (33) CLP (4) CNY (23) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (16) DOP (1) DZD (1) EGP (2) ETB (1) EUR (125) FJD (6) FKP (1) GBP (81) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (24) HNL (1) HTG (1) HUF (8) IDR (8) ILS (6) INR (43) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (42) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (8) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (14) MYR (23) MZN (1) NAD (1) NGN (6) NOK (15) NPR (2) NZD (39) OMR (5) PEN (1) PGK (1) PHP (18) PKR (17) PLN (9) PYG (1) QAR (16) RON (2) RSD (1) RUB (11) RWF (1) SAR (10) SBD (4) SCR (1) SDG (1) SEK (15) SGD (40) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (17) TJS (1) TMT (1) TND (1) TOP (1) TRY (14) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (14) ZWL (1)

How to Choose the Best Money Transfer Provider

A comprehensive guide to choosing the best money transfer provider, covering key factors like fees, speed, exchange rates, and customer support, with comparisons of top providers.

Compare the Best Multi-Currency Accounts for Travel, Business & Transfers

We compare the features, exchange rates and security of the three best multi-currency accounts available today — the Wise Account, the WorldFirst World Account, and the OFX Global Currency Account.

Wise vs Revolut (USA): Transfers & Travel in 2025

U.S.-based and choosing between Wise and Revolut? Here’s a clear, current comparison of fees, exchange rates, card/ATM rules, and travel perks—plus who each suits best.

OFX vs Wise: Which Money Transfer Service Is Best For You in 2026

Looking to transfer money internationally? We compare OFX and Wise side by side, covering costs, exchange rates, speed, and features to help you choose the best service for your needs in 2026.

Why Online Sellers Should Use an FX Specialist

If you’re selling online internationally, using an FX specialist can save you thousands. Better exchange rates, lower fees, and protection against currency swings can make a huge difference to your bottom line. Find out why smart online sellers are choosing FX specialists to manage their global payments — and how it could help you scale faster.

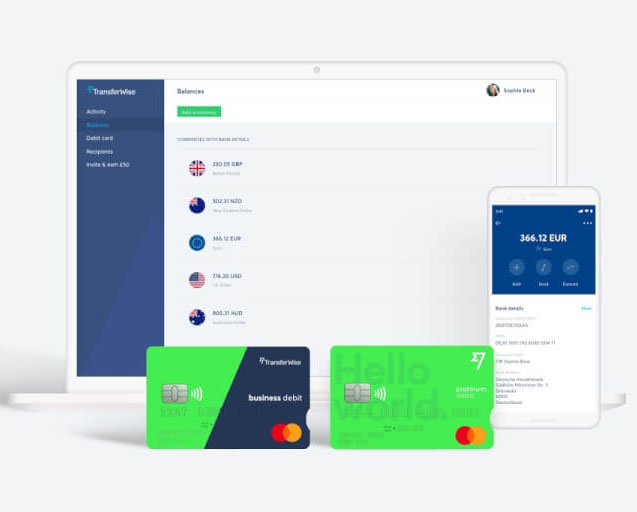

Wise Review: Is It the Best Way to Transfer Money Internationally?

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

Wise Account

The Wise Account allows users to hold and convert funds in 40 different currencies and send and spend internationally, all at the “real” exchange rate and with exceptionally low service fees. Users can also receive major-currency payments free of charge.

Fintechs vs. Banks: Remittance War Rages On as FX Costs Slashed for Millions 2019-05-19

For many currency routes, FX costs have been slashed in recent years by a number of industry-disrupting fintechs, allowing such firms to slice great chunks from the banking sector’s lucrative remittance markets. Banks are fighting back, though, by developing low-cost, digital offerings of their own.

Consumers Throwing Away Billions on FX Fees (TransferWise Study) 2019-05-03

As in the rest of the world, consumers in Singapore are being fleeced when it comes to foreign exchange costs, a study by TransferWise has revealed. Individuals in Singapore are being charged 15 times more on international payments than companies are, with S$2 billion lost in hidden FX fees annually.

Remittances Reach All-Time High 2019-04-20

Remittances to low and middle-income countries reached a record high last year, the World Bank has said. Average transaction costs remain high, with an average of 7 percent paid to transfer $200 or equivalent.

TransferWise Announces PayNow Funding Option 2019-03-29

TransferWise is now officially offering PayNow as a funding option for users in Singapore, the company has announced.

Banking Sector Fights Back Against Fintech Rivals 2019-03-27

Citigroup’s announcement this week of plans to develop its own consumer-payments platform is the latest indication of a fightback by the banking establishment against fintech rivals that threaten its most lucrative markets.

Messaging Apps to Take Slice of Remittance Market Using Their Own Cryptocurrencies 2019-03-07

Users of popular messaging apps, including WhatsApp and Line, might soon be able to make cross-border payments effortlessly. In a move that will further disrupt the payments industry, the creators of such apps, including Facebook, are working hard to develop their own digital currencies that can be transferred to anyone in a user’s contact list.