Explore our latest INR tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (179)

By Topic:

About Us (12)

Africa (1)

American Express (1)

Banks (2)

Business (11)

Crypto (1)

Expat (9)

Fintech (25)

Foreign Currency Accounts (9)

Foreign Transfers (27)

Forex (3)

Fx Risk (5)

Fx Trading (3)

Large Amounts (12)

Locations (10)

Monetary Policy (1)

Newsletters (1)

Ofx (11)

Online Sellers (1)

Paypal (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (5)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (11)

Wise (12)

Worldfirst (9)

Worldremit (2)

Xe (2)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (79) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BGN (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (45) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (112) FJD (6) FKP (1) GBP (76) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (29) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (30) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (3) KWD (1) KYD (1) KZT (1) LAK (1) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (1) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (11) MYR (25) MZN (1) NAD (1) NGN (6) NOK (8) NPR (1) NZD (38) OMR (4) PEN (1) PGK (1) PHP (13) PKR (11) PLN (7) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (8) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (1) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (7) TTD (1) TWD (10) TZS (1) UAH (2) UGX (2) USD (108) UYU (1) UZS (1) VEF (1) VND (9) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (10) ZWL (1)

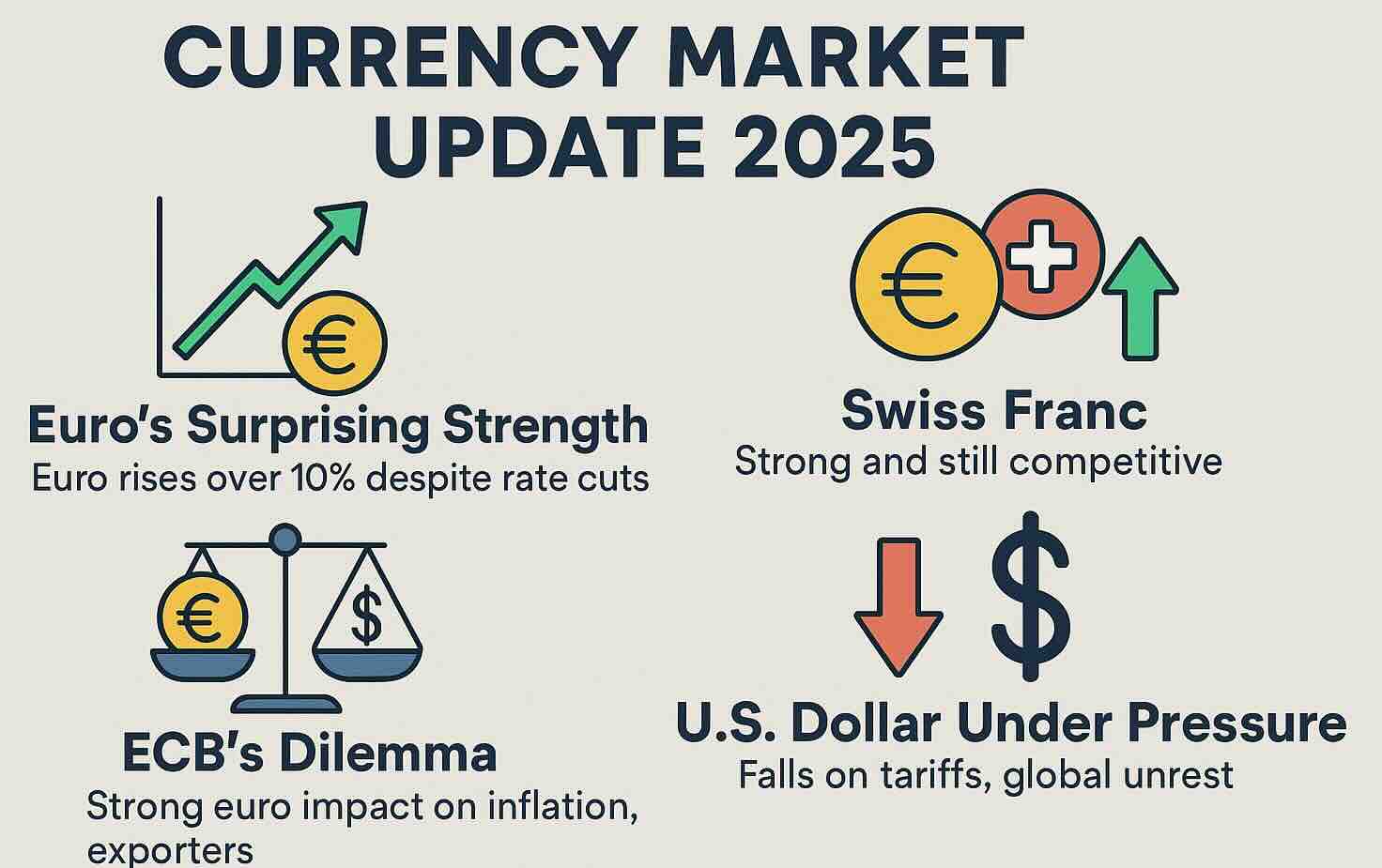

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong 2025-06-03

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

Global Currency Markets React to U.S. Tariffs and Economic Policies 2025-03-27

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

War and Inflation Powers US Dollar Strength 2022-05-10

During periods of rising inflation a stronger currency benefits a country's economics as this makes imports cheaper.

New Zealand Opening After Two Years - Aussies Welcomed First 2022-03-16

'Fortress New Zealand' opening after two long pandemic years - Aussies welcomed back first on April 12th and other nationalities on 1st of May.

Next Crises: China Property plus European Energy shake Currency Markets 2021-09-24

Fears Chinese mega developer Evergrande’s collapse will spark a contagion event and the ongoing European gas crisis has hit confidence.

India Country Guide (IN)

India is a vibrant, colourful, and fascinating country to explore but can be a little intimidating for first time visitors. There are many magical places to visit so try to make a point of staying at least two nights in any one place.

You ...

SAR to INR 2025 Forecasts

Recent forecasts for the exchange rate between the Saudi Arabian Riyal (SAR) and the Indian Rupee (INR) reflect mixed influences stemming from geopolitical...

HKD to INR 2025 Forecasts

The recent currency market updates highlight a complex landscape for the HKD to INR exchange rate.

CHF to INR 2025 Forecasts

Recent analyses suggest a notable strengthening of the Swiss franc (CHF) against the Indian rupee (INR), driven by several factors in the global and regional economic landscape.

AED to INR 2025 Forecasts

The exchange rate forecast for the AED to INR shows a complex interplay of geopolitical factors and economic conditions affecting both currencies.

NZD to INR 2025 Forecasts

The New Zealand dollar (NZD) has shown a muted performance recently, affected by a lack of significant driving factors despite an overall risk-on market sentiment.

MYR to INR 2025 Forecasts

Recent forecasts for the MYR to INR exchange rate indicate a complex landscape influenced by escalating trade tensions and regional economic pressures.

INR to THB 2025 Forecasts

The recent exchange rate forecasts for the INR to THB indicate significant volatility and mixed influences driven by geopolitical tensions, U.S.

INR to SGD 2025 Forecasts

The recent forecasts for the INR to SGD exchange rate reflect a complex interplay of geopolitical tensions and economic policies.

INR to JPY 2025 Forecasts

The recent exchange rate forecasts for the Indian Rupee (INR) to Japanese Yen (JPY) have been influenced by a combination of geopolitical tensions and...

INR to HKD 2025 Forecasts

The exchange rate forecast for the Indian Rupee (INR) against the Hong Kong Dollar (HKD) depicts a complex landscape influenced by geopolitical tensions and...

INR to GBP 2025 Forecasts

The recent exchange rate forecasts for the Indian Rupee (INR) to British Pound (GBP) reflect a complex interplay of regional and global factors that could...

INR to EUR 2025 Forecasts

The exchange rate for the Indian Rupee (INR) to Euro (EUR) has recently faced notable pressures, dropping to 90-day lows near 0.009974.

INR to CNY 2025 Forecasts

The Indian rupee (INR) and Chinese yuan (CNY) are currently influenced by a confluence of geopolitical tensions and economic policies, which are shaping...

INR to CAD 2025 Forecasts

The recent exchange rate forecasts for the Indian Rupee (INR) against the Canadian Dollar (CAD) present a complex picture influenced by geopolitical events,...

INR to AUD 2025 Forecasts

The exchange rate forecast for the Indian Rupee (INR) to Australian Dollar (AUD) reflects a mix of geopolitical tensions, economic uncertainties, and market sentiment.

INR to AED 2025 Forecasts

Recent forecasts and market updates indicate a complex landscape for the Indian Rupee (INR) against the UAE Dirham (AED).

INR to USD 2025 Forecasts

The Indian rupee (INR) has recently experienced mixed influences in the foreign exchange market, particularly in relation to the US dollar (USD).

SGD to INR 2025 Forecasts

Recent analysis indicates that the exchange rate for Singapore Dollar (SGD) to Indian Rupee (INR) is facing downward pressure as the geopolitical landscape...

CAD to INR 2025 Forecasts

Recent developments indicate a mixed outlook for the CAD to INR exchange rate, influenced by fluctuations in oil prices, geopolitical tensions, and economic...

AUD to INR 2025 Forecasts

The AUD to INR exchange rate has recently shown some volatility, currently sitting at 55.85, which is 1.9% above its three-month average of 54.8.

EUR to INR 2025 Forecasts

The recent trends in the EUR to INR exchange rate have highlighted key dynamics influenced by both the Eurozone and global factors.

GBP to INR 2025 Forecasts

The recent trajectory of the GBP to INR exchange rate reflects a confluence of factors influencing both currencies.

USD to INR 2025 Forecasts

Recent forecasts for the USD to INR exchange rate indicate a complex interplay of factors affecting both currencies.