Explore our latest NZD tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (179)

By Topic:

About Us (12)

Africa (1)

American Express (1)

Banks (2)

Business (11)

Crypto (1)

Expat (9)

Fintech (25)

Foreign Currency Accounts (9)

Foreign Transfers (27)

Forex (3)

Fx Risk (5)

Fx Trading (3)

Large Amounts (12)

Locations (10)

Monetary Policy (1)

Newsletters (1)

Ofx (11)

Online Sellers (1)

Paypal (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (5)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (11)

Wise (12)

Worldfirst (9)

Worldremit (2)

Xe (2)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (79) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BGN (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (45) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (112) FJD (6) FKP (1) GBP (76) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (29) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (30) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (3) KWD (1) KYD (1) KZT (1) LAK (1) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (1) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (11) MYR (25) MZN (1) NAD (1) NGN (6) NOK (8) NPR (1) NZD (38) OMR (4) PEN (1) PGK (1) PHP (13) PKR (11) PLN (7) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (8) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (1) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (7) TTD (1) TWD (10) TZS (1) UAH (2) UGX (2) USD (108) UYU (1) UZS (1) VEF (1) VND (9) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (10) ZWL (1)

Volatile May for Foreign Exchange Rates: EUR, GBP, JPY, AUD, NZD, RON 2025-05-16

In May 2025, currency markets experienced notable fluctuations influenced by geopolitical developments, economic policies, and trade relations. The pound (GBP) and euro (EUR) were strong while U.S. dollar (USD) exhibited a weakening trend, while several other currencies demonstrated strength.

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching 2025-04-25

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

New Zealand Opening After Two Years - Aussies Welcomed First 2022-03-16

'Fortress New Zealand' opening after two long pandemic years - Aussies welcomed back first on April 12th and other nationalities on 1st of May.

Next Crises: China Property plus European Energy shake Currency Markets 2021-09-24

Fears Chinese mega developer Evergrande’s collapse will spark a contagion event and the ongoing European gas crisis has hit confidence.

Cook Islands Country Guide (CK)

The Cook Islands is a self-governing island country in the Pacific Ocean, with 15 islands that spread over an area of 2 million square kilometers. It's a territory associated with New Zealand and is located in Oceania, near to American Samoa and F...

New Zealand Country Guide (NZ)

New Zealand is an island nation located in the southwestern Pacific Ocean. The country is sparsely populated, with most of its population concentrated in the North Island. New Zealand is renowned for its natural beauty, with its stunning landscape...

Niue Country Guide (NU)

Niue is a remote, beautifully unspoiled island in the South Pacific. The locals are friendly and welcoming, and there is plenty to see and do, including snorkelling, diving, fishing, and hiking. The island has a warm climate, and the scenery is si...

Tokelau Country Guide (TK)

In a world where travel has become easy and accessible to the masses, travelling to Tokelau – a territory of New Zealand – still requires a dedication that dissuades all but the most committed visitors. It takes upwards of 24 hours to reach To...

CAD to NZD 2025 Forecasts

Recent forecasts for the CAD to NZD exchange rate highlight a relatively stable environment for both currencies, influenced significantly by ongoing trade...

AUD to NZD 2025 Forecasts

Recent forecasts for the AUD to NZD exchange rate reflect a cautious yet optimistic sentiment, influenced by various domestic and international factors.

EUR to NZD 2025 Forecasts

The recent movements in the EUR to NZD exchange rate reflect a complex interplay of economic indicators and market sentiment.

GBP to NZD 2025 Forecasts

The GBP to NZD exchange rate has recently displayed some flux, reflecting broader economic developments and sentiments.

USD to NZD 2025 Forecasts

The USD to NZD exchange rate has recently demonstrated notable volatility, currently trading at 1.6418, which is 2.4% below the three-month average of 1.683.

NZD to ZAR 2025 Forecasts

The New Zealand dollar (NZD) has exhibited muted performance recently, failing to capitalize on a general risk-on market sentiment that has benefited some other currencies.

NZD to XPF 2025 Forecasts

The New Zealand dollar (NZD) has exhibited muted performance in recent weeks, failing to capitalize on a broader risk-on sentiment in financial markets.

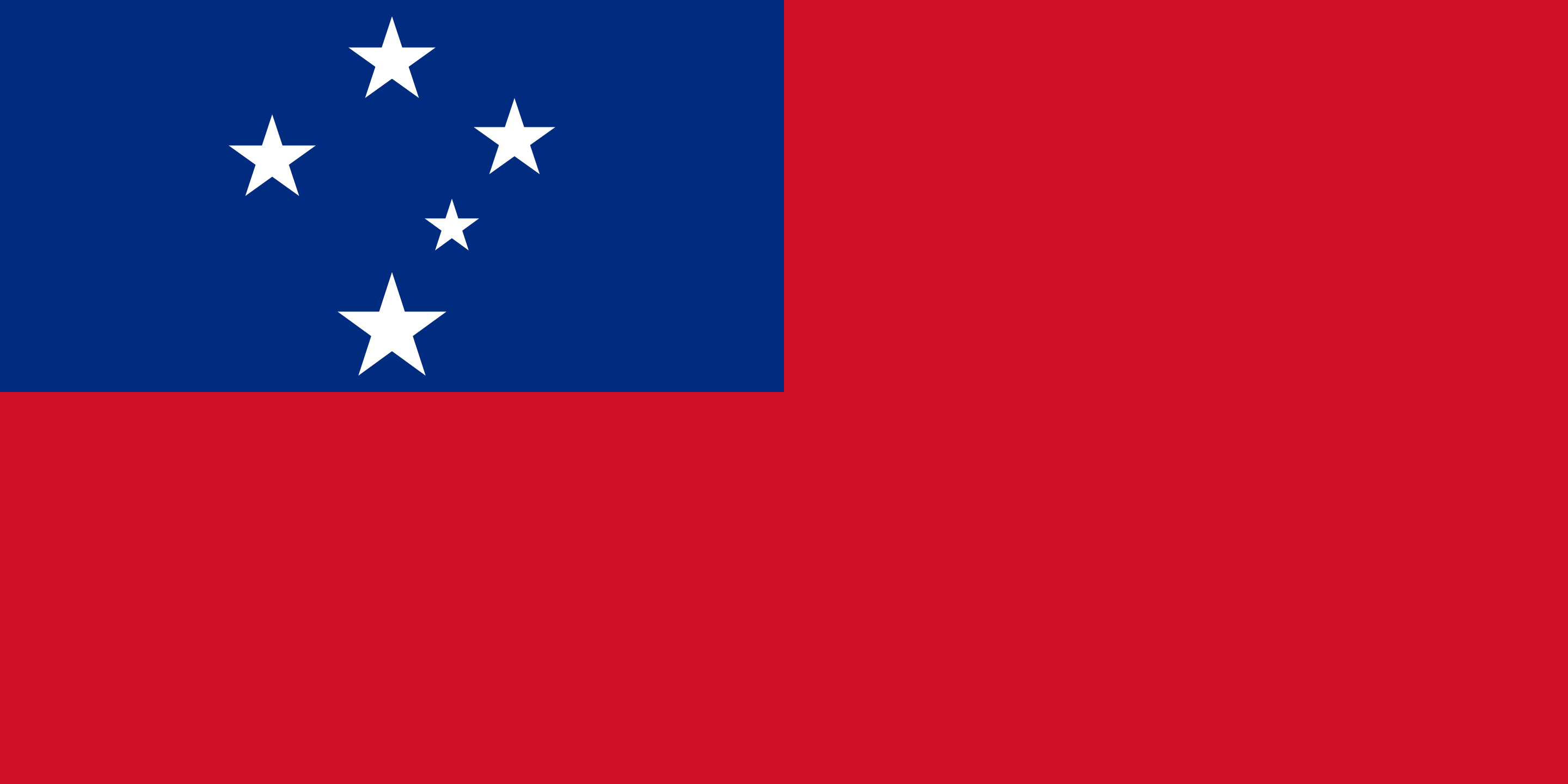

NZD to WST 2025 Forecasts

The New Zealand dollar (NZD) has recently shown muted performance despite a generally positive risk-on mood in the markets.

NZD to VND 2025 Forecasts

The New Zealand dollar (NZD) is currently experiencing muted performance amidst a risk-on sentiment in the market, particularly compared to its Australian counterpart.

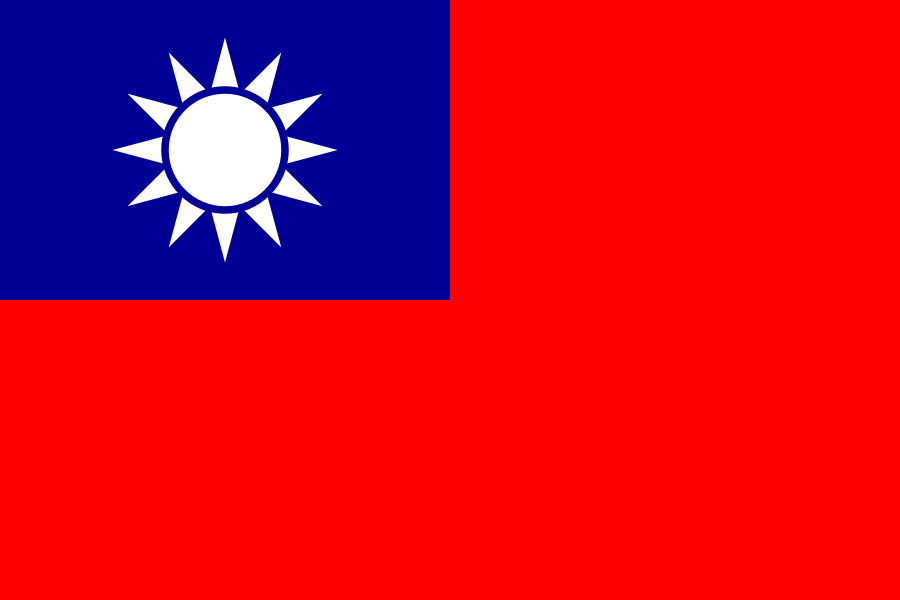

NZD to TWD 2025 Forecasts

The New Zealand dollar (NZD) has displayed a muted performance recently, struggling to gain momentum even in a market with an increased risk appetite.

NZD to THB 2025 Forecasts

The New Zealand dollar (NZD) has demonstrated muted performance recently, lacking the robust support seen in the Australian dollar (AUD), despite a general...

NZD to SGD 2025 Forecasts

Recent analysis of the NZD to SGD exchange rate indicates a complex interplay of factors influencing both currencies.

NZD to SBD 2025 Forecasts

The recent performance of the New Zealand dollar (NZD) reflects a muted response to improving market risk appetite, especially when compared to its Australian counterpart.

NZD to PHP 2025 Forecasts

The New Zealand dollar (NZD) has shown muted performance despite an overall risk-on sentiment in the markets.

NZD to MYR 2025 Forecasts

The exchange rate forecast for the New Zealand dollar (NZD) against the Malaysian ringgit (MYR) remains cautious amid prevailing global market dynamics.

NZD to JPY 2025 Forecasts

The New Zealand dollar (NZD) has faced challenges recently, remaining somewhat muted compared to its Australian counterpart, even as market risk appetite appeared to increase.

NZD to INR 2025 Forecasts

The New Zealand dollar (NZD) has shown a muted performance recently, affected by a lack of significant driving factors despite an overall risk-on market sentiment.

NZD to HKD 2025 Forecasts

The exchange rate forecast for the New Zealand Dollar (NZD) against the Hong Kong Dollar (HKD) has recently shown signs of volatility influenced by market...

NZD to GBP 2025 Forecasts

The NZD to GBP exchange rate has recently experienced some fluctuations, settling at 30-day lows near 0.4412, which is just 0.6% below its three-month average of 0.4441.

NZD to FJD 2025 Forecasts

Recent analysis suggests the New Zealand dollar (NZD) is facing challenges despite a broader market risk-on sentiment.

NZD to EUR 2025 Forecasts

Recent analysis of the NZD to EUR exchange rate indicates a subdued outlook for the New Zealand dollar (NZD) amid a fluctuating global risk sentiment.

NZD to CNY 2025 Forecasts

Recent forecasts for the NZD to CNY exchange rate highlight a complex interplay of factors influencing both currencies.

NZD to CHF 2025 Forecasts

The New Zealand dollar (NZD) has shown muted performance recently, struggling to gain traction despite a generally positive market risk appetite that has...

NZD to CAD 2025 Forecasts

The recent performance of the New Zealand dollar (NZD) against the Canadian dollar (CAD) exhibits a complex interplay of factors affecting both currencies.

NZD to AUD 2025 Forecasts

The recent forecasts for the NZD to AUD exchange rate reflect a cautious outlook given the divergent factors influencing each currency.

NZD to USD 2025 Forecasts

The New Zealand dollar (NZD) has struggled to gain traction despite a risk-on market mood, contrasting the performance of its Australian counterpart.