Explore our latest USD tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (171)

By Topic:

About Us (11)

Africa (1)

Banks (1)

Business (1)

Business Fx Specialists (11)

Crypto (1)

Expat (11)

Foreign Currency Accounts (11)

Foreign Transfers (31)

Fx Analysis (5)

Fx Risk (6)

Fx Specialists (23)

Large Amounts (11)

Ofx (12)

Online Sellers (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (8)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (12)

Wise (13)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (71) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (49) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (114) FJD (6) FKP (1) GBP (71) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (31) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (31) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (4) KWD (1) KYD (1) KZT (1) LAK (2) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (2) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (13) MYR (23) MZN (1) NAD (1) NGN (6) NOK (8) NPR (2) NZD (39) OIL (1) OMR (4) PEN (1) PGK (1) PHP (13) PKR (12) PLN (8) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (9) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (2) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (8) TTD (1) TWD (12) TZS (1) UAH (2) UGX (2) USD (112) UYU (1) UZS (1) VEF (1) VND (11) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (11) ZWL (1)

Understanding the US Dollar: A Guide to America's Currency for Travelers and Investors

The United States dollar is the official currency of the United States of America but also is the world’s dominant reserve currency, and it accounts for roughly 62% of global foreign exchange reserves, double that of the Euro and Yen. In fact, the US Dollar has been the world’s reserve currency for over 100 years.

Currency Market Update - Week ending 2026-03-01 2026-02-23

Weekly currency market update—practical actions for SMBs, expats and travellers across AUD, CAD, GBP, NZD, SGD, USD, EUR and JPY

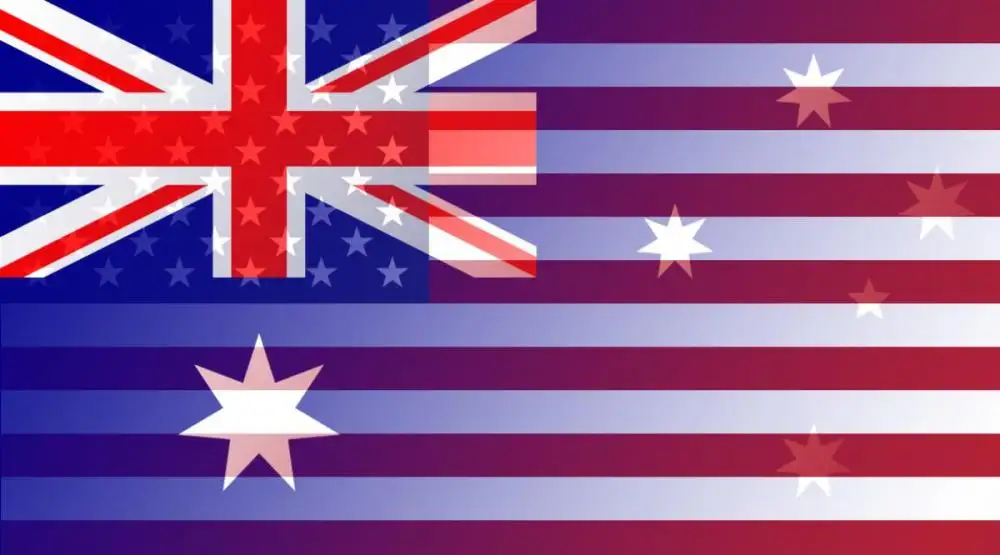

Australian Dollar Outlook: RBA–Fed Split Could Drive AUD Higher 2025-12-21

Markets are rapidly repricing Australian interest rates higher while the US moves toward cuts — a mix that has historically been powerful for the Aussie dollar.

Wise vs Revolut (USA): Transfers & Travel in 2025

U.S.-based and choosing between Wise and Revolut? Here’s a clear, current comparison of fees, exchange rates, card/ATM rules, and travel perks—plus who each suits best.

Global Central Banks Shift Policy: Key FX Impacts for August 2025 2025-08-28

Central banks are moving in different directions—Australia cuts, UK eases despite inflation, and the Fed faces political risks. Here’s what it means for exchange rates and transfer timing.

Trump Imposes Broad Tariff Hikes as Global Trade Tensions Escalate 2025-08-02

President Trump has raised U.S. tariffs to an average of 15.2%, targeting Canada, Asia, and Europe, as part of his push to reshape global trade. Markets and currencies reacted with caution amid rising uncertainty.

USD/MXN Dips as Mexico Wins 90‑Day Tariff Reprieve 2025-08-01

USD/MXN slipped below 19.00 as Mexico received a 90‑day reprieve from planned U.S. tariffs. The peso gained short‑term support, but traders now watch Fed policy and U.S. jobs data for the next market move.

Dollar Surges, Rupee Stumbles: What's Driving FX Markets Now 2025-07-30

Global FX markets shifted in July as the USD gained on trade deals, the British pound climbed, and the Indian rupee weakened on tariff fears. Here’s what’s driving currencies now.

Swedish Krona's Strength Challenges Euro Adoption Support 2025-06-11

The Swedish Krona's recent appreciation has led to a decline in public support for adopting the Euro, with only 32% favoring the change in 2025.

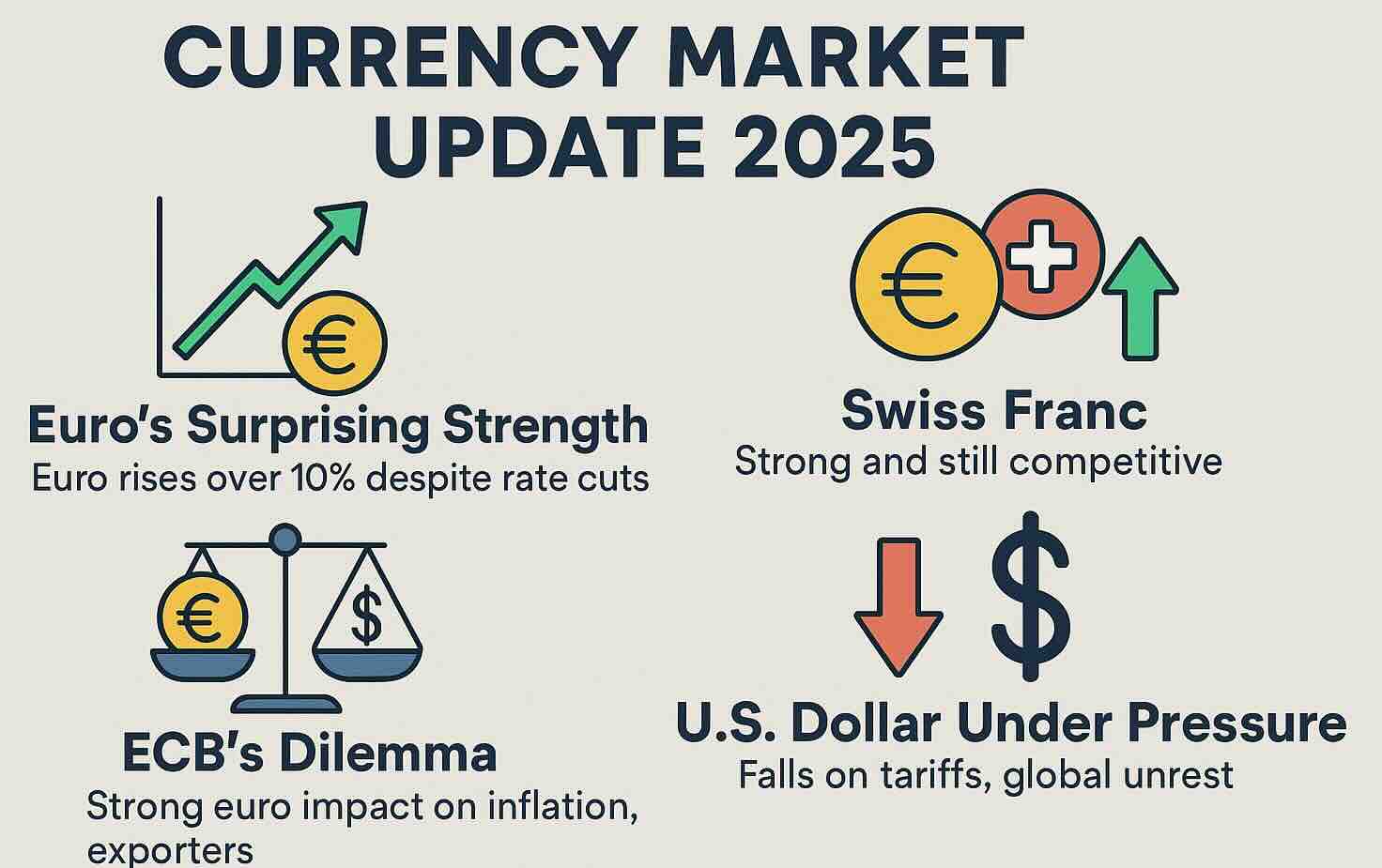

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong 2025-06-03

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

US-China Trade Truce Boosts Dollar, Euro and Yen React 2025-05-13

The US dollar surged following a 90-day tariff pause between the US and China, while the euro and yen weakened in response.

Aussie Dollar's 2025 Performance and Impact of Labor Party's Landslide Victory 2025-05-05

The Australian dollar has experienced notable fluctuations in 2025, influenced by global trade tensions and domestic political developments, including the Labor Party's decisive election win. However, trade tariffs imposed by the United States, have introduced volatility, prompting market analysts to adjust their forecasts for the currency's trajectory.

Loonie Resilience Defies Odds Amid Carney Election and Trade Tensions 2025-04-29

The Canadian dollar has defied political chaos and global headwinds to emerge as one of 2025’s unlikely winners. But with minority rule in Ottawa, soaring household debt, and a high-stakes U.S. election looming, the loonie’s fight for survival is just beginning.

Argentina's Peso Surprises Markets Amid Economic Reforms 2025-04-28

Milei publicly criticizes economists as econo-swindlers and alarmists as Argentina's peso has defied expectations by maintaining stability following recent economic reforms, easing inflation concerns and bolstering investor confidence.

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching 2025-04-25

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

US Dollar Hits Three-Year Low On Jerome Powell Dismissal Threat 2025-04-14

The US dollar has fallen to a three-year low, influenced by Trump policy back flips plus concerns over the Federal Reserve's independence. Analysts suggest a long-overdue correction due to overvaluation and trade tensions.

Swiss Franc Surges Amid U.S. Tariff Escalation 2025-04-11

The Swiss franc has experienced a significant surge, reaching a decade-high against the U.S. dollar, following President Donald Trump's announcement of increased tariffs on Chinese imports. This development has intensified market volatility and heightened demand for safe-haven assets.

Yuan's Volatility Surges Amid U.S. Tariff Escalation 2025-04-10

The Chinese yuan has weakened following the United States' decision to impose a 125% tariff on Chinese imports, prompting the People's Bank of China to intervene to stabilize the currency.

Mexican Peso Faces Uncertainty Amid U.S. Tariff Threats and Economic Policies 2025-04-08

The Mexican peso's outlook for 2025 is clouded by potential U.S. tariffs and economic policies, with forecasts indicating possible depreciation against the U.S. dollar.

How a Strong or Weak U.S. Dollar Impacts Shoppers, Travelers, and Businesses

Discover how movements in the U.S. dollar affect everyday Americans — from the cost of imports and vacations to global competitiveness for exporters and manufacturers.

Global Currency Markets React to U.S. Tariffs and Economic Policies 2025-03-27

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

Indonesian Rupiah Nears Record Low Amid Fiscal Concerns 2025-03-26

The Indonesian rupiah approaches a historic low against the U.S. dollar, influenced by fiscal worries and government spending plans.

How the Weak US Dollar Can Impact International Business in 2025

Markets have shifted focus to the interest rate policies of other major central banks rather than the Federal Reserve.

Where to for the Loonie in 2025

Economists are predicting that the Canadian dollar could rise this year.

Strong Singapore Dollar Sparks Travel Boom and Economic Shifts

The Singapore dollar has reached its highest level in over a decade, boosting outbound travel and curbing inflation, but also putting pressure on exporters and local businesses. While sectors like logistics and finance benefit, retail, hospitality, and exports face challenges from the strong currency.

Will the US dollar remain strong?

The dollar has risen by nearly 20% against most currencies compared to this time last year.

Great News for Travelers to Europe this Summer 2024-06-25

Stronger AUD, USD, and GBP Against the Euro due to surprise French elections.

US Dollar Hits 14-Month Low on Cooling US Inflation 2023-07-17

USD sinks as global currency markets react to slowing US inflation, prompting a surge in other major currencies and a potential end to the Federal Reserve's tightening cycle.

Nigeria's Decision to End Currency Peg Triggers Historic Naira Plunge 2023-06-20

Central Bank Chief's Removal Sets Stage for Currency Liberalization

US Dollar Weakens on Regional Banks Fears and Tighter Credit 2023-05-05

The US dollar weakened due to fears surrounding regional banks, while the ECB offered a less hawkish than expected 25bp hike and the Swiss franc is in demand.

Fears of US Recession Shifts Currencies & Commodities 2022-06-23

As we approach mid-year a shift has taken place in currency markets with the narrative less about interest rates hikes and more risk-off worries about a possible coming recession.

War and Inflation Powers US Dollar Strength 2022-05-10

During periods of rising inflation a stronger currency benefits a country's economics as this makes imports cheaper.

Hong Kong Reverts to More Lenient Travel Restrictions 2022-03-21

Recognising the impact of Covid-19 on its financial status, Hong Kong has reverted back to more lenient travel restrictions to improve life for both residents and travelers.

Thailand Relaxes Covid Rules for Tourists 2022-03-20

Global travel starts to revive so Thailand moves to revive its Economy after the pandemic.

New Zealand Opening After Two Years - Aussies Welcomed First 2022-03-16

'Fortress New Zealand' opening after two long pandemic years - Aussies welcomed back first on April 12th and other nationalities on 1st of May.

SWIFT Trials Real-Time Transfers in Europe; GPI Network an Answer to Ripple 2019-05-28

The operator of the world’s largest financial messaging system, SWIFT, has said it will trial real-time "gpi" cross-border payments using the European Central Bank's TIPS platform. SWIFT gpi has been developed as an answer to distributed ledger payment technologies, most notably Ripple.

East Timor Country Guide (TL)

The Democratic Republic of Timor-Leste, also known as East Timor, gained independence from Indonesia on 20 May 2002, making it the first new sovereign state of the 21st century. Despite its rich natural beauty and unique cultural heritage, includi...

Ecuador Country Guide (EC)

Ecuador is a country located in South America, bordered by Colombia to the north, Peru to the east and south, and the Pacific Ocean to the west. It is known for its diverse culture and natural beauty. The country's official language is Spanish and...

El Salvador Country Guide (SV)

El Salvador suffers horribly from bad press. While gang violence still dominates international headlines – and keeps so many adventurous travelers at bay – the vast majority of this beautiful country remains untouched by 'the troubles.'

...

Turks and Caicos Islands Country Guide (TC)

The Turks and Caicos are a chain of 40 islands that include Providenciales (the most populated island) as well as Grand Turk, Middle Caicos, South Caicos, and more. There are two airports—on Providenciales and Grand Turk—but most travelers fly...

United States Country Guide (US)

By staying informed and planning ahead, you can effectively manage your finances while enjoying your visit to the United States.

British Virgin Islands Country Guide (VG)

More than 60 islands –some of them uninhabited and declared national parks– make up this Caribbean archipelago, a paradise of lush rainforests, white-sand beaches and bright turquoise waters. Most visitors travel to the British Virgin Islands ...

US Virgin Islands Country Guide (VI)

This trio of islands in the Caribbean Sea—St. John, St. Croix, and St. Thomas—is famous for its dreamy beaches, world-class snorkeling and diving, and pristine beaches. Travelers can find accommodations for all types of trips, whether it's a f...

CAD to USD Rates - 2026 Forecast

CAD/USD Outlook: The CAD/USD pair is currently at 14-day lows but just above its recent average, suggesting it is slightly weaker, but likely to move sideways.

AUD to USD Rates - 2026 Forecast

AUD/USD Outlook: The AUD/USD is slightly positive but likely to move sideways.

EUR to USD Rates - 2026 Forecast

EUR/USD Outlook: The EUR/USD is currently above its recent average and has shown stability, aligning with a bullish outlook.

GBP to USD Rates - 2026 Forecast

GBP/USD Outlook: The GBP/USD rate is currently hovering near its 3-month average, suggesting a slightly positive outlook but likely to move sideways.

USD to ZAR Rates - 2026 Forecast

USD/ZAR Outlook: The USD/ZAR rate is currently below its recent average and near recent lows, indicating a bearish outlook.

USD to XPF Rates - 2026 Forecast

USD/XPF Outlook: The USD/XPF outlook is slightly weaker, but likely to move sideways.

USD to XOF Rates - 2026 Forecast

USD/XOF Outlook: The USD/XOF exchange rate is slightly weaker, but likely to move sideways, trading just below its recent average.

USD to XAF Rates - 2026 Forecast

USD/XAF Outlook: The USD/XAF exchange rate is slightly weaker, currently trading just below its recent average and within a stable range.

USD to WST Rates - 2026 Forecast

USD/WST Outlook: The USD/WST exchange rate is likely to decrease as it trades below its three-month average and near recent lows.

USD to VND Rates - 2026 Forecast

USD/VND Outlook: The USD/VND is currently trading near its 3-month average and is at 14-day highs.

USD to UAH Rates - 2026 Forecast

USD/UAH Outlook: The USD/UAH is likely to increase, currently positioned 1.

USD to TWD Rates - 2026 Forecast

USD/TWD Outlook: The USD/TWD exchange rate is likely to decrease as it is currently near recent lows and below its 90-day average.

USD to TRY Rates - 2026 Forecast

USD/TRY Outlook: The USD/TRY exchange rate is likely to increase as it is trading significantly above its recent average and near recent highs.

USD to THB Rates - 2026 Forecast

USD/THB Outlook: The USD/THB exchange rate is currently below its recent average and is near its recent lows.

USD to SGD Rates - 2026 Forecast

USD/SGD Outlook: The USD/SGD is slightly weaker, currently trading below its recent average and near recent lows.

USD to SEK Rates - 2026 Forecast

USD/SEK Outlook: The USD/SEK rate is currently below its recent average and likely to move sideways.

USD to SBD Rates - 2026 Forecast

USD/SBD Outlook: The outlook for USD/SBD is slightly weaker, but likely to move sideways, as the rate is below its recent average and near its recent lows.

USD to RUB Rates - 2026 Forecast

USD/RUB Outlook: The USD/RUB rate is currently below its recent average and near its recent lows.

USD to QAR Rates - 2026 Forecast

USD/QAR Outlook: The USD/QAR exchange rate is likely to move sideways, trading near its 3-month average and maintaining stability.

USD to PLN Rates - 2026 Forecast

USD/PLN Outlook: The USD/PLN exchange rate is currently below its recent average and near recent lows, leading to a likely decrease.

USD to PKR Rates - 2026 Forecast

USD/PKR Outlook: The USD/PKR rate is likely to move sideways as it trades near its recent average and has encountered resistance at 14-day highs.

USD to PHP Rates - 2026 Forecast

USD/PHP Outlook: The USD/PHP rate is likely to decrease as it is currently below its recent average and near recent lows.

USD to NZD Rates - 2026 Forecast

USD/NZD Outlook: The USD/NZD is likely to decrease as it currently trades below its recent average and near recent lows.

USD to NOK Rates - 2026 Forecast

USD/NOK Outlook: The USD/NOK exchange rate is likely to decrease, as it currently trades significantly below its recent average and is near recent lows.

USD to NGN Rates - 2026 Forecast

USD/NGN Outlook: The USD/NGN exchange rate appears slightly weaker, likely to move sideways as it is currently below its recent average and near recent lows.

USD to MYR Rates - 2026 Forecast

USD/MYR Outlook: The USD/MYR pair is likely to decrease as it currently trades significantly below its recent average and is near recent lows, pressured...

USD to MXN Rates - 2026 Forecast

USD/MXN Outlook: The USD/MXN rate is currently below its recent average and near recent lows, indicating a likely decrease in value.

USD to LKR Rates - 2026 Forecast

USD/LKR Outlook: The USD/LKR exchange rate is likely to move sideways as it is near the recent average and has been trading within a stable range.

USD to KRW Rates - 2026 Forecast

USD/KRW Outlook: The outlook for USD/KRW is likely to decrease as the rate is currently below its recent average and near recent lows.

USD to JPY Rates - 2026 Forecast

USD/JPY Outlook: The USD/JPY is slightly positive but likely to move sideways as it currently trades near its 3-month average and displays no clear driving factors.

USD to INR Rates - 2026 Forecast

USD/INR Outlook: The USD/INR rate is slightly positive, indicating that it may remain stable as it is above its recent average and towards the higher end...

USD to ILS Rates - 2026 Forecast

USD/ILS Outlook: The USD/ILS exchange rate is slightly weaker but likely to move sideways.

USD to IDR Rates - 2026 Forecast

USD/IDR Outlook: The USD/IDR is slightly positive, but likely to move sideways as it hovers just above its recent average and remains near the lower end...

USD to HUF Rates - 2026 Forecast

USD/HUF Outlook: The USD/HUF outlook is slightly weaker, but likely to move sideways as the pair is below its recent average and near recent lows.

USD to HKD Rates - 2026 Forecast

USD/HKD Outlook: The USD/HKD exchange rate is likely to increase, currently trading above its recent average and near recent highs.

USD to GBP Rates - 2026 Forecast

USD/GBP Outlook: The USD/GBP exchange rate is likely to move sideways, currently trading near its 3-month average.

USD to FJD Rates - 2026 Forecast

USD/FJD Outlook: The USD/FJD is slightly weaker, but likely to move sideways as it trades below the recent average and is positioned towards the lower...

USD to EUR Rates - 2026 Forecast

USD/EUR Outlook: The USD/EUR rate is currently below its recent average and is near recent lows.

USD to EGP Rates - 2026 Forecast

USD/EGP Outlook: The USD/EGP outlook is likely to increase as the exchange rate is currently above its recent average and near recent highs.

USD to DKK Rates - 2026 Forecast

USD/DKK Outlook: The USD/DKK exchange rate is slightly weaker, but likely to move sideways as it currently trades just below its recent average and within a stable range.

USD to CZK Rates - 2026 Forecast

USD/CZK Outlook: The USD/CZK pair is slightly weaker, but likely to move sideways.

USD to CNY Rates - 2026 Forecast

USD/CNY Outlook: The USD/CNY exchange rate is likely to decrease as it is trading 1.

USD to CLP Rates - 2026 Forecast

USD/CLP Outlook: The USD/CLP is likely to decrease, as it currently trades below its recent average and is near recent lows.

USD to CAD Rates - 2026 Forecast

USD/CAD Outlook: The outlook for USD/CAD remains slightly positive but likely to move sideways, as the rate is just below its recent average and near recent highs.

USD to BRL Rates - 2026 Forecast

USD/BRL Outlook: The USD/BRL pair is likely to decrease as it trades significantly below its recent average and is near recent lows.

USD to AUD Rates - 2026 Forecast

USD/AUD Outlook: The USD/AUD rate is currently below its recent average and near recent lows, suggesting a bearish outlook.

BTC to USD Rates - 2026 Forecast

BTC/USD Outlook: The BTC/USD exchange rate is likely to decrease as it is currently near recent lows and well below its 90-day average.

BRL to USD Rates - 2026 Forecast

BRL/USD Outlook: The BRL/USD is slightly positive, but likely to move sideways as the rate currently trades above its 90-day average and is near recent highs.

HUF to USD Rates - 2026 Forecast

HUF/USD Outlook: The HUF/USD rate is currently slightly positive, reflecting a position above the 90-day average and showing stability in the mid-range of recent trading.

KRW to USD Rates - 2026 Forecast

KRW/USD Outlook: The KRW/USD outlook is likely to decrease as the South Korean Won remains below its recent average and has been trading near recent lows.

ZAR to USD Rates - 2026 Forecast

ZAR/USD Outlook: The ZAR/USD rate is currently above its recent average and is showing a bullish tendency, supported by a strong rebound in commodity prices.

TRY to USD Rates - 2026 Forecast

TRY/USD Outlook: The TRY/USD is likely to decrease as it is currently trading significantly below its recent average and near recent lows, influenced by...

RUB to USD Rates - 2026 Forecast

RUB/USD Outlook: The RUB/USD exchange rate is slightly positive but likely to move sideways as it is above its recent average yet lacks a strong driver...

QAR to USD Rates - 2026 Forecast

QAR/USD Outlook: The QAR/USD rate is likely to move sideways as it is currently near its recent average and mid-range.

NOK to USD Rates - 2026 Forecast

NOK/USD Outlook: The NOK/USD exchange rate is slightly positive, but likely to move sideways as it currently sits above its 90-day average and is just...

SEK to USD Rates - 2026 Forecast

SEK/USD Outlook: The SEK/USD rate is slightly positive and likely to move sideways as it currently trades above its 90-day average.

DKK to USD Rates - 2026 Forecast

DKK/USD Outlook: The DKK/USD exchange rate is slightly positive but likely to move sideways, as it is just above the 90-day average and remains within a stable range.

MXN to USD Rates - 2026 Forecast

MXN/USD Outlook: The MXN/USD exchange rate is slightly positive but likely to move sideways as it is currently above its 90-day average and trading near...

PLN to USD Rates - 2026 Forecast

PLN/USD Outlook: The PLN/USD rate is slightly positive but likely to move sideways.

PKR to USD Rates - 2026 Forecast

PKR/USD Outlook: The PKR/USD is slightly positive, but likely to move sideways as it trades just above its recent average and within a stable range.

PHP to USD Rates - 2026 Forecast

PHP/USD Outlook: The PHP/USD exchange rate is slightly positive, but likely to move sideways as it trades above its recent average and within a tight range.

CHF to USD Rates - 2026 Forecast

CHF/USD Outlook: The CHF/USD is currently above its 90-day average and near recent highs, supported by elevated safe-haven demand as global uncertainties persist.

NZD to USD Rates - 2026 Forecast

NZD/USD Outlook: The New Zealand dollar (NZD) is slightly positive but likely to move sideways, currently trading above its 90-day average and near...

MYR to USD Rates - 2026 Forecast

MYR/USD Outlook: The MYR is slightly positive, trading above its recent average and near the mid-range of the last three months, supported by strong...

INR to USD Rates - 2026 Forecast

INR/USD Outlook: The INR/USD is slightly weaker, but likely to move sideways as it trades just below its 90-day average and within its recent range.

SGD to USD Rates - 2026 Forecast

SGD/USD Outlook: The SGD/USD exchange rate is slightly positive but likely to move sideways as it currently trades above its recent average, although...

OIL to USD Rates - 2026 Forecast

The recent forecasts for the OIL to USD exchange rate show a complex interplay between US economic indicators and oil market dynamics.