Explore our latest SGD tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (179)

By Topic:

About Us (12)

Africa (1)

American Express (1)

Banks (2)

Business (11)

Crypto (1)

Expat (9)

Fintech (25)

Foreign Currency Accounts (9)

Foreign Transfers (27)

Forex (3)

Fx Risk (5)

Fx Trading (3)

Large Amounts (12)

Locations (10)

Monetary Policy (1)

Newsletters (1)

Ofx (11)

Online Sellers (1)

Paypal (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (5)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (11)

Wise (12)

Worldfirst (9)

Worldremit (2)

Xe (2)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (79) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BGN (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (45) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (112) FJD (6) FKP (1) GBP (76) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (29) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (30) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (3) KWD (1) KYD (1) KZT (1) LAK (1) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (1) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (11) MYR (25) MZN (1) NAD (1) NGN (6) NOK (8) NPR (1) NZD (38) OMR (4) PEN (1) PGK (1) PHP (13) PKR (11) PLN (7) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (8) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (1) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (7) TTD (1) TWD (10) TZS (1) UAH (2) UGX (2) USD (108) UYU (1) UZS (1) VEF (1) VND (9) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (10) ZWL (1)

How the Weak US Dollar Can Impact International Business in 2025

Markets have shifted focus to the interest rate policies of other major central banks rather than the Federal Reserve.

Strong Singapore Dollar Sparks Travel Boom and Economic Shifts

The Singapore dollar has reached its highest level in over a decade, boosting outbound travel and curbing inflation, but also putting pressure on exporters and local businesses. While sectors like logistics and finance benefit, retail, hospitality, and exports face challenges from the strong currency.

Singapore simplifies Covid travel protocols 2022-04-03

Singapore is chasing tourists again relaxing some of their covid rules

Next Crises: China Property plus European Energy shake Currency Markets 2021-09-24

Fears Chinese mega developer Evergrande’s collapse will spark a contagion event and the ongoing European gas crisis has hit confidence.

Consumers Throwing Away Billions on FX Fees (TransferWise Study) 2019-05-03

As in the rest of the world, consumers in Singapore are being fleeced when it comes to foreign exchange costs, a study by TransferWise has revealed. Individuals in Singapore are being charged 15 times more on international payments than companies are, with S$2 billion lost in hidden FX fees annually.

SGD/MYR at 17-Month High; Ringgit Slumps on FTSE Index Deselection 2019-04-18

What is arguably Southeast Asia’s most important exchange rate, Singapore dollar-Malaysian ringgit, leapt on Thursday to its highest level since November 2017, driven by FTSE Russell’s decision to reconsider Malaysia’s inclusion in an important bond index.

Singapore Country Guide (SG)

Singapore is a city-state located in Southeast Asia that is known for its blend of modernity and tradition. It is a vibrant and cosmopolitan city with a mix of cultures, languages, and religions.

Singapore has a strong economy and is...

CAD to SGD 2025 Forecasts

The Canadian dollar (CAD) has recently experienced some pressure due to softening oil prices and ongoing trade uncertainties, particularly regarding U.S.

AUD to SGD 2025 Forecasts

Recent forecasts for the AUD to SGD exchange rate indicate a cautious outlook, driven by a combination of global economic uncertainties and specific local developments.

EUR to SGD 2025 Forecasts

Recent forecasts and updates suggest a mixed outlook for the EUR to SGD exchange rate amidst prevailing economic conditions and geopolitical developments.

GBP to SGD 2025 Forecasts

The GBP/SGD exchange rate has faced notable challenges in recent weeks, with analysts highlighting significant pressures on the UK economy.

USD to SGD 2025 Forecasts

Recent forecasts indicate a mixed outlook for the USD to SGD exchange rate, influenced largely by geopolitical tensions and evolving trade policies.

HKD to SGD 2025 Forecasts

Recent forecasts regarding the HKD to SGD exchange rate have emerged amid ongoing economic challenges and geopolitical tensions.

CHF to SGD 2025 Forecasts

Recent forecasts for the CHF to SGD exchange rate indicate a complex interplay of factors driven largely by geopolitical tensions and economic conditions.

AED to SGD 2025 Forecasts

Recent forecasts for the AED to SGD exchange rate reflect a complex interplay of geopolitical tensions and evolving trade dynamics.

NZD to SGD 2025 Forecasts

The New Zealand dollar (NZD) has recently faced downward pressure, primarily due to a risk-off sentiment in the markets.

MYR to SGD 2025 Forecasts

The recent outlook for the Malaysian Ringgit (MYR) to Singapore Dollar (SGD) exchange rate has been influenced significantly by geopolitical tensions and...

INR to SGD 2025 Forecasts

The recent forecast for the INR to SGD exchange rate reveals a complex interplay of geopolitical and economic factors impacting both currencies.

SGD to VND 2025 Forecasts

Recent forecasts for the SGD to VND exchange rate suggest a troubled outlook for the Singapore dollar in light of escalating trade tensions.

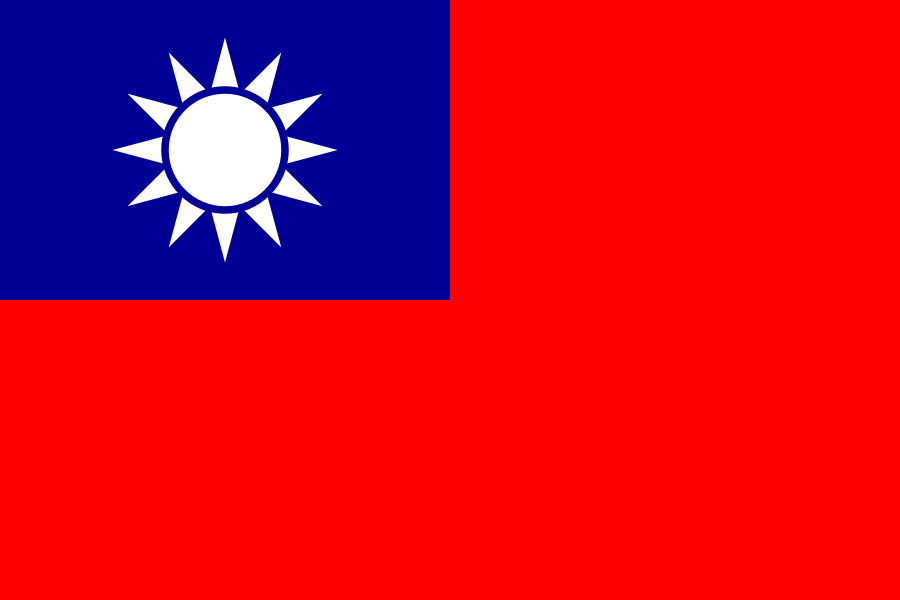

SGD to TWD 2025 Forecasts

Recent forecasts for the SGD to TWD exchange rate indicate a challenging outlook influenced by escalating trade tensions and economic uncertainty.

SGD to THB 2025 Forecasts

Recent forecasts for the Singapore Dollar (SGD) to Thai Baht (THB) exchange rate have become increasingly cautious due to escalating trade tensions and...

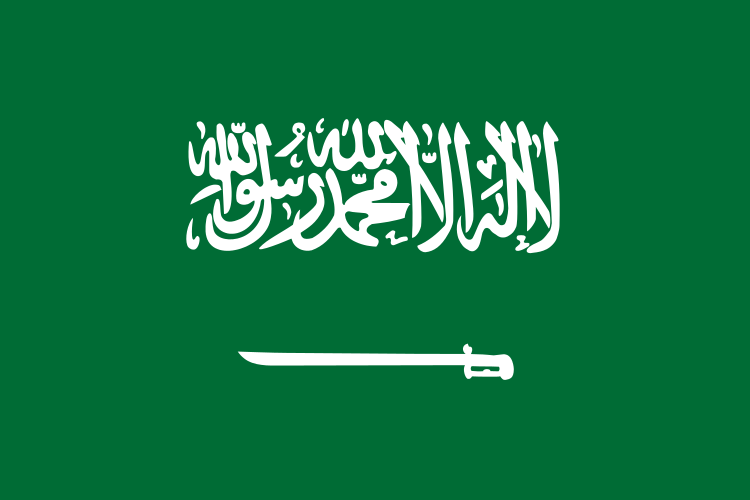

SGD to SAR 2025 Forecasts

Recent developments surrounding the SGD to SAR exchange rate reflect growing concerns over trade tensions and their potential impact on Asian currencies.

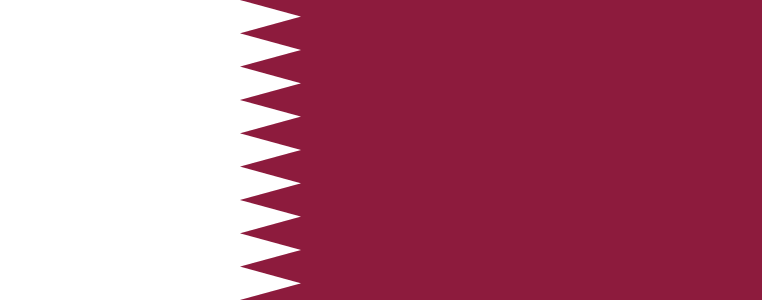

SGD to QAR 2025 Forecasts

The recent exchange rate forecasts for SGD to QAR indicate a cautious outlook amid escalating trade tensions, particularly following U.S.

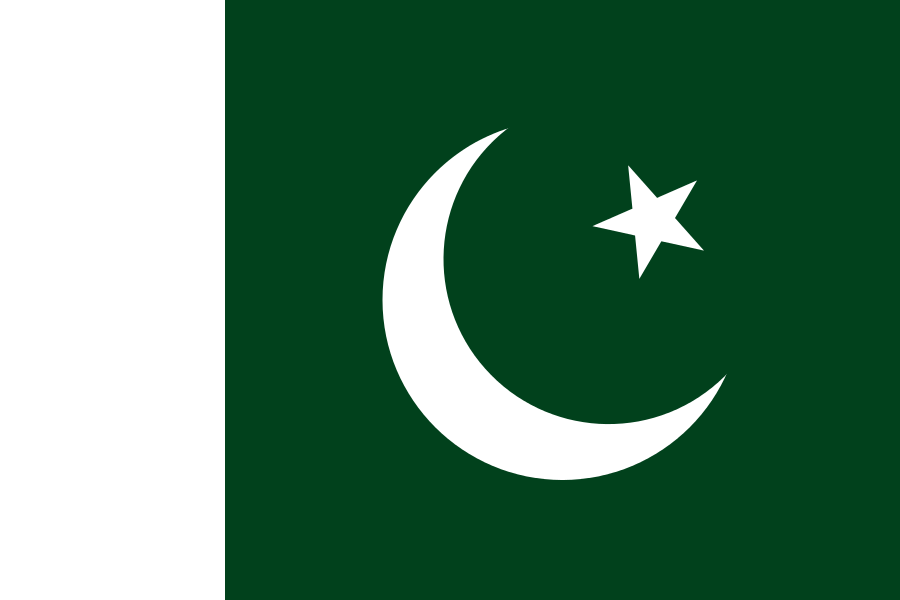

SGD to PKR 2025 Forecasts

Recent forecasts for the SGD to PKR exchange rate indicate a complex landscape influenced by escalating trade tensions and regional geopolitical dynamics.

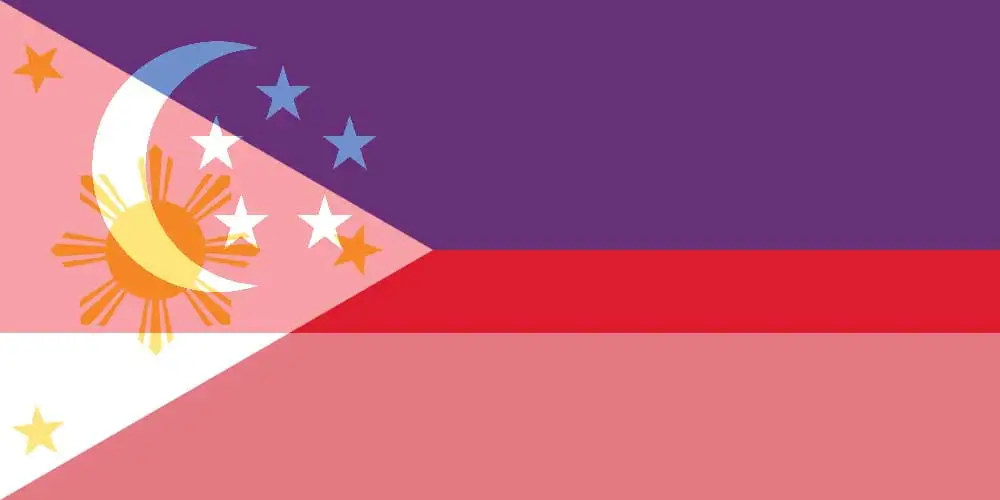

SGD to PHP 2025 Forecasts

The recent exchange rate forecasts for the Singapore Dollar (SGD) to Philippine Peso (PHP) highlight a challenging environment influenced by geopolitical...

SGD to MYR 2025 Forecasts

The recent exchange rate forecasts for the SGD to MYR reflect a challenging environment influenced by escalating trade tensions and tariff announcements from the U.S.

SGD to JPY 2025 Forecasts

The exchange rate outlook for SGD to JPY is being significantly influenced by the ongoing trade tensions initiated by U.S.

SGD to INR 2025 Forecasts

The recent exchange rate forecasts for SGD to INR have been influenced by escalating trade tensions and shifting economic conditions in the region.

SGD to IDR 2025 Forecasts

Recent forecasts indicate a cautious outlook for the SGD to IDR exchange rate amidst escalating global trade tensions, particularly following the U.S.

SGD to HKD 2025 Forecasts

Recent forecasts for the SGD to HKD exchange rate indicate significant influence from geopolitical tensions and economic measures in both regions.

SGD to GBP 2025 Forecasts

The recent exchange rate forecasts for SGD to GBP reflect growing concerns over trade policy and economic performance in both Singapore and the UK.

SGD to EUR 2025 Forecasts

The SGD to EUR exchange rate has faced notable pressures influenced by macroeconomic factors in both the Singapore and Eurozone economies.

SGD to CNY 2025 Forecasts

The current exchange rate forecast for the Singapore dollar (SGD) against the Chinese yuan (CNY) reflects a complex interplay of geopolitical tensions and...

SGD to CHF 2025 Forecasts

The exchange rate forecast for the SGD to CHF indicates a challenging environment influenced by ongoing geopolitical events and economic policies.

SGD to CAD 2025 Forecasts

Recent forecasts for the SGD to CAD exchange rate reveal a complex interaction between trade tensions, commodity prices, and monetary policy.

SGD to AUD 2025 Forecasts

Recent analysts' forecasts indicate a challenging outlook for the SGD to AUD exchange rate, reflecting the impact of geopolitical tensions and economic factors.

SGD to AED 2025 Forecasts

Recent forecasts and market updates for the SGD to AED exchange rate have been heavily influenced by geopolitical and economic developments.

SGD to USD 2025 Forecasts

Recent forecasts for the SGD to USD exchange rate indicate growing uncertainty due to geopolitical tensions and changing economic conditions.