Explore our latest CAD tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (179)

By Topic:

About Us (12)

Africa (1)

American Express (1)

Banks (2)

Business (11)

Crypto (1)

Expat (9)

Fintech (25)

Foreign Currency Accounts (9)

Foreign Transfers (27)

Forex (3)

Fx Risk (5)

Fx Trading (3)

Large Amounts (12)

Locations (10)

Monetary Policy (1)

Newsletters (1)

Ofx (11)

Online Sellers (1)

Paypal (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (5)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (11)

Wise (12)

Worldfirst (9)

Worldremit (2)

Xe (2)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (79) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BGN (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (45) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (112) FJD (6) FKP (1) GBP (76) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (29) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (30) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (3) KWD (1) KYD (1) KZT (1) LAK (1) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (1) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (11) MYR (25) MZN (1) NAD (1) NGN (6) NOK (8) NPR (1) NZD (38) OMR (4) PEN (1) PGK (1) PHP (13) PKR (11) PLN (7) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (8) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (1) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (7) TTD (1) TWD (10) TZS (1) UAH (2) UGX (2) USD (108) UYU (1) UZS (1) VEF (1) VND (9) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (10) ZWL (1)

Loonie Resilience Defies Odds Amid Carney Election and Trade Tensions 2025-04-29

The Canadian dollar has defied political chaos and global headwinds to emerge as one of 2025’s unlikely winners. But with minority rule in Ottawa, soaring household debt, and a high-stakes U.S. election looming, the loonie’s fight for survival is just beginning.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

Where to for the Loonie in 2025

Economists are predicting that the Canadian dollar could rise this year.

Will the US dollar remain strong?

The dollar has risen by nearly 20% against most currencies compared to this time last year.

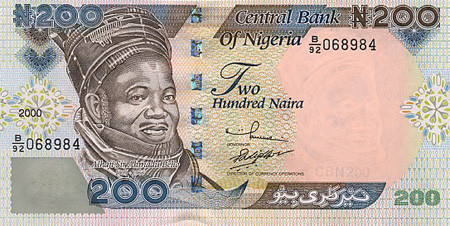

Nigeria's Decision to End Currency Peg Triggers Historic Naira Plunge 2023-06-20

Central Bank Chief's Removal Sets Stage for Currency Liberalization

US Dollar Weakens on Regional Banks Fears and Tighter Credit 2023-05-05

The US dollar weakened due to fears surrounding regional banks, while the ECB offered a less hawkish than expected 25bp hike and the Swiss franc is in demand.

Ski vacations and exchange rates

We look at tips for finding the best value locations for skiing, there are countries where skiing may be more affordable due to favourable exchange rates or lower costs of living.

Fears of US Recession Shifts Currencies & Commodities 2022-06-23

As we approach mid-year a shift has taken place in currency markets with the narrative less about interest rates hikes and more risk-off worries about a possible coming recession.

Russian sanctions mount - US dollar gains 2022-02-28

Any curbs to Russian access to its foreign reserves could present a bigger blow to the Russian economy than the impact of a ban on Swift.

Next Crises: China Property plus European Energy shake Currency Markets 2021-09-24

Fears Chinese mega developer Evergrande’s collapse will spark a contagion event and the ongoing European gas crisis has hit confidence.

Canada Country Guide (CA)

Canada is a vast country with a lot to see and do, so it's a good idea to spend some time planning your trip to make the most of your time there. Here are some things you might consider when planning a trip to Canada:

Planning a t...

CAD to ZAR 2025 Forecasts

The CAD to ZAR exchange rate has recently seen relative stability, with the Canadian dollar (CAD) currently valued at 12.90 ZAR, which stands 2.4% below its...

CAD to TWD 2025 Forecasts

The Canadian dollar (CAD) has shown signs of stabilization recently, particularly as trade discussions between the U.S.

CAD to THB 2025 Forecasts

The CAD to THB exchange rate has shown relative stability in recent weeks, trading at approximately 23.80, just slightly below its three-month average of 23.92.

CAD to SGD 2025 Forecasts

The Canadian dollar (CAD) has recently shown signs of stabilization, particularly following the withdrawal of the Canadian government's digital tax plans,...

CAD to PKR 2025 Forecasts

The exchange rate between the Canadian dollar (CAD) and the Pakistani rupee (PKR) has recently shown resilience, with the CAD trading at approximately 208.0 PKR.

CAD to PHP 2025 Forecasts

The Canadian dollar (CAD) has recently shown stability, recovering some losses amidst the ongoing US-Canada trade discussions following Canada's withdrawal of digital tax plans.

CAD to NZD 2025 Forecasts

The exchange rate forecast for CAD to NZD reflects a mix of influencing factors currently impacting both currencies.

CAD to MYR 2025 Forecasts

The exchange rate between the Canadian dollar (CAD) and Malaysian ringgit (MYR) remains under pressure, recently trading at approximately 3.0760.

CAD to MXN 2025 Forecasts

The recent exchange rate forecasts for the CAD to MXN currency pair indicate a complex interplay of geopolitical and economic factors influencing both currencies.

CAD to JPY 2025 Forecasts

The CAD to JPY exchange rate has shown some stability recently, currently sitting at 105.2, which is just 0.7% above its three-month average of 104.5.

CAD to INR 2025 Forecasts

The Canadian dollar (CAD) has recently stabilized amid resuming trade talks with the United States, following a withdrawal of Canadian digital tax plans.

CAD to ILS 2025 Forecasts

The Canadian dollar (CAD) has recently shown signs of stabilization, recovering from prior losses as U.S.-Canada trade discussions restart, particularly...

CAD to HKD 2025 Forecasts

The recent performance of the CAD to HKD exchange rate reflects various influencing factors on both currencies.

CAD to GBP 2025 Forecasts

Recent market data indicates a stable yet somewhat pressured forex landscape for the Canadian dollar (CAD) against the British pound (GBP).

CAD to EUR 2025 Forecasts

The recent forecasts for the CAD to EUR exchange rate suggest a complex interplay of economic factors influencing both currencies.

CAD to DKK 2025 Forecasts

The recent forecasts for the Canadian dollar (CAD) against the Danish krone (DKK) indicate a degree of stabilization for the loonie, influenced by ongoing...

CAD to CZK 2025 Forecasts

The CAD/CZK exchange rate currently stands at 15.33, which is approximately 3.3% below its three-month average of 15.86.

CAD to CNY 2025 Forecasts

The exchange rate between the Canadian Dollar (CAD) and the Chinese Yuan (CNY) has been influenced by several recent developments in both countries.

CAD to CLP 2025 Forecasts

The CAD to CLP exchange rate remains relatively stable, currently sitting at 680.7, just 0.6% below its three-month average of 684.7.

CAD to CHF 2025 Forecasts

The recent outlook for the CAD to CHF exchange rate indicates a complex interplay of factors influencing both currencies.

CAD to BRL 2025 Forecasts

The exchange rate between the Canadian dollar (CAD) and the Brazilian real (BRL) has witnessed fluctuations in the past two months, shaped by significant...

CAD to AUD 2025 Forecasts

The CAD to AUD exchange rate has shown some stability recently, with CAD trading at 1.1140, which is 1.2% below its three-month average of 1.1276.

CAD to AED 2025 Forecasts

The Canadian dollar (CAD) is currently trading at 2.6924 AED, reflecting a 1.3% increase above its 3-month average of 2.6569 AED.

CAD to USD 2025 Forecasts

The Canadian dollar (CAD) has recently demonstrated some resilience, trading at 0.7330 USD, which is 1.3% above its three-month average of 0.7234.

AUD to CAD 2025 Forecasts

The exchange rate forecast for the AUD to CAD has seen fluctuations in recent weeks, largely influenced by developments in both Australian and Canadian economies.

EUR to CAD 2025 Forecasts

Recent forecasts for the EUR to CAD exchange rate reveal a complex interplay of factors affecting both currencies.

GBP to CAD 2025 Forecasts

The recent forecasts and analyses regarding the GBP to CAD exchange rate indicate significant pressure on the British pound, influenced primarily by...

USD to CAD 2025 Forecasts

The exchange rate forecast for the USD to CAD has shown notable influences from both economic and geopolitical developments over the past two months.

CHF to CAD 2025 Forecasts

Recent forecasts and updates suggest a complex landscape for the CHF to CAD exchange rate.

AED to CAD 2025 Forecasts

The exchange rate forecast for the AED to CAD continues to be influenced by several key factors impacting both currencies.

NZD to CAD 2025 Forecasts

The recent performance of the New Zealand dollar (NZD) against the Canadian dollar (CAD) exhibits a complex interplay of factors affecting both currencies.

INR to CAD 2025 Forecasts

The recent exchange rate forecasts for the Indian Rupee (INR) against the Canadian Dollar (CAD) present a complex picture influenced by geopolitical events,...

SGD to CAD 2025 Forecasts

The exchange rate forecast for the Singapore Dollar (SGD) to Canadian Dollar (CAD) is currently shaped by a mix of trade tensions and commodity price movements.