Explore our latest EUR tagged content. From expert guides and forecasts to provider reviews and practical money tips, these posts help you stay informed and make smarter currency decisions.

All Content (179)

By Topic:

About Us (12)

Africa (1)

American Express (1)

Banks (2)

Business (11)

Crypto (1)

Expat (9)

Fintech (25)

Foreign Currency Accounts (9)

Foreign Transfers (27)

Forex (3)

Fx Risk (5)

Fx Trading (3)

Large Amounts (12)

Locations (10)

Monetary Policy (1)

Newsletters (1)

Ofx (11)

Online Sellers (1)

Paypal (1)

Popular (3)

Property (2)

Pursuits (1)

Revolut (5)

Study Abroad (7)

Travel (1)

Travel Cards (9)

Travel Money (11)

Wise (12)

Worldfirst (9)

Worldremit (2)

Xe (2)

By Currency: AED (28) AFN (1) ALL (1) AMD (1) ANG (2) AOA (1) ARS (2) AUD (79) AWG (1) AZN (1) BAM (1) BBD (1) BDT (1) BGN (1) BHD (1) BIF (1) BMD (1) BND (1) BOB (1) BRL (6) BSD (1) BTC (1) BTN (1) BWP (1) BZD (1) CAD (45) CDF (1) CHF (33) CLP (4) CNY (22) COP (1) CUP (1) CVE (1) CZK (5) DJF (1) DKK (9) DOP (1) DZD (1) EGP (2) ETB (1) EUR (112) FJD (6) FKP (1) GBP (76) GEL (1) GHS (2) GIP (1) GMD (1) GNF (1) GTQ (1) GYD (1) HKD (22) HNL (1) HTG (1) HUF (5) IDR (8) ILS (6) INR (29) IQD (1) IRR (1) ISK (1) JMD (1) JOD (1) JPY (30) KES (2) KGS (1) KHR (1) KMF (1) KPW (1) KRW (3) KWD (1) KYD (1) KZT (1) LAK (1) LBP (1) LKR (2) LRD (1) LSL (1) LYD (1) MAD (2) MDL (1) MGA (1) MKD (1) MMK (1) MNT (1) MOP (1) MRO (1) MUR (1) MVR (1) MWK (1) MXN (11) MYR (25) MZN (1) NAD (1) NGN (6) NOK (8) NPR (1) NZD (38) OMR (4) PEN (1) PGK (1) PHP (13) PKR (11) PLN (7) PYG (1) QAR (7) RON (2) RSD (1) RUB (8) RWF (1) SAR (9) SBD (4) SCR (1) SDG (1) SEK (8) SGD (38) SHP (1) SLL (1) SOS (1) SRD (1) SYP (1) SZL (1) THB (16) TJS (1) TMT (1) TND (1) TOP (1) TRY (7) TTD (1) TWD (10) TZS (1) UAH (2) UGX (2) USD (108) UYU (1) UZS (1) VEF (1) VND (9) VUV (1) WST (6) XAF (9) XCD (10) XOF (11) XPF (7) YER (1) ZAR (10) ZWL (1)

Swedish Krona's Strength Challenges Euro Adoption Support 2025-06-11

The Swedish Krona's recent appreciation has led to a decline in public support for adopting the Euro, with only 32% favoring the change in 2025.

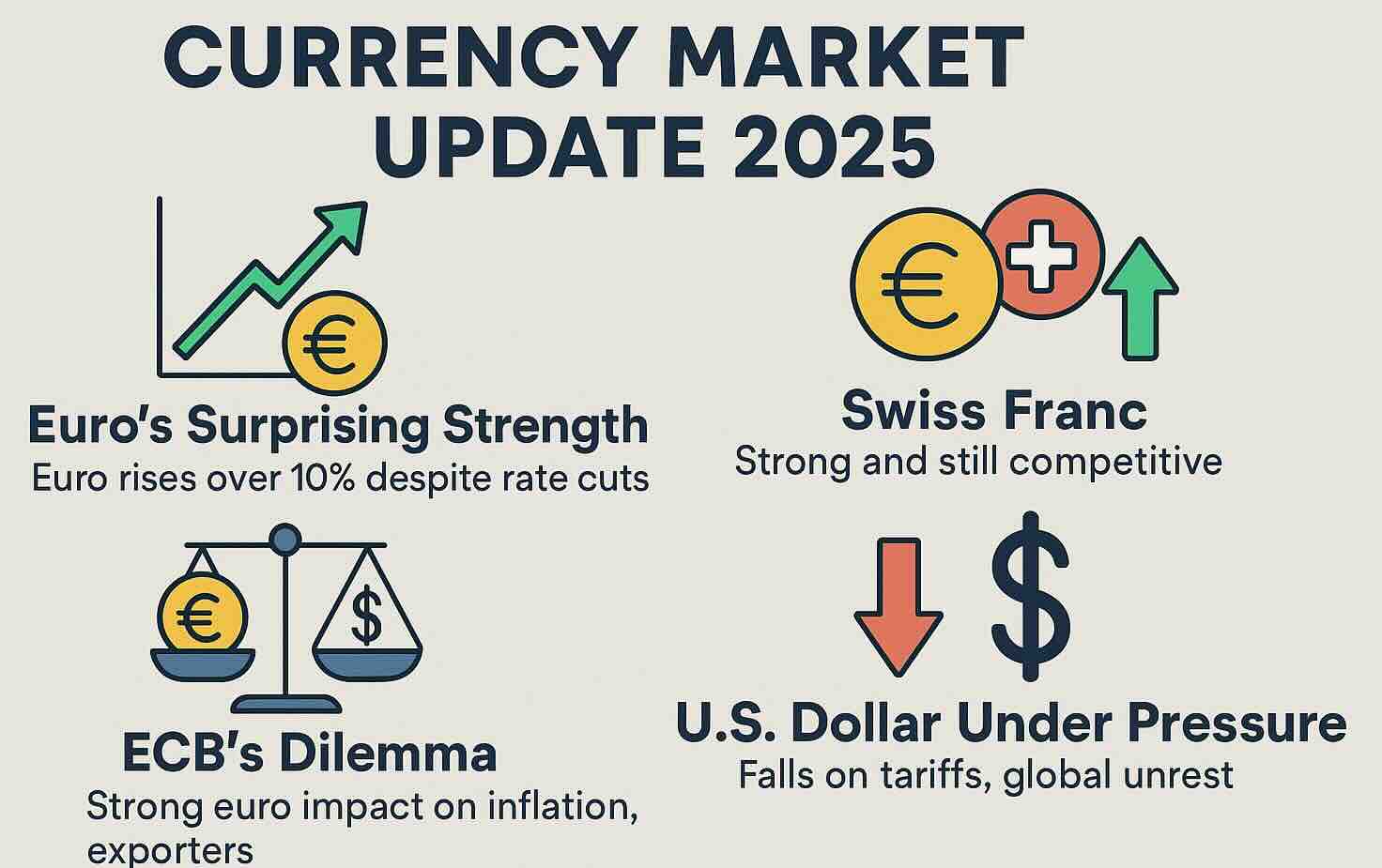

Global Currency Shake-Up: Euro Surges, Dollar Stumbles, Franc Holds Strong 2025-06-03

The euro's unexpected rise against the U.S. dollar presents the European Central Bank with a complex dilemma, as global trade tensions and policy shifts influence currency dynamics.

Volatile May for Foreign Exchange Rates: EUR, GBP, JPY, AUD, NZD, RON 2025-05-16

In May 2025, currency markets experienced notable fluctuations influenced by geopolitical developments, economic policies, and trade relations. The pound (GBP) and euro (EUR) were strong while U.S. dollar (USD) exhibited a weakening trend, while several other currencies demonstrated strength.

US-China Trade Truce Boosts Dollar, Euro and Yen React 2025-05-13

The US dollar surged following a 90-day tariff pause between the US and China, while the euro and yen weakened in response.

The U.S. Dollar Is Losing Ground to the Euro — And the World Is Watching 2025-04-25

Deutsche Bank forecasts a significant weakening of the US dollar in the coming years, potentially reaching its lowest level against the euro in over a decade.

US Dollar Hits Three-Year Low On Jerome Powell Dismissal Threat 2025-04-14

The US dollar has fallen to a three-year low, influenced by Trump policy back flips plus concerns over the Federal Reserve's independence. Analysts suggest a long-overdue correction due to overvaluation and trade tensions.

Yuan's Volatility Surges Amid U.S. Tariff Escalation 2025-04-10

The Chinese yuan has weakened following the United States' decision to impose a 125% tariff on Chinese imports, prompting the People's Bank of China to intervene to stabilize the currency.

Global Currency Markets React to U.S. Tariffs and Economic Policies 2025-03-27

Recent U.S. trade policies, including aggressive tariffs on auto imports, have introduced significant volatility in global currency markets, affecting major currencies such as the euro, British pound, and Japanese yen.

Currency Markets in Flux: Euro's Ascent Amidst Global Economic Shifts 2025-03-19

The global currency landscape is experiencing notable shifts as the euro strengthens against major currencies, influenced by economic policies, geopolitical events, and fluctuating oil prices.

Will the US dollar remain strong?

The dollar has risen by nearly 20% against most currencies compared to this time last year.

Great News for Travelers to Europe this Summer 2024-06-25

Stronger AUD, USD, and GBP Against the Euro due to surprise French elections.

Guide to the Euro: Understanding Europe's Common Currency for Travelers and Investors

Understanding the Euro is not only crucial for navigating the financial landscapes of these countries but also for appreciating the broader economic and cultural contexts that shape Europe today.

US Dollar Hits 14-Month Low on Cooling US Inflation 2023-07-17

USD sinks as global currency markets react to slowing US inflation, prompting a surge in other major currencies and a potential end to the Federal Reserve's tightening cycle.

US Dollar Weakens on Regional Banks Fears and Tighter Credit 2023-05-05

The US dollar weakened due to fears surrounding regional banks, while the ECB offered a less hawkish than expected 25bp hike and the Swiss franc is in demand.

Ski vacations and exchange rates

We look at tips for finding the best value locations for skiing, there are countries where skiing may be more affordable due to favourable exchange rates or lower costs of living.

Fears of US Recession Shifts Currencies & Commodities 2022-06-23

As we approach mid-year a shift has taken place in currency markets with the narrative less about interest rates hikes and more risk-off worries about a possible coming recession.

War and Inflation Powers US Dollar Strength 2022-05-10

During periods of rising inflation a stronger currency benefits a country's economics as this makes imports cheaper.

Russian sanctions mount - US dollar gains 2022-02-28

Any curbs to Russian access to its foreign reserves could present a bigger blow to the Russian economy than the impact of a ban on Swift.

Geo-politics replaces COVID-19 Risk for Currency Markets 2022-02-24

Russia attacking Ukraine has sparked volatility and a flight to safe-haven currencies such as CHF.

Next Crises: China Property plus European Energy shake Currency Markets 2021-09-24

Fears Chinese mega developer Evergrande’s collapse will spark a contagion event and the ongoing European gas crisis has hit confidence.

SWIFT Trials Real-Time Transfers in Europe; GPI Network an Answer to Ripple 2019-05-28

The operator of the world’s largest financial messaging system, SWIFT, has said it will trial real-time "gpi" cross-border payments using the European Central Bank's TIPS platform. SWIFT gpi has been developed as an answer to distributed ledger payment technologies, most notably Ripple.

Austria Country Guide (AT)

Austria, located in central Europe, is a landlocked country bordered by Germany, the Czech Republic, Slovakia, Hungary, Slovenia, Italy, Switzerland, and Liechtenstein. Its capital city, Vienna, is renowned for its rich history and cultural signif...

Aaland Islands Country Guide (AX)

The Åland Islands (or Aland Islands in English) are an archipelago consisting of around 6,500 islands located in the Baltic Sea, between Sweden and Finland. The islands are a self-governing territory of Finland and have a population of around 30,...

Belgium Country Guide (BE)

Belgium is a country located in Western Europe, bordered by the Netherlands to the north, Germany to the east, Luxembourg to the southeast, France to the southwest, and the North Sea to the northwest. It is a federal parliamentary democracy with a...

Saint Barthelemy Country Guide (BL)

Saint Barthélemy, also known as St. Barth's, is a small island located in the Caribbean Sea. It is a French overseas collectivity and is known for its beautiful beaches, luxury hotels, and high-end shopping. The island has a tropical climate, wit...

Croatia Country Guide (HR)

Croatia is a Central European country that is bordered by Slovenia, Hungary, Bosnia and Herzegovina, and Montenegro. Its coastline along the Adriatic Sea is dotted with over 1,000 islands. The capital, Zagreb, is home to a 13th-century castle, and...

Cyprus Country Guide (CY)

Cyprus is an island country located in the Eastern Mediterranean, south of Turkey. The island is known for its beautiful beaches, clear waters, historic sites, and rich culture. The official languages are Greek and Turkish, and the country has a d...

Estonia Country Guide (EE)

Estonia is a country located in Northern Europe, bordered by the Baltic Sea to the west, Latvia to the south, and Russia to the east. It is known for its unique culture, advanced technology, and natural beauty. The country's official language is E...

Eurozone Country Guide (EU)

No destination holds as much variety and cultural difference as Europe. From the sunny south to the snowy north there is no shortage of places to see here. When arriving at any new destination for first time visitors it cant hurt to stop by the To...

Finland Country Guide (FI)

Finland is a country located in Northern Europe, known for its beautiful natural landscapes, vibrant culture and modern technology. It is a popular destination for tourists and expats alike, with its clean and safe environment, high-quality health...

French Guinea Country Guide (GF)

French Guinea, also known as Guinea, was a French colonial possession in West Africa that existed from 1891 to 1958. It was located on the Gulf of Guinea and bordered present-day Guinea, Sierra Leone, and Liberia. The colony was established as a p...

French Southern Territories Country Guide (TF)

The French Southern and Antarctic Lands (French: Terres australes et antarctiques françaises, TAAF) is an overseas territory (French: Territoire d'outre-mer or TOM) of France. It consists of: Kerguelen Islands (Archipel des Kerguelen), a group of...

Germany Country Guide (DE)

Germany is a country located in Central Europe, known for its rich culture, history, and landmarks. It is the most populous member state of the European Union and the second most populous country in Europe.

Greece Country Guide (GR)

Greece is a popular tourist destination known for its beautiful beaches, ancient ruins, and charming villages. The country has a well-developed tourism infrastructure, making it easy for visitors to get around and explore the many sights and exper...

Guadeloupe Country Guide (GP)

Guadeloupe is an overseas department and region of France located in the Caribbean Sea. It is an archipelago of islands, including the main islands of Grande-Terre and Basse-Terre, as well as the smalle...

Ireland Country Guide (IE)

Ireland, known as the Emerald Isle, offers travelers a rich tapestry of landscapes, history, and culture. To ensure a seamless journey, consider the following practical tips:

Italy Country Guide (IT)

Italy is a country located in southern Europe. It is home to the city of Rome, and is also known for its association with the Roman Catholic Church. Italy is a popular tourist destination, and is known for its food, fashion, art, and architecture....

Latvia Country Guide (LV)

Latvia has the Baltic Sea to the West and is sandwiched between Estonia in the North and Lithuania to the South. The landscape is characterised by wide beaches and dense forest. Riga, is the medieval capital of Latvia, famous for the medieval old ...

Luxembourg Country Guide (LU)

Right in the middle of Europe, you’ll find the beautiful country of Luxembourg. A landlocked country, it’s full of forests, fairytale castles, and jagged gorges. The capital of the country is also called Luxembourg and is situated to the South...

Montenegro Country Guide (ME)

Recently it's almost impossible to come across a travel section without someone trumpeting Montenegro as the new 'it' destination. With its rugged mountain views and glistening seaside ports, it’s surprising that the charm and allure of Monteneg...

Malta Country Guide (MT)

Malta is a small island nation in the Mediterranean Sea. It is a popular tourist destination for its sunny weather, beautiful beaches, and historic sites. Malta is also a popular destination for expats, especially those from the UK, due to its clo...

Martinique Country Guide (MQ)

Volcanic in origin, Martinique is a mountainous stunner crowned by the still-smoldering Mont Pelée, the volcano that wiped out the former capital of St-Pierre in 1902. Offering a striking diversity of landscapes and atmospheres, Martinique is a c...

Monaco Country Guide (MC)

Welcome to the opulent principality of Monaco, a playground for the world's elite and a haven for luxury experiences. Whether you're planning to try your luck at the Casino de Monte-Carlo, attend the Grand Prix, or soak in the Mediterranean sun, h...

Netherlands Country Guide (NL)

The Netherlands is a small country located in northwest Europe. It is known for its windmills, tulips, and canals. The capital of the Netherlands is Amsterdam, and the official language is Dutch. The Netherlands is a popular tourist destination fo...

Portugal Country Guide (PT)

Portugal has been popular with European vacationers. Beaches and high mountains aside, the rest of Portugal is a diverse and verdant country of deep valleys and rolling hills dotted with stone-built villages. The country has with excellent sandy...

Reunion Country Guide (RE)

Reunion holds a multitude of records and notable features that should have made it world famous. Instead, it remains an undiscovered secret among all but the French, who claim it as a part of their own country. This volcanic island is covered in l...

Saint Pierre and Miquelon Country Guide (PM)

A trip to the French islands of Saint-Pierre and Miquelon is a must for anyone planning travel in eastern Newfoundland. With a piece of Europe just 20 km from the province’s southern coast, why wouldn’t you plan an international trip? That bei...

San Marino Country Guide (SM)

The Most Serene Republic of San Marino is a must-see destination for lovers of history—and for those who love picturesque panoramas. A sole survivor of Italy's once powerful city-state network, this landlocked micronation clung on long after the...

Slovakia Country Guide (SK)

Right in the heart of Europe, Slovakia is a land of castles and mountains, occasionally punctuated by industrial sprawl. More than a quarter-century after Czechoslovakia's break-up, Slovakia has emerged as a self-assured, independent nation. Capit...

Slovenia Country Guide (SI)

Slovenia is a charming and comfortable place to travel, with architecturally grand, cultured cities, and lush pine-forested countryside, perfect for hiking and biking in summer and skiing in winter. The country managed to avoid much of the strife ...

Spain Country Guide (ES)

Spain is a country located in southwestern Europe known for its rich culture, history, and beautiful landscapes. It is a popular destination for tourists and expats alike, with its sunny climate, delicious food, and vibrant nightlife.

Vatican City Country Guide (VA)

It might only cover about half a square kilometre, but the Vatican looks every inch a religious superpower. Its holy buildings are monumental in scale and its lavishly-decorated halls house some of the world’s most celebrated artworks.

CAD to EUR 2025 Forecasts

The exchange rate forecast for the Canadian dollar (CAD) against the euro (EUR) indicates a cautious outlook as recent market dynamics unfold.

AUD to EUR 2025 Forecasts

The exchange rate forecast for the Australian dollar (AUD) against the euro (EUR) has recently been influenced by several key developments.

EUR to ZAR 2025 Forecasts

The exchange rate for EUR to ZAR is currently positioned at 20.72, just below its three-month average, trading within an 8% range from 20.14 to 21.75.

EUR to XPF 2025 Forecasts

The EUR to XPF exchange rate is currently stable, holding steady at its 3-month average of 119.3.

EUR to XOF 2025 Forecasts

Recent forecasts for the EUR to XOF exchange rate point to stability, with the EUR remaining steady at its 3-month average of 656 XOF.

EUR to XCD 2025 Forecasts

The recent performance of the Euro (EUR) against the East Caribbean Dollar (XCD) indicates volatility, as the EUR is currently trading at 3.1891,...

EUR to XAF 2025 Forecasts

The euro (EUR) has faced challenges recently, mainly influenced by slowing German inflation, which has led to speculation about a potential European Central...

EUR to WST 2025 Forecasts

The recent performance of the Euro (EUR) against the Samoan Tala (WST) reflects significant influences from economic conditions in the Eurozone,...

EUR to VND 2025 Forecasts

The recent forecasts for the EUR to VND exchange rate suggest a complex interplay of factors influencing the euro's strength.

EUR to TWD 2025 Forecasts

The EUR to TWD exchange rate is currently influenced by a range of factors that signal a precarious position for the euro in the near term.

EUR to TRY 2025 Forecasts

Recent forecasts for the EUR to TRY exchange rate indicate a complex interplay of economic indicators, geopolitical factors, and market sentiments.

EUR to THB 2025 Forecasts

The EUR to THB exchange rate has been influenced by several recent developments in both the Eurozone and Thailand.

EUR to SGD 2025 Forecasts

Recent forecasts for the EUR to SGD exchange rate suggest a cautious outlook, influenced by various economic developments in both Europe and Singapore.

EUR to SEK 2025 Forecasts

The EUR to SEK exchange rate has recently shown volatility, with the euro trading at 90-day highs around 11.23, approximately 2.3% above its 3-month average of 10.98.

EUR to SAR 2025 Forecasts

Recent forecasts for the EUR to SAR exchange rate indicate a cautious outlook for the euro, influenced by a variety of economic factors.

EUR to RUB 2025 Forecasts

Recent forecasts and market updates indicate a complex outlook for the EUR to RUB exchange rate.

EUR to QAR 2025 Forecasts

The EUR to QAR exchange rate is currently at 4.2906, which represents a 3.5% increase from its three-month average of 4.1447.

EUR to PLN 2025 Forecasts

Recent forecasts and market updates indicate a challenging outlook for the EUR to PLN exchange rate, driven by multiple economic factors affecting both currencies.

EUR to PKR 2025 Forecasts

The recent exchange rate forecasts for the EUR to PKR indicate a complex scenario driven by both euro and Pakistani rupee-specific factors.

EUR to PHP 2025 Forecasts

The recent performance of the euro (EUR) against the Philippine peso (PHP) highlights significant volatility and potential shifts in market sentiment.

EUR to OMR 2025 Forecasts

Recent analysis indicates that the euro (EUR) is currently under pressure, primarily influenced by a notable slowdown in German inflation and concerns over...

EUR to NZD 2025 Forecasts

The recent movements in the EUR to NZD exchange rate reflect a complex interplay of economic indicators and market sentiment.

EUR to NOK 2025 Forecasts

The current outlook for the EUR/NOK exchange rate reflects significant market dynamics influenced by macroeconomic developments in both the Eurozone and Norway.

EUR to NGN 2025 Forecasts

The EUR to NGN exchange rate has recently experienced some volatility, reflecting broader economic trends and geopolitical influences.

EUR to MYR 2025 Forecasts

The EUR to MYR exchange rate is currently reflecting significant market dynamics, with the euro experiencing pressure due to recent economic data from...

EUR to MXN 2025 Forecasts

The EUR to MXN exchange rate has recently been influenced by a confluence of factors affecting both the euro and the Mexican peso, all of which pose...

EUR to JPY 2025 Forecasts

Recent analysis highlights a complex outlook for the EUR to JPY exchange rate.

EUR to INR 2025 Forecasts

The EUR to INR exchange rate recently reached 90-day highs near 101.1, marking a 3.9% increase from its 3-month average of 97.35.

EUR to ILS 2025 Forecasts

Recent forecasts for the EUR to ILS exchange rate indicate a complex interplay of factors influencing both currencies.

EUR to IDR 2025 Forecasts

The recent performance of the euro (EUR) against the Indonesian rupiah (IDR) has shown some volatility amid fluctuating economic indicators and geopolitical influences.

EUR to HUF 2025 Forecasts

The EUR/HUF exchange rate has recently shown notable stability, trading at 400.1, just 1.0% below its three-month average of 404, with fluctuations...

EUR to HKD 2025 Forecasts

The recent performance of the euro (EUR) against the Hong Kong dollar (HKD) has been influenced by a variety of economic indicators and forecasts.

EUR to GBP 2025 Forecasts

The recent analysis of the EUR to GBP exchange rate highlights several critical factors influencing market sentiment and forecasts.

EUR to DKK 2025 Forecasts

The recent performance of the euro (EUR) against the Danish kroner (DKK) has been closely tied to economic data and broader market dynamics.

EUR to CZK 2025 Forecasts

The EUR to CZK exchange rate has recently shown notable weakness, currently trading near 90-day lows around 24.66, which is approximately 1.0% below its...

EUR to CNY 2025 Forecasts

The recent forecasts for the EUR to CNY exchange rate have been shaped significantly by both economic data and geopolitical developments.

EUR to CHF 2025 Forecasts

The EUR to CHF exchange rate has recently encountered downward pressure, largely influenced by evolving economic indicators and geopolitical tensions.

EUR to CAD 2025 Forecasts

The recent forecasts and market updates indicate a mixed outlook for the EUR to CAD exchange rate.

EUR to BRL 2025 Forecasts

Recent forecasts and market updates indicate a cautious outlook for the EUR to BRL exchange rate.

EUR to AUD 2025 Forecasts

The recent sentiment surrounding the EUR to AUD exchange rate indicates a complex interplay between the Eurozone's slowing economic indicators and...

EUR to AED 2025 Forecasts

The recent performance and outlook for the EUR to AED exchange rate have been influenced by a mix of economic data, geopolitical developments, and market sentiment.

EUR to USD 2025 Forecasts

The EUR/USD exchange rate has experienced notable volatility over the past two months, influenced by shifting economic indicators and geopolitical concerns.

GBP to EUR 2025 Forecasts

The recent performance of the GBP to EUR exchange rate reflects ongoing economic pressures in both the UK and the Eurozone.

USD to EUR 2025 Forecasts

The USD to EUR exchange rate has struggled recently, with the US dollar (USD) hitting a three-year low near 0.8470, which is approximately 3.6% below its...

SAR to EUR 2025 Forecasts

The Saudi Riyal (SAR) to Euro (EUR) exchange rate remains under pressure, currently sitting at approximately 0.2275.

SEK to EUR 2025 Forecasts

The exchange rate outlook for SEK to EUR is influenced by a combination of recent developments in monetary policy, economic indicators, and external market factors.

PLN to EUR 2025 Forecasts

The recent performance of the Polish zloty (PLN) against the euro (EUR) has been heavily influenced by both domestic and international factors.

CHF to EUR 2025 Forecasts

Recent forecasts have highlighted a notable interaction between the Swiss franc (CHF) and the euro (EUR), with both currencies influenced by ongoing...

AED to EUR 2025 Forecasts

The exchange rate forecast for the AED to EUR suggests a challenging terrain for the UAE Dirham (AED) as it hovers near 90-day lows at 0.2323, significantly...

NZD to EUR 2025 Forecasts

Recent analysis of the NZD to EUR exchange rate indicates a subdued outlook for the New Zealand dollar (NZD) amid a fluctuating global risk sentiment.

MYR to EUR 2025 Forecasts

The recent exchange rate forecasts for the Malaysian Ringgit (MYR) against the Euro (EUR) reflect the complexities of geopolitical tensions and economic...

INR to EUR 2025 Forecasts

The exchange rate for the Indian Rupee (INR) to Euro (EUR) has recently faced notable pressures, dropping to 90-day lows near 0.009974.

SGD to EUR 2025 Forecasts

The current exchange rate for SGD to EUR is trading at 60-day lows near 0.6686, which is 1.4% below its 3-month average of 0.6784.